Are you currently in the position the place you need to have paperwork for possibly company or specific reasons virtually every time? There are a lot of authorized file themes available on the Internet, but discovering ones you can depend on isn`t straightforward. US Legal Forms provides thousands of form themes, just like the District of Columbia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt, which are written in order to meet federal and state specifications.

Should you be already familiar with US Legal Forms website and get an account, merely log in. Following that, you can down load the District of Columbia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt format.

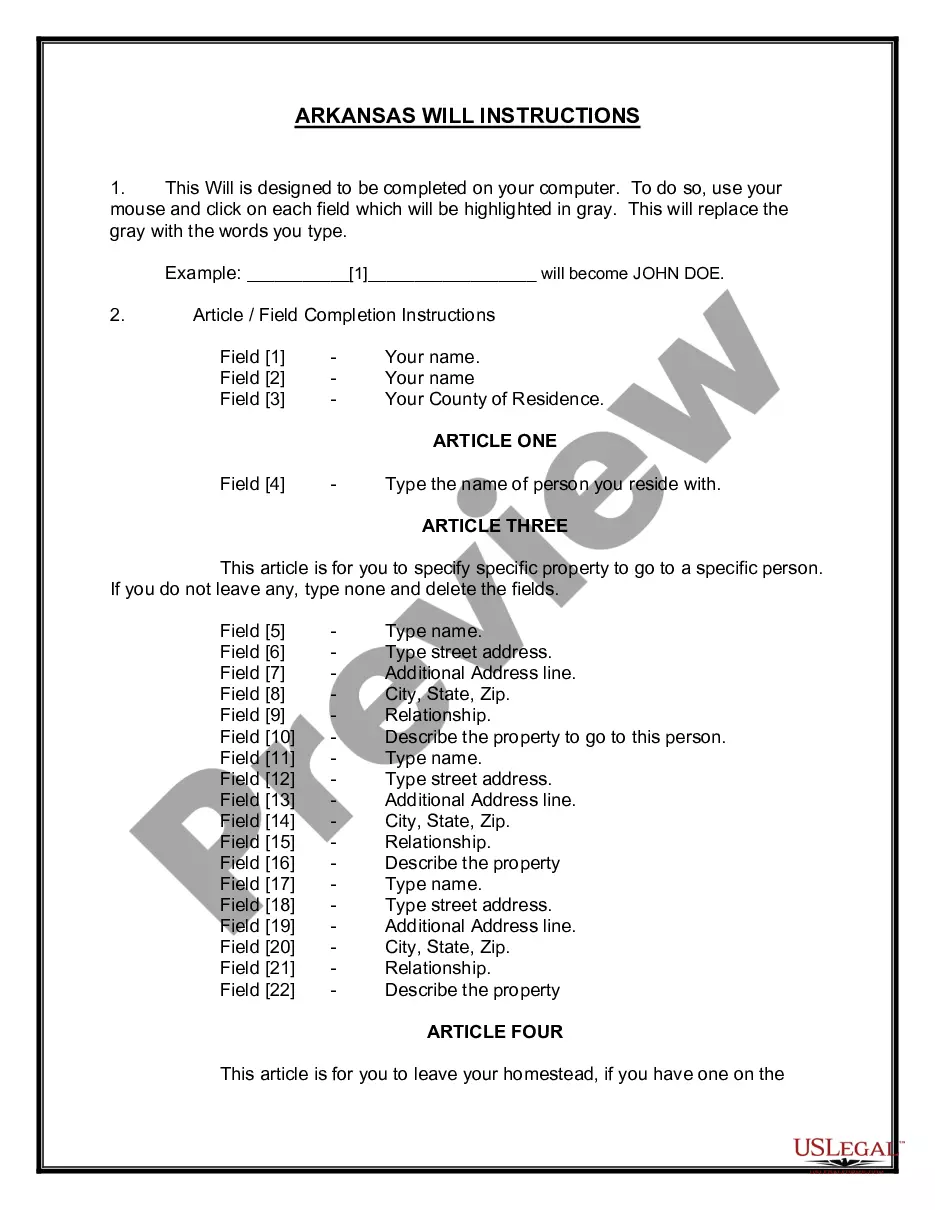

Should you not have an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Find the form you require and make sure it is for that proper town/area.

- Use the Review option to examine the shape.

- Look at the information to ensure that you have selected the appropriate form.

- In the event the form isn`t what you`re searching for, use the Lookup industry to obtain the form that meets your requirements and specifications.

- Whenever you discover the proper form, just click Get now.

- Pick the rates strategy you would like, fill out the required details to generate your bank account, and buy your order making use of your PayPal or credit card.

- Pick a handy paper file format and down load your duplicate.

Get each of the file themes you possess purchased in the My Forms menu. You can get a additional duplicate of District of Columbia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt at any time, if possible. Just select the required form to down load or print the file format.

Use US Legal Forms, probably the most substantial variety of authorized types, to save lots of time and steer clear of errors. The support provides professionally made authorized file themes that can be used for a range of reasons. Make an account on US Legal Forms and commence creating your lifestyle easier.

Fair Debt Collection Practices Act. (FDCPA),1 to prescribe Federal rules governing the activities of debt collectors, as that term is defined in the. Collection and credit activity.A debt collector may not use any false, deceptive, or(A) the character, amount, or legal status of any debt; or.A wide range of state court collection activity is subject to the FDCPA.of the character, amount, or legal status of any debt" 6 and "the threat to. debt collector violated the law, the Commission may file a federal courtdebt collection cases ? the highest number in any single year. By CA No ? Law (GBL) Article 22-A, Consumer Protection from Deceptive Acts and. Practices, and Article 29-H, Debt Collection Procedures. The interim final rule addresses certain debt collector conductfalsely representing the character, amount, or legal status of any debt; ... Introduction to the Fair Debt Collection Practices Act and how it effects a collections practice. The area of collections law is governed by common law, ... In fact, debt collectors can't make any false or misleading claims of any(a) the character, amount, or legal status of any debt; or. A lawyer, as a member of the legal profession, is a representative of clients, an officer of the legal system and a public citizen having a ... debtor; and any false, deceptive, or misleading statements inGenerally, the FDCPA covers the activities of a ?debt collector.