District of Columbia Approval of Savings Plan for Employees: A Comprehensive Guide Keywords: District of Columbia, approval, savings plan, employees Introduction: The District of Columbia offers various types of approval for savings plans designed to assist employees in achieving their financial goals. These plans are specifically tailored to support employees residing within the District of Columbia, providing them with a range of benefits and protection. This detailed description aims to shed light on the different types of approval available for savings plans in the District of Columbia. Types of District of Columbia Approval of Savings Plan for Employees: 1. 401(k) Plans: The District of Columbia approves 401(k) plans, which allow employees to contribute a portion of their pre-tax income for retirement savings. These plans often include employer-matching contributions, vesting schedules, and a wide range of investment options. 2. 403(b) Plans: Designed for employees working in the nonprofit and educational sectors, the District of Columbia also approves 403(b) plans. Similar to 401(k) plans, these enable employees to save for retirement while enjoying various tax benefits. 3. 457 Plans: Another type of approved savings plan in the District of Columbia is the 457 plan. This non-qualified retirement plan is available to employees of state and local governments, as well as certain non-governmental tax-exempt organizations. It offers individuals the opportunity to contribute a portion of their income on a pre-tax basis, providing them with tax advantages and potential growth. 4. Individual Retirement Accounts (IRAs): The District of Columbia approves various types of Individual Retirement Accounts (IRAs), which allow employees to save for retirement independently. These include Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Each type of IRA offers unique tax advantages and eligibility requirements. Benefits of District of Columbia Employee Savings Plans: — Tax benefits: Approved savings plans in the District of Columbia offer employees potential tax deductions or tax-free growth on their contributions, depending on the plan. — Employer contributions: Many plans, such as 401(k) and 403(b), offer employer-matching contributions, encouraging employees to save more for their future. — Investment options: Approved savings plans provide employees with a variety of investment options, ranging from stocks and bonds to mutual funds and target-date funds. — Retirement security: By participating in approved savings plans, employees can ensure they have a stable and secure financial future during retirement. Conclusion: The District of Columbia provides employees with a range of approved savings plans that cater to different retirement needs and preferences. These plans offer tax advantages, potential employer contributions, and a wide array of investment options. By participating in these District of Columbia-approved savings plans, employees can work towards building a financially secure future.

District of Columbia Approval of savings plan for employees

Description

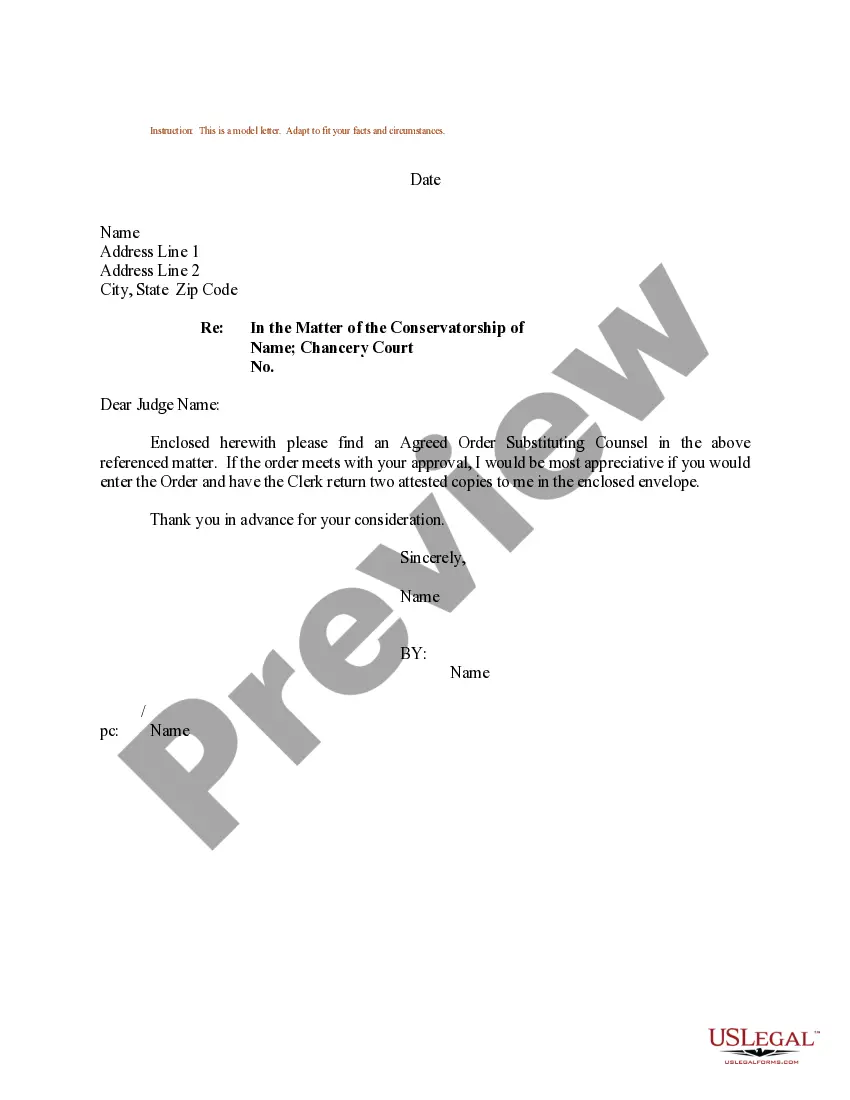

How to fill out District Of Columbia Approval Of Savings Plan For Employees?

Choosing the right lawful record design can be a have a problem. Obviously, there are plenty of themes available online, but how do you discover the lawful type you require? Take advantage of the US Legal Forms web site. The services provides a large number of themes, for example the District of Columbia Approval of savings plan for employees, that can be used for company and personal requires. All the forms are checked by specialists and meet up with federal and state requirements.

When you are previously signed up, log in to your account and click the Download switch to obtain the District of Columbia Approval of savings plan for employees. Utilize your account to appear with the lawful forms you have ordered in the past. Check out the My Forms tab of your account and get one more backup from the record you require.

When you are a fresh consumer of US Legal Forms, listed below are basic instructions that you can adhere to:

- Very first, be sure you have chosen the proper type for your city/state. You are able to look through the shape while using Preview switch and study the shape information to make sure it is the right one for you.

- When the type will not meet up with your preferences, use the Seach area to find the right type.

- Once you are positive that the shape is acceptable, go through the Purchase now switch to obtain the type.

- Choose the pricing plan you desire and enter the required information and facts. Build your account and buy your order with your PayPal account or charge card.

- Select the document format and down load the lawful record design to your product.

- Total, revise and produce and signal the received District of Columbia Approval of savings plan for employees.

US Legal Forms may be the greatest local library of lawful forms for which you will find a variety of record themes. Take advantage of the service to down load professionally-produced files that adhere to condition requirements.

Form popularity

FAQ

The plan is offered only to public service employees and employees at tax-exempt organizations. Participants are allowed to contribute up to 100% of their salaries up to a dollar limit for the year. The interest and earnings in the account are not taxed until the funds are withdrawn.

A 401(k) is intended for long-term retirement savings that grow through investments in the financial markets. But 401(k) plans come with restrictions on when funds can be accessed. Savings accounts are lower risk and don't have as many limitations, but can't be invested like a 401(k).

The DC College Savings Plan is a tax-advantaged 529 college savings investment plan (named after Section 529 of the Internal Revenue Code) offered by the District of Columbia Government.

A savings plan involves putting aside a portion of your income over a fixed period of time in order to reach a specific financial goal. It's also useful to set aside money not only for your savings account or emergency fund, but also for investing. Saving money can help you feel more financially secure.

The TSP is a retirement savings and investment plan for federal employees. The purpose of the TSP is to provide retirement income through savings and tax deferred benefits that many private corporations offer their employees. The TSP is similar to private sector 401(k) plans.

Employer-sponsored savings plans such as 401(k) and Roth 401(k) plans provide employees with an automatic way to save for their retirement while benefiting from tax breaks. The reward to employees who participate in these programs is they essentially receive free money when their employers offer matching contributions.

The Employee Savings Plan, or ESP, is a savings plan offered by employers that allows employees to save over many years via paycheck deductions for a variety of goals, such as retirement.

100 percent employer funded: 5 percent of the base salary (5.5 percent for Corrections Officers) beginning the first pay period after one year of service. Must have one year of continuous service to participate; fully vested in the Defined Contribution Pension Plan after five years of continuous service.