The District of Columbia Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. is a legal contract outlining the terms and conditions of the relationship between the two entities in managing investments and assets within the District of Columbia jurisdiction. This agreement ensures transparency, accountability, and compliance with the regulatory framework established by the District of Columbia government. Under this management agreement, Advisers Managers Trust, a registered investment adviser, entrusts Berger and Berman Management Inc., a reputable investment management firm, with the responsibility of managing and overseeing specific investment portfolios and assets within the District of Columbia. The agreement lays out the rights, obligations, and responsibilities of both parties involved, fostering a mutually beneficial relationship and aligning their interests. The District of Columbia Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. addresses various aspects related to investment management, including: 1. Scope of the Agreement: This section defines the specific investment portfolios, accounts, or assets covered by the agreement. It provides clarity on which funds or assets are included and excluded from the management relationship. 2. Investment Objectives and Restrictions: The agreement explicitly states the investment goals and strategies to be pursued by Berger and Berman Management Inc., ensuring they align with the overall investment objectives of Advisers Managers Trust. It outlines any specific investment restrictions or limitations imposed by the District of Columbia or other regulatory bodies. 3. Fee Structure and Compensation: This section details the fees and compensation arrangements between the parties involved. It includes information on management fees, performance-based fees, and any other expenses reimbursable by Advisers Managers Trust. 4. Reporting and Communication: The agreement establishes the regular reporting requirements, frequency, and format for communicating investment performance, portfolio updates, and other relevant information. It may specify the technology or platforms to be utilized for efficient reporting and communication. 5. Termination and Transition: This section outlines the conditions under which the agreement can be terminated by either party. It may include provisions for notice periods, termination fees, and procedures for the orderly transition of assets, accounts, and responsibilities. 6. Compliance and Regulatory Requirements: The agreement emphasizes the importance of adherence to all applicable laws, regulations, and guidelines set by the District of Columbia authorities. It includes obligations related to record-keeping, reporting, anti-money laundering compliance, and any other relevant regulatory requirements. Different types of District of Columbia Management Agreements between Advisers Managers Trust and Berger and Berman Management Inc. may exist depending on factors such as the type of investment strategy, asset class, or specific client requirements. Some potential variations could include agreements for managing equity portfolios, fixed-income portfolios, alternative investments, or specialized portfolios catering to specific investor needs, such as retirement or education savings. Each type of agreement would have its unique terms and considerations while still complying with the relevant District of Columbia regulations.

District of Columbia Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

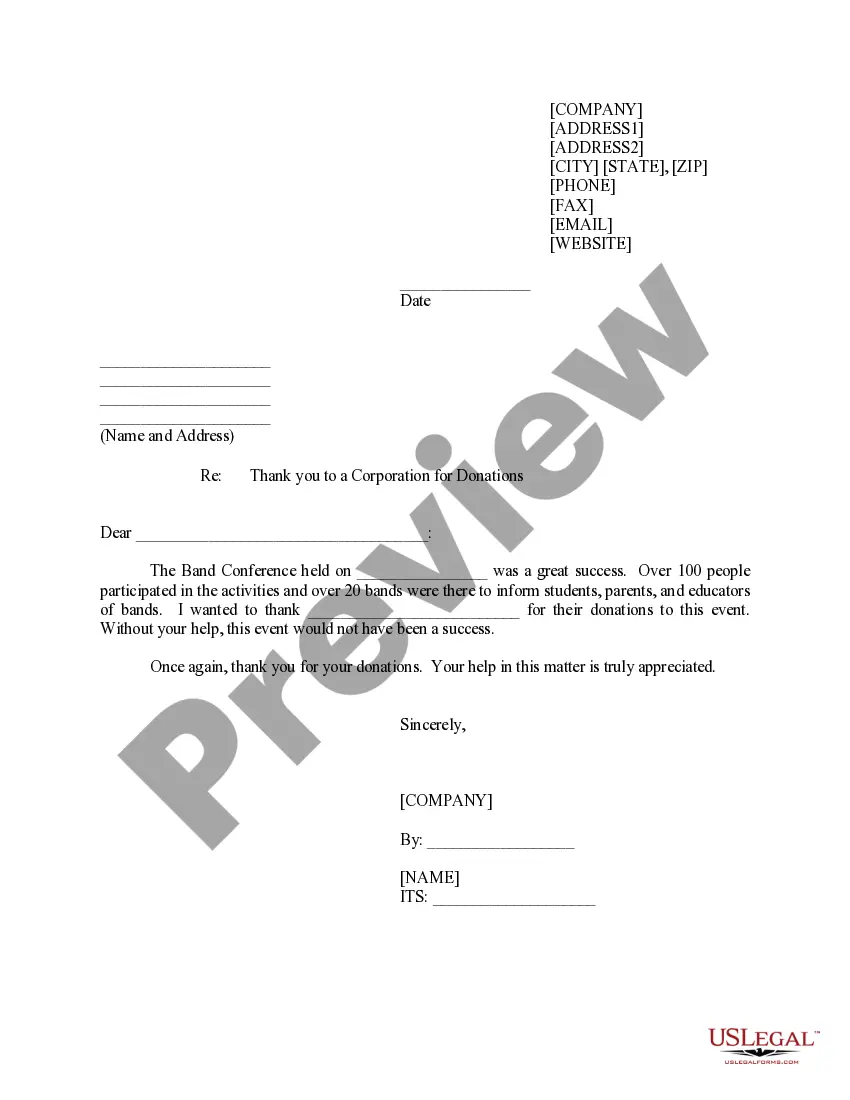

How to fill out District Of Columbia Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

You may commit several hours on the web trying to find the authorized record format that suits the state and federal specifications you need. US Legal Forms supplies 1000s of authorized kinds which are evaluated by experts. It is possible to obtain or produce the District of Columbia Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. from my assistance.

If you have a US Legal Forms bank account, you can log in and click the Download key. Following that, you can comprehensive, edit, produce, or indicator the District of Columbia Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. Every single authorized record format you purchase is yours eternally. To obtain yet another copy associated with a obtained type, check out the My Forms tab and click the related key.

If you work with the US Legal Forms website initially, keep to the straightforward recommendations below:

- Initial, make sure that you have selected the correct record format to the state/area of your choice. See the type outline to make sure you have chosen the appropriate type. If accessible, take advantage of the Review key to look through the record format as well.

- If you want to locate yet another variation from the type, take advantage of the Search industry to discover the format that fits your needs and specifications.

- Upon having discovered the format you desire, click on Get now to continue.

- Choose the pricing strategy you desire, type your credentials, and register for a free account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal bank account to pay for the authorized type.

- Choose the structure from the record and obtain it for your device.

- Make adjustments for your record if necessary. You may comprehensive, edit and indicator and produce District of Columbia Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Download and produce 1000s of record layouts while using US Legal Forms site, that offers the largest collection of authorized kinds. Use professional and state-particular layouts to handle your company or specific requires.