The District of Columbia Stock Option Plan for Nonemployee Directors is a comprehensive equity compensation program designed for non-employee directors of Cameo International, Inc. This plan provides an attractive incentive package to reward these directors for their contributions to the company's success. With a focus on stock options, the plan allows non-employee directors to participate in the company's future growth and financial performance. Under this plan, non-employee directors are granted stock options, which provide them with the right to purchase a specified number of shares of Cameo International, Inc. common stock at a predetermined price, typically referred to as the exercise price. These stock options are generally granted as part of the director's compensation package and form a significant portion of their overall remuneration. The District of Columbia Stock Option Plan for Nonemployee Directors aims to align the interests of directors with those of the company's shareholders. By tying a portion of their compensation to the company's stock price performance, non-employee directors are incentivized to act in the best interest of the shareholders, actively working towards maximizing shareholder value. The plan is structured in various types, depending on the specific needs and requirements of Cameo International, Inc. and its non-employee directors. These different types may include: 1. Standard Stock Option Plan: This is the most common type of stock option plan, wherein non-employee directors receive stock options with a fixed exercise price and predetermined vesting schedule. The vesting period might be spread over several years, incentivizing directors to remain involved with the company for an extended period. 2. Performance-based Stock Option Plan: This type of plan sets specific performance criteria that need to be met before the stock options can be exercised. The performance indicators could be financial targets, operational milestones, or other predetermined metrics. By linking the exercise of stock options to company performance, this type of plan encourages non-employee directors to actively contribute to the company's growth and profitability. 3. Restricted Stock Unit (RSU) Plan: In this type of plan, non-employee directors are granted RSS instead of stock options. RSS represents a promise to deliver a specified number of company shares at a future date, typically upon vesting. Unlike stock options, RSS do not have an exercise price and are subject to specific vesting conditions. RSU plans are an alternative to traditional stock option plans, which may be offered based on the company's discretion. The District of Columbia Stock Option Plan for Nonemployee Directors of Cameo International, Inc. ensures that non-employee directors have a stake in the company's performance and fosters a sense of ownership and loyalty. These directors are motivated to actively contribute their expertise and experience to drive the company's success, ultimately benefiting both themselves and the shareholders.

District of Columbia Stock Option Plan for Nonemployee Directors of Camco International, Inc.

Description

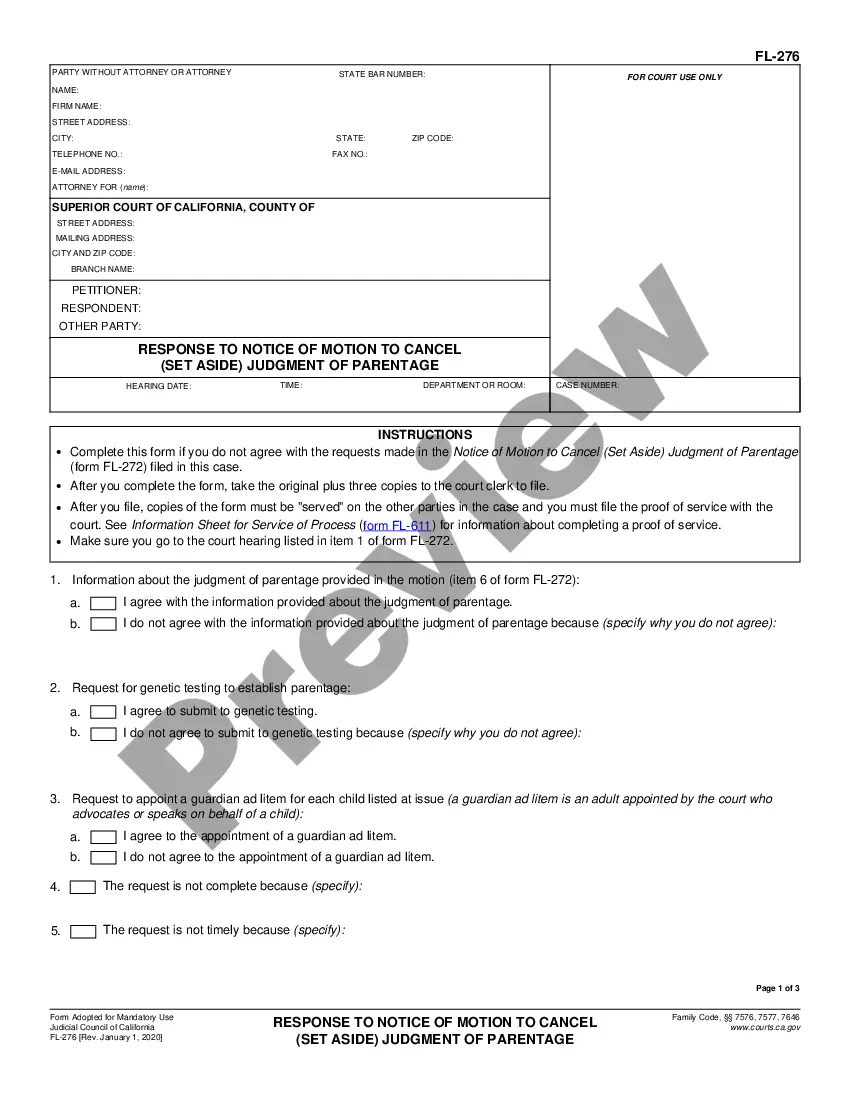

How to fill out District Of Columbia Stock Option Plan For Nonemployee Directors Of Camco International, Inc.?

Are you in the place that you require documents for either business or specific functions just about every day time? There are plenty of lawful record layouts accessible on the Internet, but locating versions you can trust is not simple. US Legal Forms provides a large number of type layouts, such as the District of Columbia Stock Option Plan for Nonemployee Directors of Camco International, Inc., which are written in order to meet federal and state demands.

If you are presently acquainted with US Legal Forms internet site and also have your account, basically log in. After that, you may down load the District of Columbia Stock Option Plan for Nonemployee Directors of Camco International, Inc. template.

If you do not come with an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the type you need and make sure it is for your correct town/area.

- Take advantage of the Preview button to check the shape.

- See the description to actually have selected the right type.

- In case the type is not what you are trying to find, utilize the Look for discipline to find the type that suits you and demands.

- When you find the correct type, simply click Buy now.

- Opt for the rates plan you desire, fill out the specified info to generate your money, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free file file format and down load your copy.

Discover each of the record layouts you possess bought in the My Forms menus. You may get a further copy of District of Columbia Stock Option Plan for Nonemployee Directors of Camco International, Inc. any time, if needed. Just click the needed type to down load or produce the record template.

Use US Legal Forms, the most extensive selection of lawful varieties, in order to save time as well as steer clear of blunders. The service provides expertly produced lawful record layouts which you can use for a selection of functions. Create your account on US Legal Forms and commence making your way of life easier.