Title: Exploring the District of Columbia's Authorized Sale of Fractional Shares Introduction: The District of Columbia has recently authorized the sale of fractional shares, allowing investors to participate in the financial market without needing to purchase whole shares. This progressive move opens up new opportunities for individuals seeking investment avenues in the nation's capital. Let's delve into the details of this exciting development, understanding its implications for investors. 1. Understanding Fractional Shares: Fractional shares refer to a portion or fraction of a whole share of a company's stock. They enable investors to purchase a specific dollar amount of stock, regardless of its share price. This flexibility allows for greater accessibility to diverse investment portfolios. 2. The District of Columbia's Move to Authorize Sale of Fractional Shares: In a forward-thinking initiative, the District of Columbia has authorized the sale of fractional shares to promote financial inclusivity and offer investment opportunities to a broader range of individuals. Investors in the District can now invest as little or as much as they desire, tailored to their financial goals. 3. Key Benefits of District of Columbia's Authorized Sale of Fractional Shares: a) Enhanced Accessibility: Fractional shares empower investors with limited funds to own stocks in renowned companies that may have higher share prices, democratizing the investment landscape. b) Diversification Opportunities: As fractional shares require a smaller investment amount, it becomes easier to build a diversified portfolio with exposure to a broader range of industries and sectors. c) Risk Mitigation: By spreading investments across fractional shares, investors can lower risk exposure and potentially benefit from market fluctuations. 4. Prominent Types of District of Columbia's Authorized Sale of Fractional Shares: While there are no specific types of authorized fractional shares in the District of Columbia, investors can engage in fractional share investing in multiple ways, including: a) Direct Stock Purchase Plans (Drops): Some companies allow investors to purchase fractional shares directly from the company itself, bypassing traditional brokers. b) Stock Investment Apps: A rising trend in fractional share investing consists of investment apps that enable fractional purchasing, providing users with user-friendly experiences and access to a wide range of stocks. c) Exchange-Traded Funds (ETFs): Certain ETFs offer fractional ownership, allowing investors to gain exposure to a diversified basket of stocks, bonds, or commodities. Conclusion: The District of Columbia embracing the sale of fractional shares exemplifies its commitment to financial inclusivity and empowering investors. By unlocking doors to fractional investing, it widens investment opportunities and enables anyone, regardless of their financial means, to participate in the market. Investors in the District can leverage this innovative approach to build diversified portfolios and potentially benefit from the growth of various companies, ultimately fostering financial growth and security.

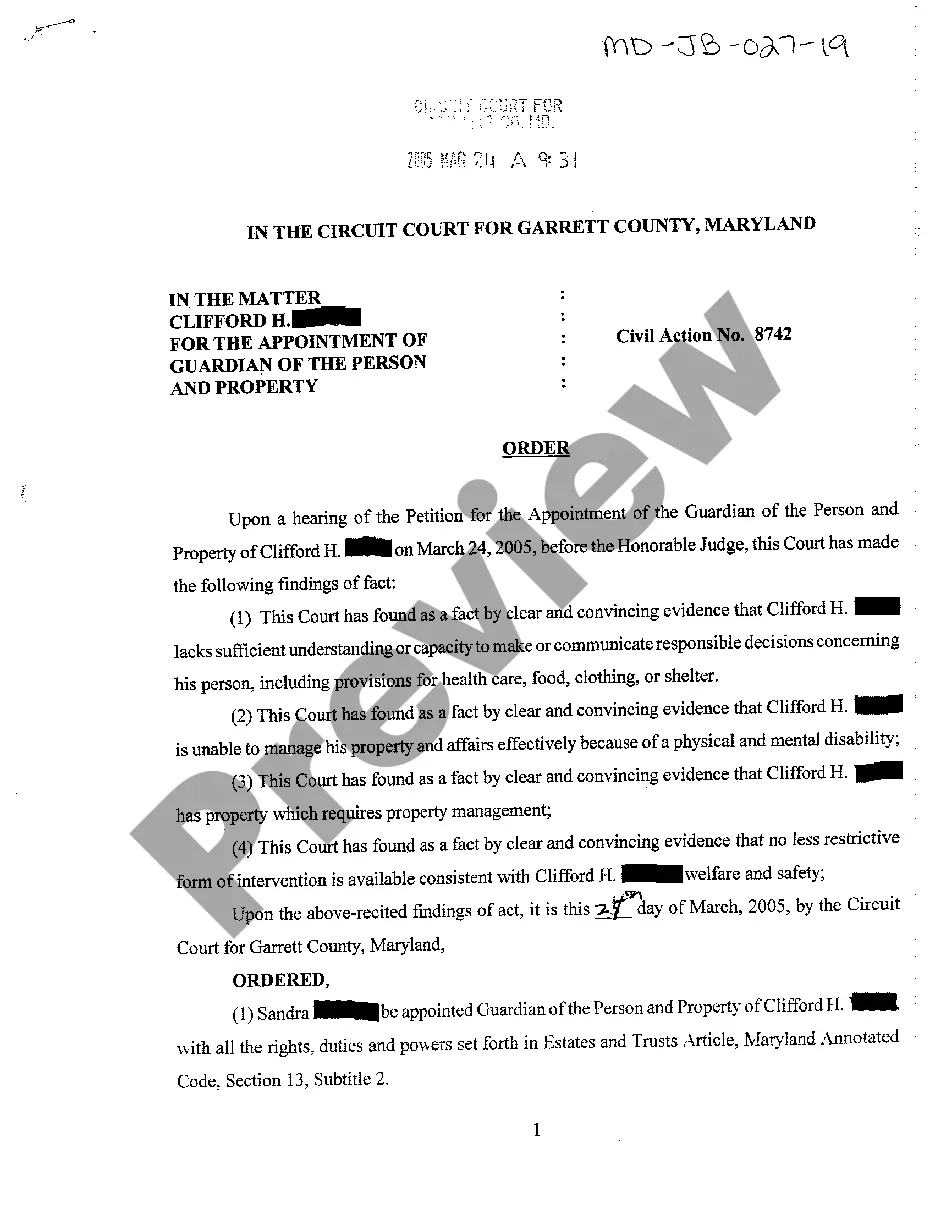

District of Columbia Authorize Sale of fractional shares

Description

How to fill out District Of Columbia Authorize Sale Of Fractional Shares?

It is possible to devote several hours on-line searching for the lawful document design that meets the state and federal specifications you will need. US Legal Forms offers a huge number of lawful kinds that are examined by experts. It is possible to obtain or produce the District of Columbia Authorize Sale of fractional shares from my assistance.

If you currently have a US Legal Forms profile, you are able to log in and click the Acquire option. Following that, you are able to total, revise, produce, or indication the District of Columbia Authorize Sale of fractional shares. Each and every lawful document design you get is your own permanently. To obtain another backup of the acquired type, go to the My Forms tab and click the related option.

If you work with the US Legal Forms site the very first time, follow the straightforward directions below:

- Very first, make sure that you have chosen the proper document design for the county/town of your liking. Read the type description to make sure you have picked out the proper type. If readily available, take advantage of the Preview option to look from the document design too.

- If you want to discover another version of your type, take advantage of the Look for discipline to find the design that meets your needs and specifications.

- Once you have located the design you would like, click Get now to move forward.

- Find the rates program you would like, key in your qualifications, and register for your account on US Legal Forms.

- Complete the purchase. You may use your credit card or PayPal profile to cover the lawful type.

- Find the format of your document and obtain it to your product.

- Make adjustments to your document if required. It is possible to total, revise and indication and produce District of Columbia Authorize Sale of fractional shares.

Acquire and produce a huge number of document templates while using US Legal Forms website, which provides the greatest selection of lawful kinds. Use skilled and condition-distinct templates to take on your company or person requires.

Form popularity

FAQ

Fractional shares, unfortunately, are not transferable. That means if you decide to switch from one brokerage firm to another or one robo-advisor to another, the fractional share investments you made cannot go with you.

Can fractional shares be sold? It is not possible to sell fractional shares in the market. Instead, the company appoints a trustee to buy back the fractional shares from investors, and the proceeds are credited to the primary bank account.

For instance, if Stock A costs $400 per share, a brokerage might sell one-tenth fractional shares for $40 each ($400/10 = $40). Fractional shares are also sometimes created in dividend reinvestment plans (DRIPs), during stock splits, and as a result of mergers and acquisitions.

Fractional shares cannot be transferred, and stock certificates are not available for them. Fractional shares need to be sold prior to any transfer.

It also does not offer fractional shares of stocks unless you're buying them as part of E*TRADE's automated investing program. Fractional shares are becoming more common in the industry; they let investors purchase stock based on a dollar amount they select rather than the price of a whole share.

If you own a very small fraction of a share, your broker may keep your dividend. For example: In cases when your fraction of a stock entitles you to less than 1¢ in dividends (0.9¢ for example), you may not receive any dividend, and that portion could be a meaningful percentage of the stock's value.

The only way to sell fractional shares is through a major brokerage firm, which can join them with other fractional shares until a whole share is attained. If the selling stock does not have a high demand in the marketplace, selling the fractional shares might take longer than hoped.

The only way to sell fractional shares is through a major brokerage firm, which can join them with other fractional shares until a whole share is attained. If the selling stock does not have a high demand in the marketplace, selling the fractional shares might take longer than hoped.