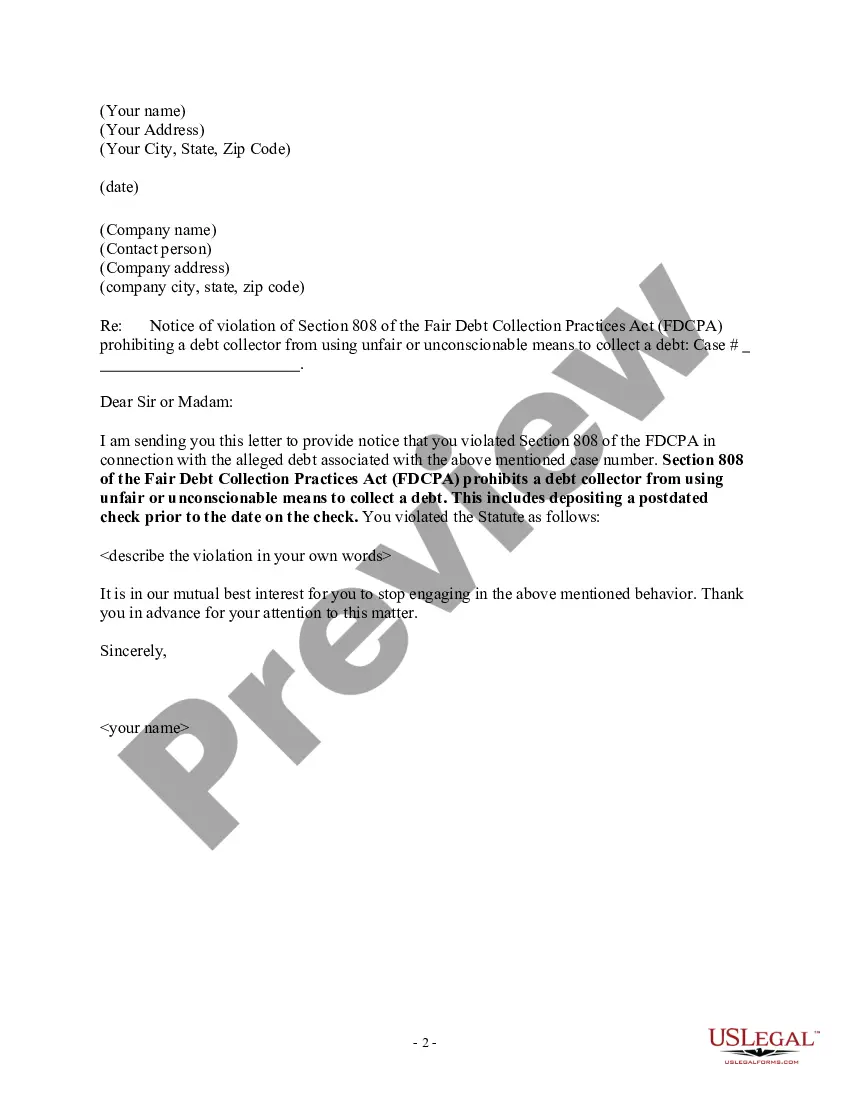

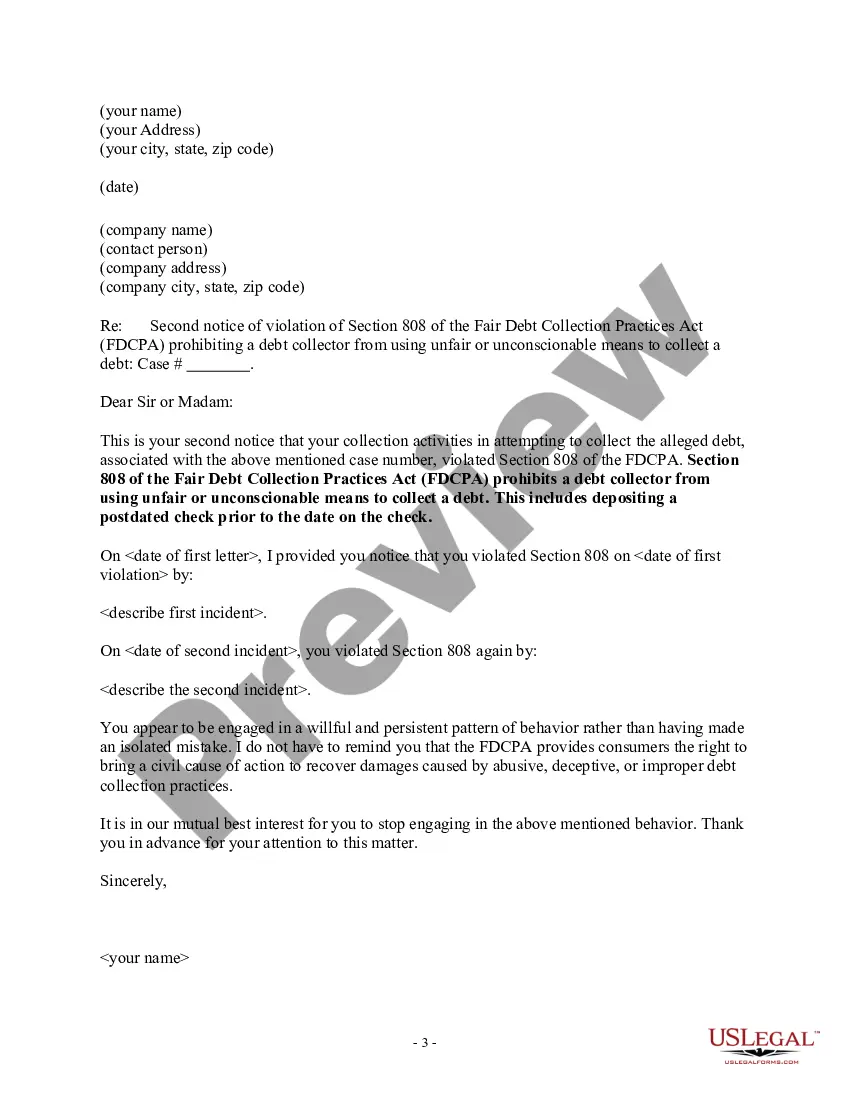

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

District of Columbia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

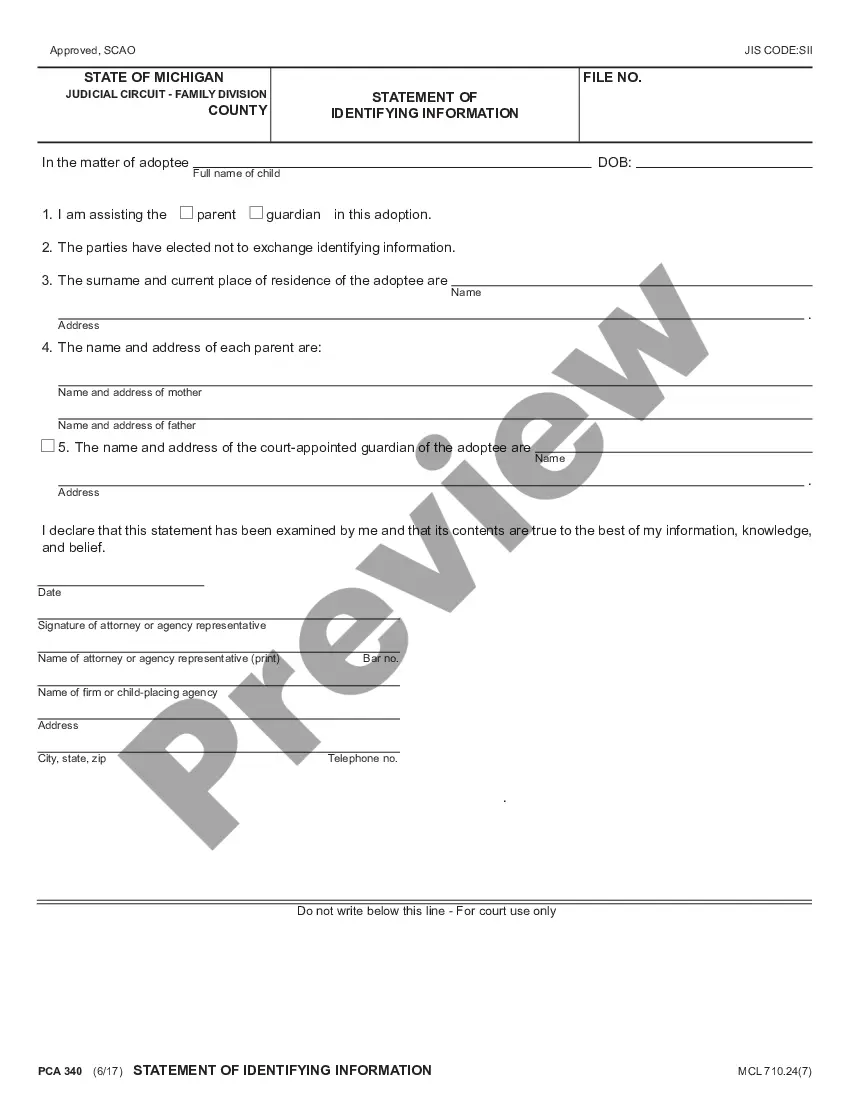

How to fill out District Of Columbia Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

US Legal Forms - among the biggest libraries of lawful kinds in the States - provides a wide range of lawful record templates you may down load or print. Utilizing the web site, you can get a large number of kinds for company and person reasons, sorted by groups, suggests, or search phrases.You will find the most up-to-date versions of kinds much like the District of Columbia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check within minutes.

If you have a registration, log in and down load District of Columbia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check from the US Legal Forms collection. The Down load key will show up on each and every kind you view. You have access to all formerly saved kinds within the My Forms tab of the account.

If you want to use US Legal Forms the very first time, listed below are simple recommendations to help you get started:

- Be sure to have selected the correct kind to your metropolis/region. Click the Review key to check the form`s articles. Browse the kind information to actually have chosen the appropriate kind.

- When the kind doesn`t satisfy your specifications, take advantage of the Research area near the top of the monitor to find the the one that does.

- When you are happy with the form, verify your decision by clicking on the Purchase now key. Then, select the rates strategy you favor and provide your credentials to register to have an account.

- Process the financial transaction. Make use of your charge card or PayPal account to complete the financial transaction.

- Choose the formatting and down load the form on your own system.

- Make adjustments. Fill out, change and print and sign the saved District of Columbia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

Every single format you added to your money does not have an expiration day and it is your own property permanently. So, in order to down load or print another duplicate, just proceed to the My Forms segment and click on the kind you need.

Obtain access to the District of Columbia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check with US Legal Forms, one of the most substantial collection of lawful record templates. Use a large number of professional and status-particular templates that meet your organization or person requirements and specifications.

Form popularity

FAQ

So, yes, you can deposit a post-dated check before the date shown, but it isn't advised. Be prepared for the possibility that the check funds won't be available. Not only do you not want to incur an insufficient funds fee, you don't want to go through the trouble of obtaining a reissued check.

It is legal for an individual to postdate a check, as well as for a bank to cash or deposit it.

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

If a post-dated cheque you wrote is mistakenly processed before its date, you should contact your bank to let them know. The cheque can be returned and the amount credited back to your account up to the day before the date written on the cheque.

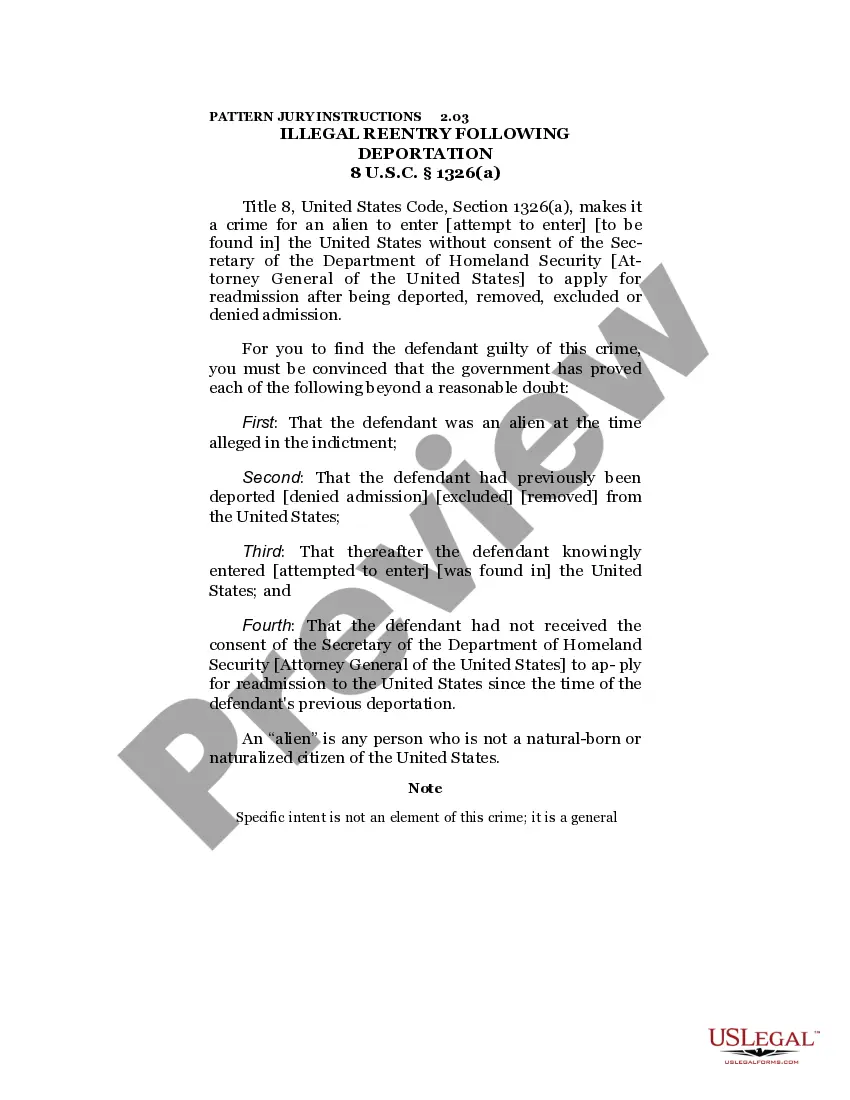

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

If the bank does not spot that the cheque has been post-dated, the cheque would then probably be paid before you intended or returned unpaid if you have insufficient funds in your account. This could potentially incur you charges and cause inconvenience to the recipient.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.