District of Columbia Purchase by company of its stock

Description

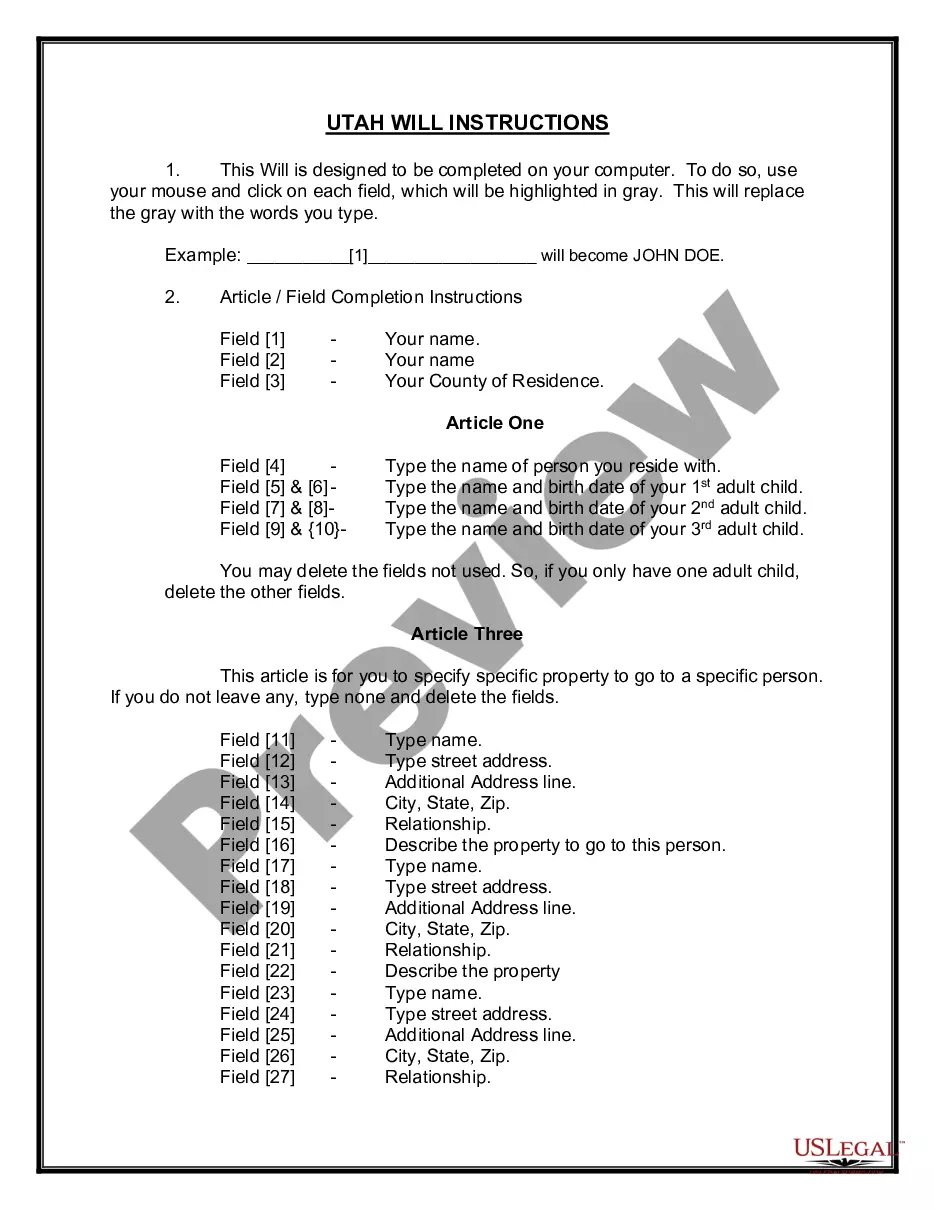

How to fill out Purchase By Company Of Its Stock?

Are you in a placement that you need to have paperwork for both organization or individual purposes just about every working day? There are tons of legal papers templates available on the net, but finding types you can rely on isn`t simple. US Legal Forms offers 1000s of kind templates, much like the District of Columbia Purchase by company of its stock, that are published in order to meet state and federal specifications.

Should you be already familiar with US Legal Forms web site and possess a free account, simply log in. After that, you may download the District of Columbia Purchase by company of its stock template.

Should you not provide an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and make sure it is for your proper area/region.

- Utilize the Review key to check the form.

- Look at the description to ensure that you have chosen the proper kind.

- In case the kind isn`t what you`re seeking, utilize the Research field to obtain the kind that fits your needs and specifications.

- Once you find the proper kind, just click Purchase now.

- Choose the pricing program you desire, fill out the desired info to make your money, and buy your order using your PayPal or bank card.

- Pick a practical document structure and download your copy.

Locate each of the papers templates you possess purchased in the My Forms food selection. You can aquire a extra copy of District of Columbia Purchase by company of its stock at any time, if needed. Just go through the necessary kind to download or printing the papers template.

Use US Legal Forms, by far the most comprehensive assortment of legal kinds, to save lots of some time and steer clear of errors. The support offers expertly created legal papers templates that can be used for a variety of purposes. Generate a free account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

(1) ?Beneficial owner? means the owner of a beneficial interest in a statutory trust or foreign statutory trust.

§ 28?3302. (b) Interest, when authorized by law, on judgments or decrees against the District of Columbia, or its officers, or its employees acting within the scope of their employment, is at the rate of not exceeding 4% per annum.

(b) A person shall not be a shareholder, director, or officer of a professional corporation or render professional services on its behalf unless the person is an individual licensed to render a professional service for which the corporation is organized; provided, that if a professional corporation has only one ...

A professional corporation may employ individuals who are not licensed, but they shall not perform professional services. No license shall be required of any person employed by a professional corporation to perform services for which a license is not otherwise required.

A beneficial owner is a person who enjoys the benefits of ownership though the property's title is in another name. Beneficial ownership is distinguished from legal ownership, though in most cases, the legal and beneficial owners are one and the same.

A beneficial owner of a reporting company (as any entity required to file a BOI report is called) is defined as any individual who, directly or indirectly, either exercises substantial control over a reporting company or owns or controls at least 25 percent of the reporting company's ownership interests.

What is a Beneficial Owner? A beneficial owner is someone who owns at least part of a property or other asset, even if its legal title is owned by someone else. That person can also vote on or otherwise influence decisions regarding transactions involving that asset or property. An example is a corporate shareholder.

The Beneficial Owner is the natural person who comes into the ultimate ownership, or who has ultimate control over the legal person directly or through a chain of ownership or control or other indirect means.