The District of Columbia Proposal to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split aims to introduce a strategic restructuring in the corporate sector. This proposal revolves around implementing a reverse stock split, specifically a one for ten ratios, within companies operating in the District of Columbia. A reverse stock split is an essential financial maneuver that combines multiple shares of a company's stock into a reduced number of shares. In this specific case, for every ten existing shares, the reverse stock split plan aims to consolidate them into a single share. This process increases the value of each share but reduces the overall number of outstanding shares in the company, resulting in a higher stock price per share. There are several types of District of Columbia Proposals to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split that can be categorized based on their nature and scope. Some common variations include: 1. Voluntary Proposals: These are proposals put forward willingly by corporations seeking to enhance their financial structure, market position, or meet certain regulatory requirements. Voluntary reverse stock splits are usually pursued as a strategic move to increase stock price, attract new investors, or elevate the company's standing in the financial markets. 2. Regulatory Compliance Proposals: Certain jurisdictions or regulatory bodies may mandate reverse stock splits to ensure compliance with specific regulations or stock exchange listing requirements. In such cases, companies are required to implement a reverse stock split to maintain their eligibility for trading, improve their market standing, or to meet minimum price standards. 3. Financial Distress Proposals: Companies facing financial hardships or declining stock performance may opt for reverse stock splits as a means to revive investor confidence and stabilize their stock value. By implementing a reverse split, distressed companies hope to boost the stock price and attract renewed investment interest. 4. Merger or Acquisition Proposals: When companies plan to merge or acquire other entities, reverse stock splits may be proposed to align share values and consolidate ownership structure. This ensures that the transaction is financially equitable and streamlines the combined entity's capitalization. These various forms of District of Columbia Proposal to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split cater to different circumstances and objectives within the corporate landscape. The ultimate goal remains to optimize the company's capital structure, stock performance, and overall market competitiveness.

District of Columbia Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

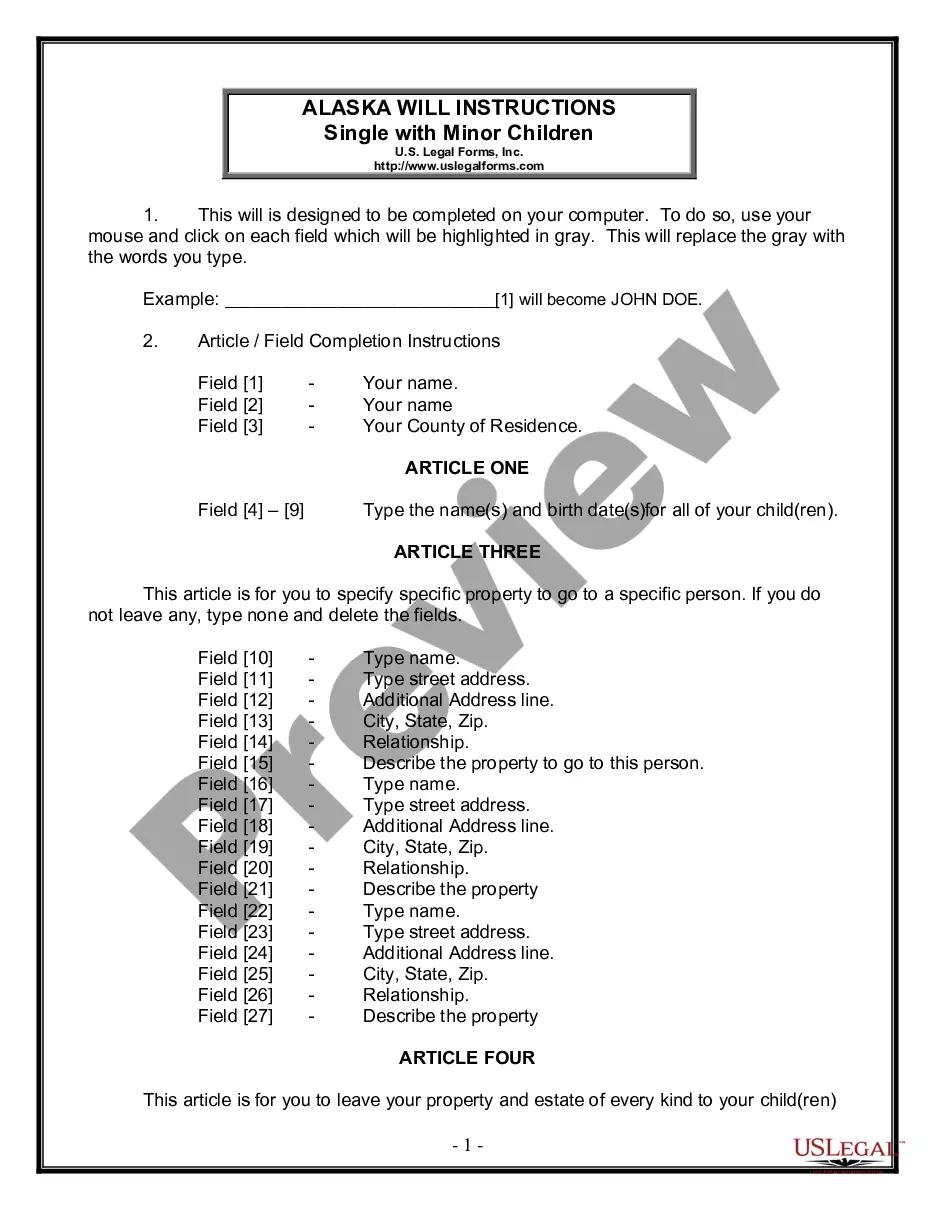

How to fill out District Of Columbia Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

Choosing the right legitimate papers web template can be a battle. Needless to say, there are tons of web templates available on the Internet, but how will you discover the legitimate form you want? Take advantage of the US Legal Forms website. The services delivers 1000s of web templates, including the District of Columbia Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split, that you can use for business and personal requires. Each of the forms are checked by specialists and fulfill state and federal demands.

In case you are previously authorized, log in to your bank account and click on the Down load option to have the District of Columbia Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split. Make use of bank account to appear through the legitimate forms you might have ordered formerly. Visit the My Forms tab of the bank account and acquire another copy in the papers you want.

In case you are a new customer of US Legal Forms, listed here are simple instructions for you to stick to:

- Very first, be sure you have chosen the proper form to your town/state. You may examine the form making use of the Review option and read the form description to make certain this is the best for you.

- When the form fails to fulfill your needs, utilize the Seach discipline to discover the right form.

- Once you are certain the form would work, select the Buy now option to have the form.

- Opt for the rates strategy you desire and enter the necessary info. Create your bank account and pay money for your order using your PayPal bank account or charge card.

- Choose the document formatting and acquire the legitimate papers web template to your device.

- Comprehensive, edit and print out and indicator the received District of Columbia Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split.

US Legal Forms is the largest library of legitimate forms in which you can discover numerous papers web templates. Take advantage of the service to acquire appropriately-made documents that stick to state demands.

Form popularity

FAQ

A reverse split isn't necessarily good or bad by itself. It is simply a change in the stock structure of a business and doesn't change anything related to the business itself. That said, a reverse split is usually taken as a sign of trouble by the market, and most of the time it isn't done for a positive reason.

Here's how a reverse split works: Say a company announces a 2 reverse split. Once approved, investors will receive one share for every 200 shares they own.

In a reverse stock split, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert ...

A reverse stock split may be used to reduce the number of shareholders. If a company completes a reverse split in which 1 new share is issued for every 100 old shares, any investor holding fewer than 100 shares would simply receive a cash payment.

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

In some reverse stock splits, small shareholders are "cashed out" (receiving a proportionate amount of cash in lieu of partial shares) so that they no longer own the company's shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

One of the few and arguably best trades in the market, is to short a stock that is going through a reverse stock split ? it will go invariably back down. This is because the stock performed so horribly, that the board of directors had to sit down and create a new facelift for the company.