A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

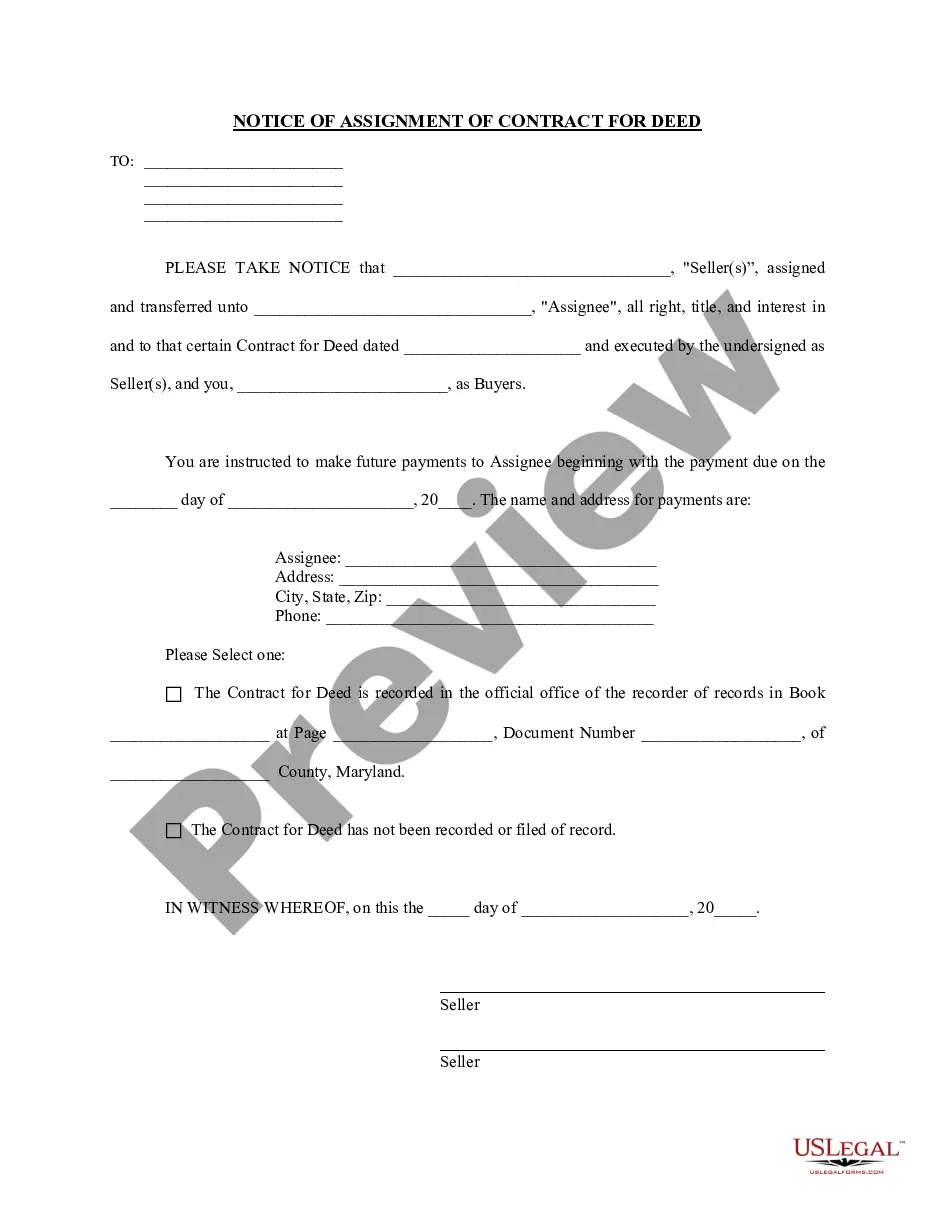

How to fill out District Of Columbia Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Choosing the best legal file template could be a struggle. Naturally, there are tons of layouts accessible on the Internet, but how will you find the legal develop you need? Make use of the US Legal Forms internet site. The services provides a large number of layouts, such as the District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, that you can use for business and private requirements. All of the kinds are examined by professionals and meet state and federal needs.

Should you be currently registered, log in for your bank account and click on the Acquire button to find the District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. Use your bank account to search with the legal kinds you may have purchased earlier. Check out the My Forms tab of your respective bank account and acquire another backup of your file you need.

Should you be a whole new customer of US Legal Forms, listed here are straightforward instructions that you can adhere to:

- Very first, make sure you have selected the proper develop for your personal city/county. You can check out the shape using the Review button and look at the shape outline to make sure this is the right one for you.

- If the develop fails to meet your requirements, use the Seach industry to get the correct develop.

- When you are sure that the shape would work, select the Get now button to find the develop.

- Opt for the costs plan you desire and type in the needed info. Build your bank account and purchase the order using your PayPal bank account or charge card.

- Select the file format and download the legal file template for your gadget.

- Full, change and produce and indicator the received District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

US Legal Forms will be the biggest library of legal kinds in which you can discover different file layouts. Make use of the service to download professionally-created files that adhere to status needs.

Form popularity

FAQ

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Statute of Limitations The Statute of limitations in the District of Columbia for open accounts and writings, such as contracts and promissory notes, is three (3) years from the date of breach. Generally, a renewed promise that can be proved to pay an old debt renews the limitations period.

Under California law, a debt collector can't make any of the following threats. Use or threaten to use physical force or criminal tactics to harm you, your property, or your reputation.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Who does regulation F apply to? Regulation F applies to collection agencies, debt collectors, debt buyers, collection law firms, and loan servicers. Creditors collecting on debts they originally owned do not qualify as debt collectors unless they enlist the aid of a debt collector or use a name other than their own.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.