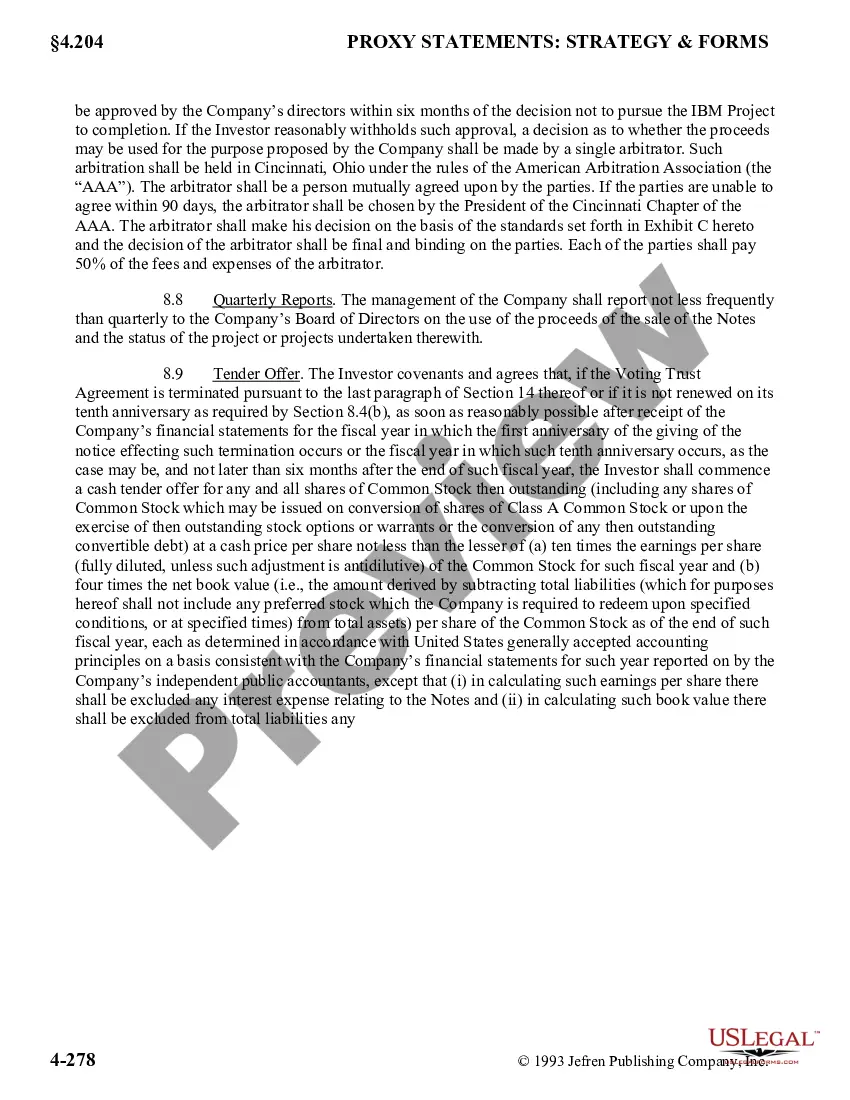

District of Columbia Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V.

Description

How to fill out Sample Note Purchase Agreement Between Access Corp. And Oce-van Der Grinten, N.V.?

Are you currently inside a position the place you require paperwork for both organization or individual uses virtually every time? There are tons of legal document templates available online, but discovering kinds you can trust isn`t easy. US Legal Forms gives thousands of develop templates, just like the District of Columbia Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V., that are created to meet state and federal requirements.

If you are already informed about US Legal Forms website and get your account, just log in. Next, you can down load the District of Columbia Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V. design.

Should you not offer an account and wish to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is for that proper metropolis/region.

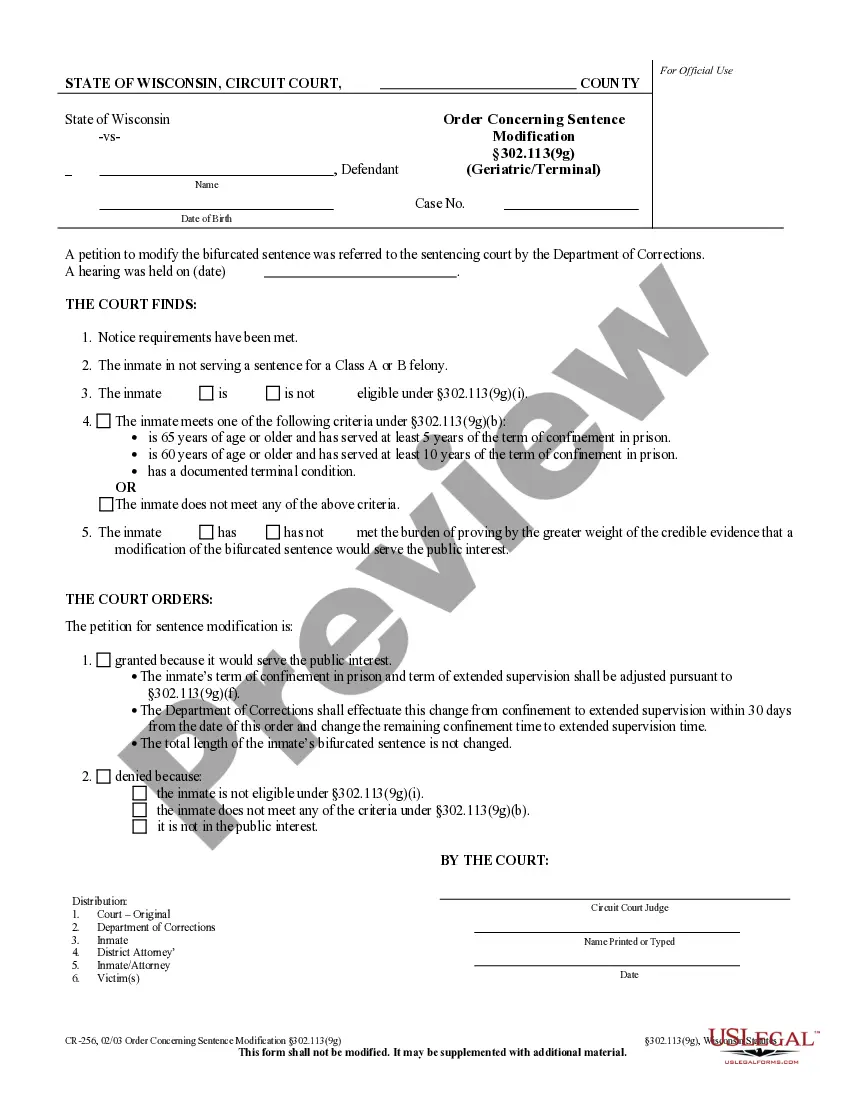

- Utilize the Review option to review the shape.

- See the outline to actually have selected the appropriate develop.

- If the develop isn`t what you are seeking, take advantage of the Search field to discover the develop that meets your needs and requirements.

- When you discover the proper develop, simply click Buy now.

- Select the costs plan you desire, submit the desired information and facts to create your account, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Decide on a practical data file file format and down load your copy.

Get every one of the document templates you may have purchased in the My Forms food selection. You can get a more copy of District of Columbia Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V. at any time, if possible. Just click the essential develop to down load or print the document design.

Use US Legal Forms, the most extensive variety of legal kinds, to save time as well as prevent faults. The assistance gives expertly created legal document templates which can be used for an array of uses. Generate your account on US Legal Forms and initiate making your way of life a little easier.