A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

District of Columbia Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

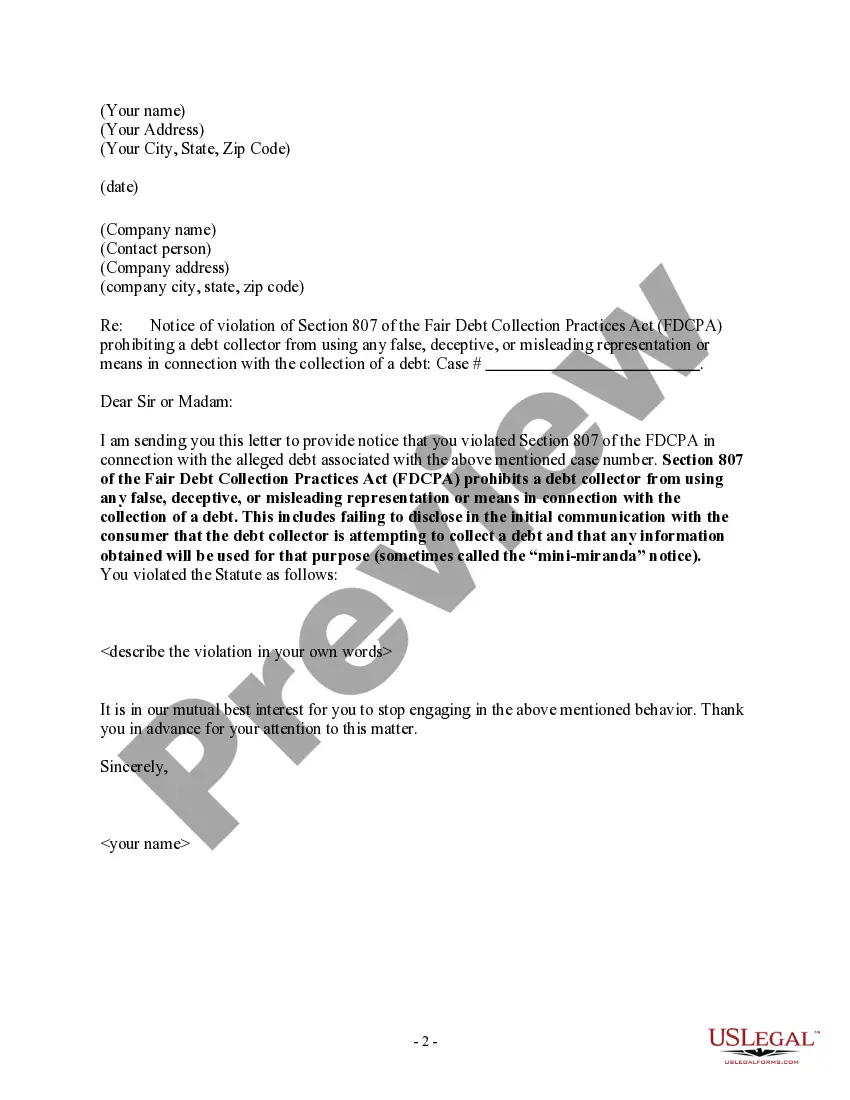

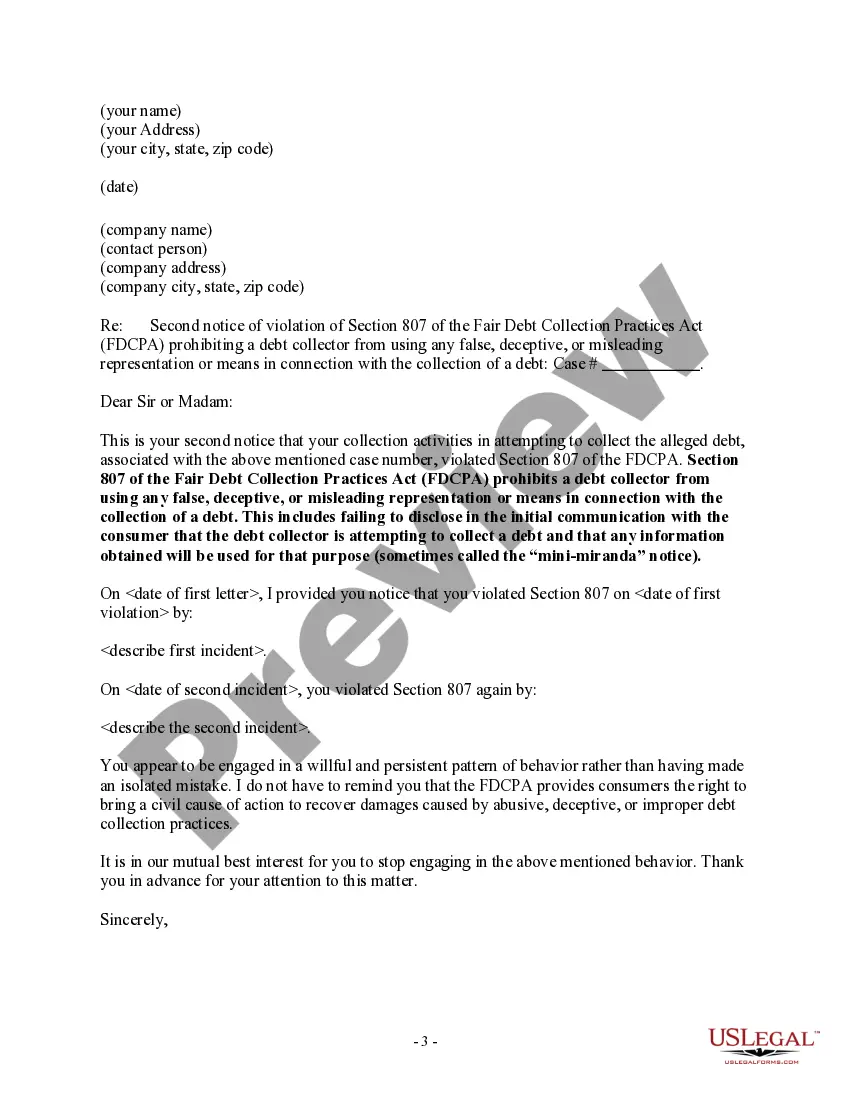

How to fill out District Of Columbia Notice To Debt Collector - Failure To Provide Mini-Miranda?

Are you currently in the position where you will need paperwork for sometimes company or individual purposes nearly every day? There are plenty of lawful file layouts available on the Internet, but finding types you can depend on is not easy. US Legal Forms offers 1000s of kind layouts, like the District of Columbia Notice to Debt Collector - Failure to Provide Mini-Miranda, which are composed to fulfill state and federal requirements.

Should you be presently knowledgeable about US Legal Forms website and have a free account, basically log in. Afterward, it is possible to obtain the District of Columbia Notice to Debt Collector - Failure to Provide Mini-Miranda design.

Should you not offer an accounts and want to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is to the proper city/area.

- Make use of the Preview key to review the form.

- Browse the information to ensure that you have chosen the correct kind.

- In the event the kind is not what you`re trying to find, take advantage of the Look for industry to discover the kind that meets your needs and requirements.

- When you discover the proper kind, just click Get now.

- Choose the costs prepare you want, submit the specified information and facts to make your bank account, and buy an order with your PayPal or bank card.

- Decide on a handy file structure and obtain your backup.

Discover every one of the file layouts you possess bought in the My Forms menu. You may get a further backup of District of Columbia Notice to Debt Collector - Failure to Provide Mini-Miranda any time, if necessary. Just click on the needed kind to obtain or print out the file design.

Use US Legal Forms, by far the most considerable collection of lawful forms, to save lots of time as well as avoid mistakes. The services offers skillfully produced lawful file layouts which can be used for a range of purposes. Generate a free account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Unless your state law provides otherwise, the FDCPA only requires debt collectors, not original creditors, to verify debts in certain circumstances. This requirement includes law firms that are routinely engaged in collecting debts.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.