District of Columbia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

How to fill out Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

Are you currently inside a position in which you need documents for possibly business or individual uses just about every day? There are tons of lawful papers themes available on the net, but finding kinds you can depend on isn`t easy. US Legal Forms gives a huge number of type themes, just like the District of Columbia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank, which can be written in order to meet state and federal needs.

When you are already familiar with US Legal Forms web site and get a free account, just log in. Afterward, you may obtain the District of Columbia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank format.

If you do not offer an profile and wish to begin using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is for your proper metropolis/region.

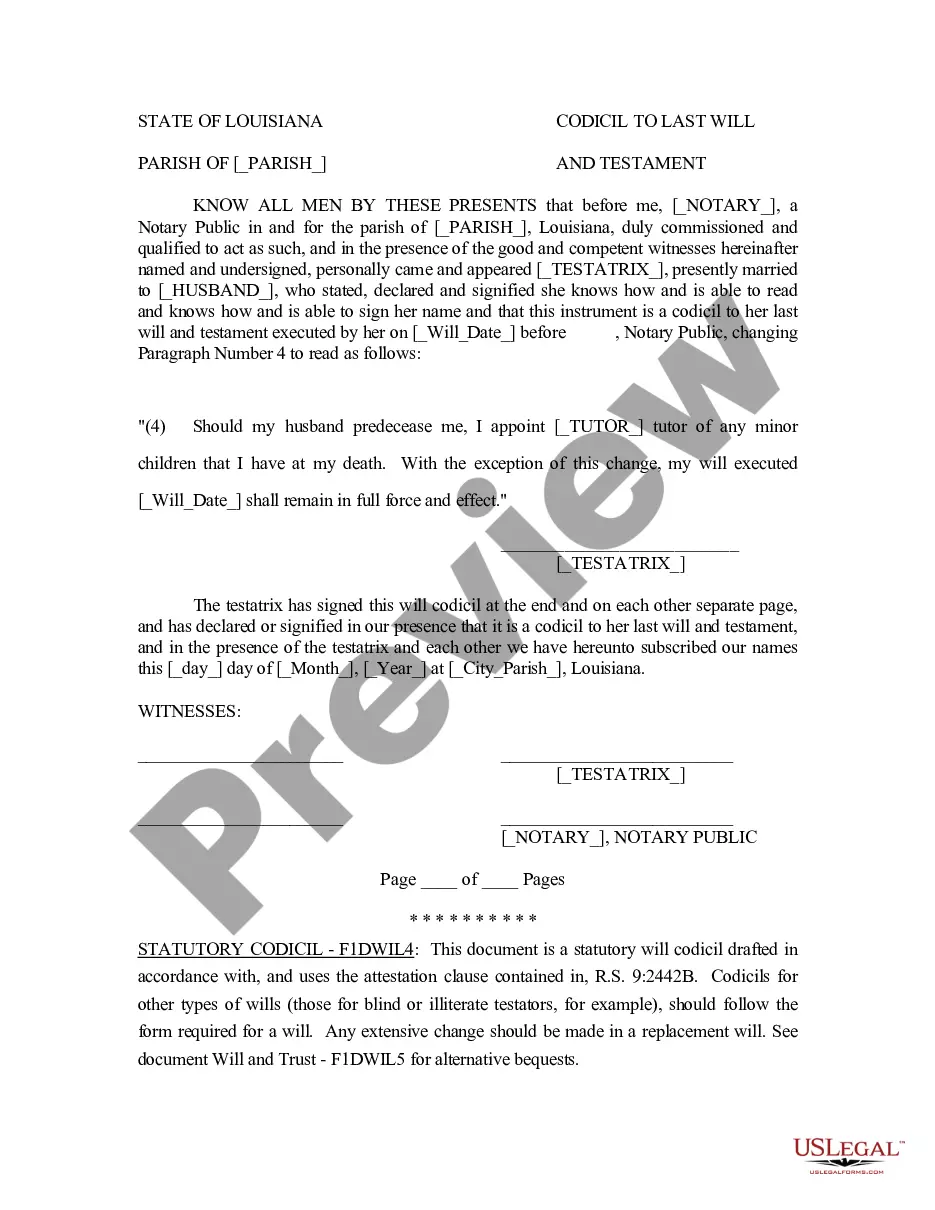

- Use the Preview switch to review the shape.

- See the outline to actually have chosen the proper type.

- In case the type isn`t what you are seeking, utilize the Look for field to obtain the type that fits your needs and needs.

- Whenever you obtain the proper type, just click Get now.

- Pick the rates strategy you want, fill in the specified information and facts to create your account, and purchase your order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free paper formatting and obtain your version.

Find each of the papers themes you might have bought in the My Forms menu. You can aquire a additional version of District of Columbia Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank any time, if needed. Just click on the essential type to obtain or print the papers format.

Use US Legal Forms, one of the most extensive assortment of lawful varieties, to save time and stay away from blunders. The service gives skillfully manufactured lawful papers themes that you can use for a variety of uses. Create a free account on US Legal Forms and start generating your life easier.