The District of Columbia Form of Convertible Promissory Note, Preferred Stock is a legal document that outlines the terms and conditions under which a company can issue convertible preferred stock notes to its investors in the District of Columbia. This type of security provides investors with the option to convert their investments into common stock or other securities at a later date. The District of Columbia Form of Convertible Promissory Note, Preferred Stock is a valuable strategic tool for both companies and investors. It offers companies a way to raise capital by selling convertible preferred stock, which can be an attractive option for investors looking to balance income potential and downside protection. Investors, on the other hand, benefit from the prospect of earning interest on their investments while still having the opportunity to benefit from any future increase in the company's stock price. There may be different variations of the District of Columbia Form of Convertible Promissory Note, Preferred Stock, such as: 1. Fixed Conversion Ratio Note: This type of note specifies a fixed conversion ratio, which determines the number of shares the investor will receive upon conversion. For example, it may state that for every $1,000 invested, the investor will receive 100 shares of common stock upon conversion. 2. Adjustable Conversion Ratio Note: Unlike the fixed conversion ratio note, this type of note allows for a flexible conversion ratio that may be subject to adjustment based on certain conditions or events. These conditions could include a stock split, stock dividend, or other corporate actions that impact the number of shares the investor receives upon conversion. 3. Optional Conversion Note: An optional conversion note gives the investor the discretion to convert their preferred stock into common stock or other securities. This type of note allows investors to assess market conditions and determine the optimal time to convert their investment. The District of Columbia Form of Convertible Promissory Note, Preferred Stock provides a clear framework for both companies and investors to understand their rights and obligations. It typically covers important details such as the interest rate, payment terms, conversion price, and any applicable conversion adjustments. This legally binding document ensures that all parties involved are protected and can make informed decisions. Companies looking to raise capital in the District of Columbia can utilize the District of Columbia Form of Convertible Promissory Note, Preferred Stock to attract potential investors. By offering a convertible security, companies can appeal to investors looking for a potential upside while providing them with downside protection in the form of a guaranteed return on investment. In conclusion, the District of Columbia Form of Convertible Promissory Note, Preferred Stock is a crucial legal document that facilitates investment opportunities and capital raising for companies operating in the District of Columbia. Whether it's fixed conversion ratios, adjustable conversion ratios, or optional conversions, this form provides a comprehensive framework for both companies and investors to benefit from this financing option.

District of Columbia Form of Convertible Promissory Note, Preferred Stock

Description

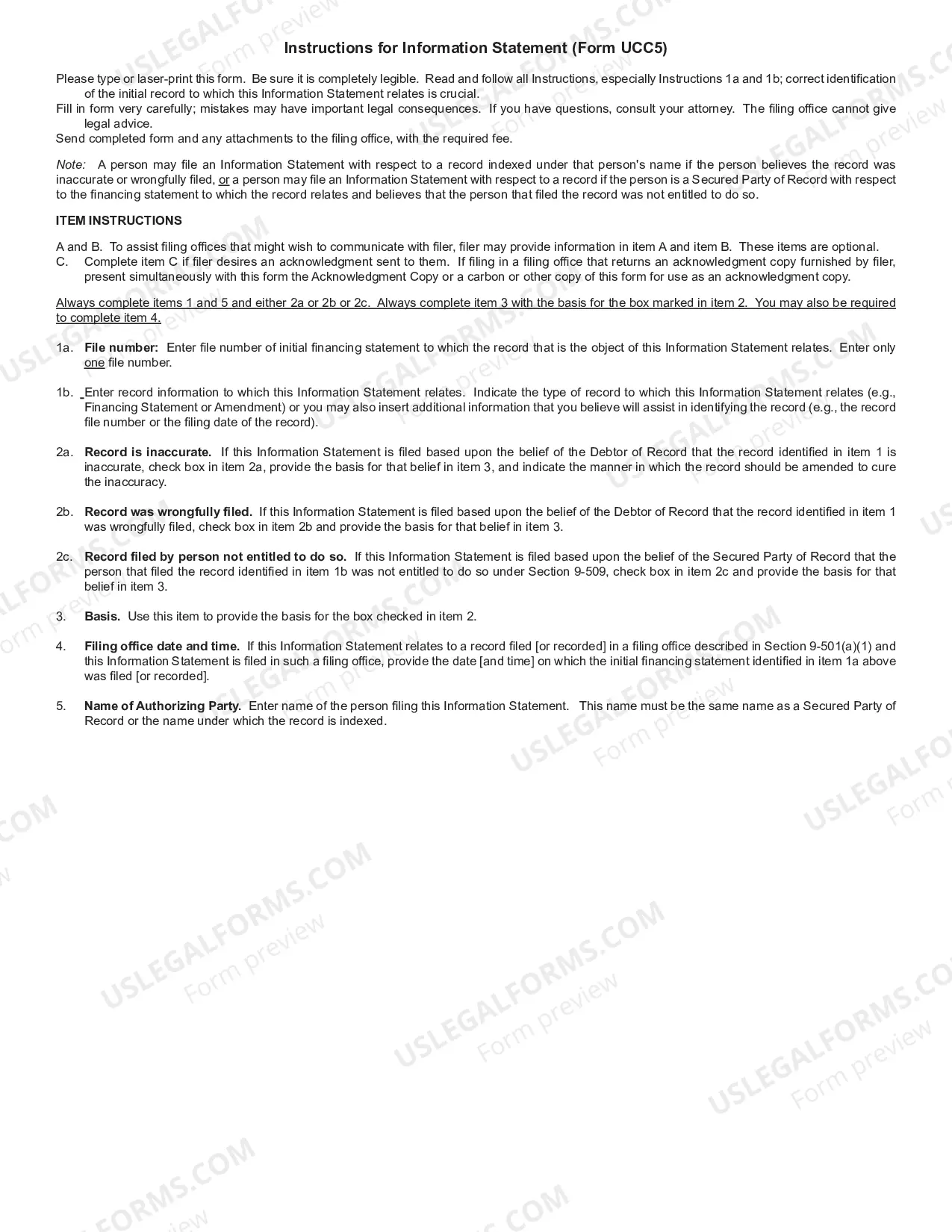

How to fill out District Of Columbia Form Of Convertible Promissory Note, Preferred Stock?

Have you been in the position the place you require paperwork for possibly company or person uses virtually every day time? There are a variety of authorized file templates available on the Internet, but getting types you can rely on is not easy. US Legal Forms delivers a huge number of develop templates, just like the District of Columbia Form of Convertible Promissory Note, Preferred Stock, which are created to meet state and federal demands.

When you are currently informed about US Legal Forms web site and also have your account, just log in. Next, it is possible to download the District of Columbia Form of Convertible Promissory Note, Preferred Stock template.

Should you not have an profile and would like to begin to use US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is for your appropriate area/area.

- Make use of the Review key to examine the shape.

- Look at the description to ensure that you have selected the right develop.

- If the develop is not what you are looking for, use the Look for area to find the develop that meets your requirements and demands.

- If you obtain the appropriate develop, just click Acquire now.

- Pick the costs prepare you need, submit the necessary information to make your money, and purchase an order with your PayPal or bank card.

- Decide on a practical file file format and download your version.

Get every one of the file templates you may have bought in the My Forms food selection. You may get a additional version of District of Columbia Form of Convertible Promissory Note, Preferred Stock anytime, if required. Just click on the necessary develop to download or print out the file template.

Use US Legal Forms, probably the most substantial variety of authorized varieties, in order to save time and prevent blunders. The services delivers expertly created authorized file templates which can be used for a range of uses. Generate your account on US Legal Forms and begin creating your way of life easier.