District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds is a legal document filed by a plaintiff in the District of Columbia to challenge a bank's attempt to recover on a note after the application of security proceeds. This type of complaint typically arises when a borrower defaults on a loan, and the bank seeks to recover the outstanding balance by applying the proceeds from any collateral held as security. Keywords: District of Columbia, complaint, action, bank, recover, note, application, security proceeds, legal document, plaintiff, borrower, loan, default, collateral, outstanding balance. Types of District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds: 1. Complaint alleging improper application of security proceeds: This type of complaint is filed when the plaintiff believes that the bank applied the security proceeds in a manner inconsistent with the terms of the loan agreement or with applicable laws and regulations. The plaintiff may argue that the bank did not follow the agreed-upon priority of payments or wrongfully applied the proceeds to unrelated debts. 2. Complaint alleging unjust enrichment: This type of complaint asserts that the bank would be unjustly enriched if it is allowed to recover on the note after already receiving the full or partial proceeds from the collateral. The plaintiff may argue that the bank should not be entitled to collect any additional funds from them as it would result in an inequitable outcome. 3. Complaint alleging breach of fiduciary duty: In certain cases, the plaintiff may claim that the bank breached its fiduciary duty by mismanaging the security proceeds or failing to act in the borrower's best interest. Such complaints may argue that the bank's actions were negligent or fraudulent, resulting in damages to the borrower. 4. Complaint seeking declaratory judgment: Instead of solely seeking monetary relief, a borrower may file a complaint requesting a declaratory judgment from the court. In this case, the plaintiff asks the court to determine the rights and obligations of the parties involved regarding the application of security proceeds and the recoverability of the outstanding note balance. By carefully preparing and filing a District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, a borrower can challenge the bank's attempts to collect additional funds and protect their rights within the legal framework. It is advisable for individuals involved in such disputes to consult with an experienced attorney to ensure they understand the specific legal requirements and strengthen their case.

District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

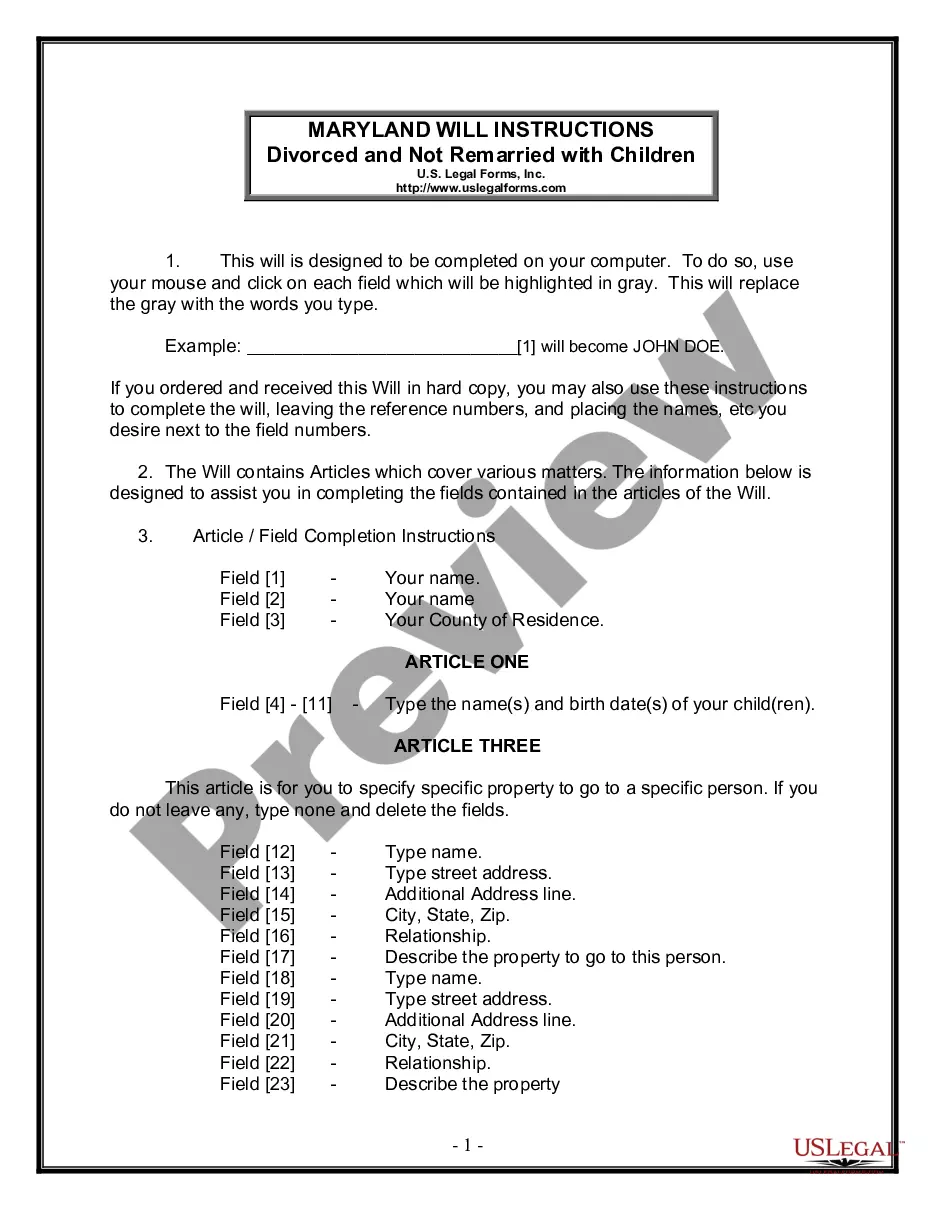

How to fill out District Of Columbia Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

You may commit hours on-line attempting to find the lawful document template that meets the state and federal demands you will need. US Legal Forms provides 1000s of lawful types which are analyzed by professionals. It is simple to obtain or print the District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds from the support.

If you currently have a US Legal Forms profile, you can log in and click the Acquire button. Afterward, you can full, change, print, or indicator the District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds. Each and every lawful document template you acquire is your own property forever. To get another duplicate for any purchased form, go to the My Forms tab and click the related button.

If you are using the US Legal Forms web site the first time, follow the simple directions listed below:

- Initial, make sure that you have selected the correct document template for the area/town that you pick. Look at the form description to make sure you have chosen the proper form. If readily available, utilize the Preview button to look through the document template too.

- If you would like discover another edition of the form, utilize the Search field to find the template that fits your needs and demands.

- Once you have discovered the template you desire, just click Acquire now to continue.

- Pick the costs prepare you desire, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal profile to cover the lawful form.

- Pick the structure of the document and obtain it for your system.

- Make modifications for your document if possible. You may full, change and indicator and print District of Columbia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Acquire and print 1000s of document themes utilizing the US Legal Forms website, which offers the most important variety of lawful types. Use expert and status-particular themes to deal with your small business or person requirements.

Form popularity

FAQ

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

In the unlikely event of a bank failure, the FDIC acts quickly to protect insured depositors by arranging a sale to a healthy bank, or by paying depositors directly for their deposit accounts to the insured limit.

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

If you need assistance submitting your consumer complaint, please contact the Consumer Complaint Hotline at 202-442-9828 or email consumer.protection@dc.gov. It only takes 5 minutes to submit your complaint online - be prepared to provide: Your contact information (address, phone number, email address).

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: .

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

Section 10(c) of the FDI Act authorizes the FDIC to conduct a formal investigation to obtain needed information or evidence.

To determine your deposit insurance coverage or ask any other specific deposit insurance questions, call 1-877-ASK-FDIC (1-877-275-3342).