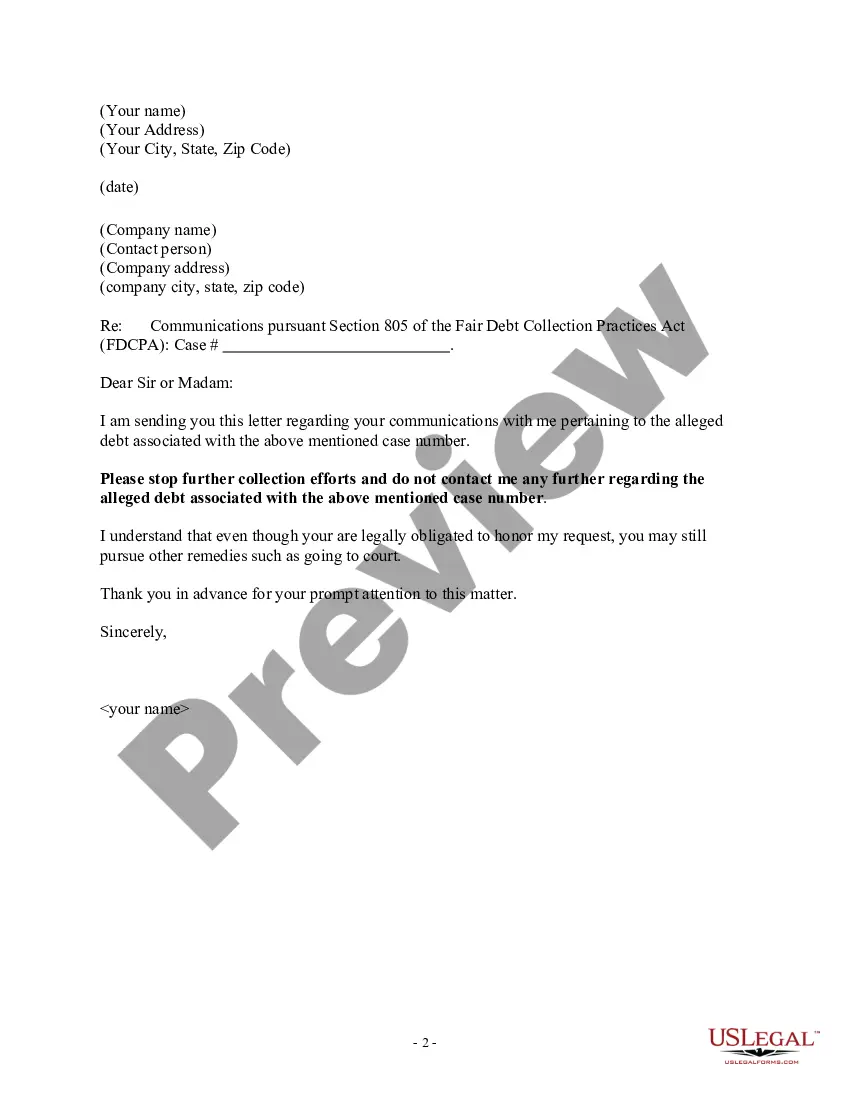

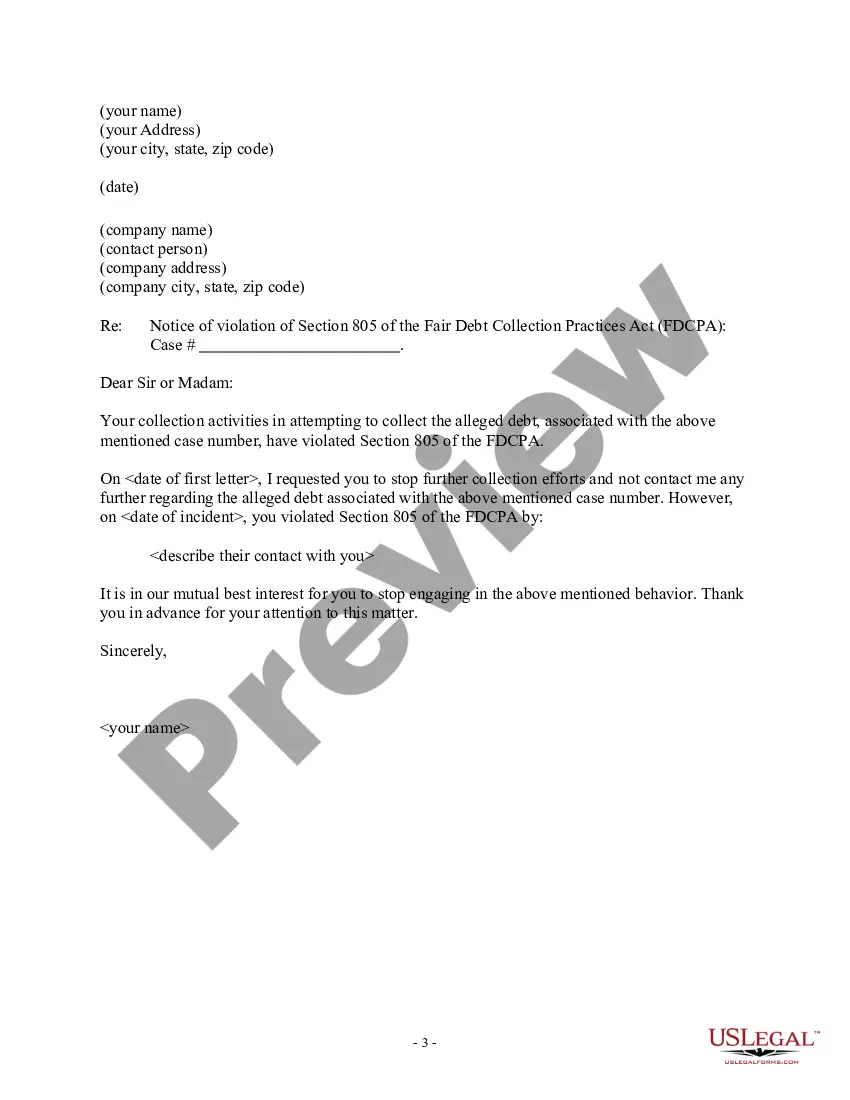

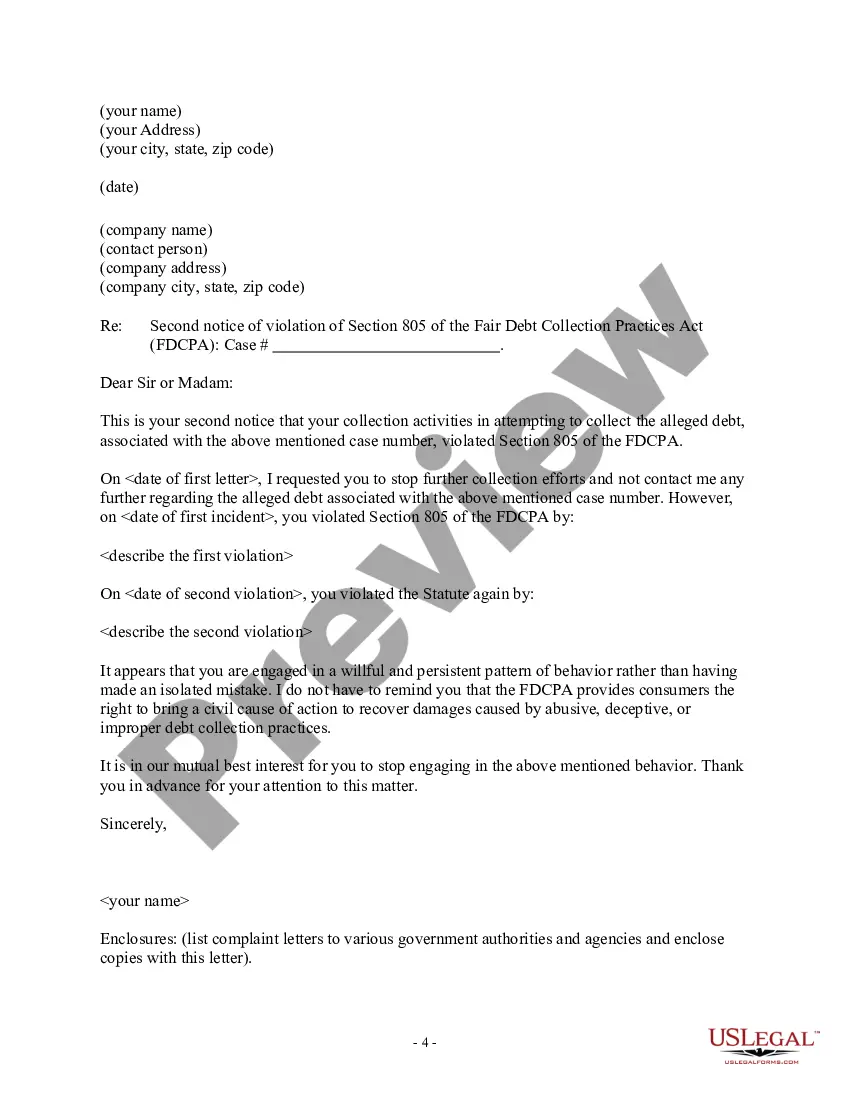

District of Columbia Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out District Of Columbia Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Discovering the right legal file web template might be a battle. Obviously, there are tons of themes available on the net, but how would you obtain the legal type you will need? Take advantage of the US Legal Forms site. The service gives thousands of themes, like the District of Columbia Notice of Violation of Fair Debt Act - Notice to Stop Contact, that can be used for organization and private requirements. Every one of the types are checked by professionals and satisfy federal and state demands.

When you are presently listed, log in to your bank account and then click the Down load button to have the District of Columbia Notice of Violation of Fair Debt Act - Notice to Stop Contact. Utilize your bank account to appear through the legal types you might have ordered earlier. Visit the My Forms tab of your bank account and acquire another backup of the file you will need.

When you are a new user of US Legal Forms, listed here are simple directions that you should adhere to:

- Initially, make certain you have selected the right type for your city/state. You are able to check out the shape while using Review button and look at the shape outline to make sure it is the right one for you.

- In case the type will not satisfy your requirements, use the Seach discipline to find the right type.

- When you are positive that the shape is suitable, select the Buy now button to have the type.

- Pick the pricing prepare you want and enter in the required information and facts. Build your bank account and pay money for your order making use of your PayPal bank account or Visa or Mastercard.

- Choose the submit structure and obtain the legal file web template to your device.

- Complete, revise and produce and indication the attained District of Columbia Notice of Violation of Fair Debt Act - Notice to Stop Contact.

US Legal Forms is the largest collection of legal types in which you can find various file themes. Take advantage of the company to obtain skillfully-manufactured papers that adhere to status demands.

Form popularity

FAQ

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.