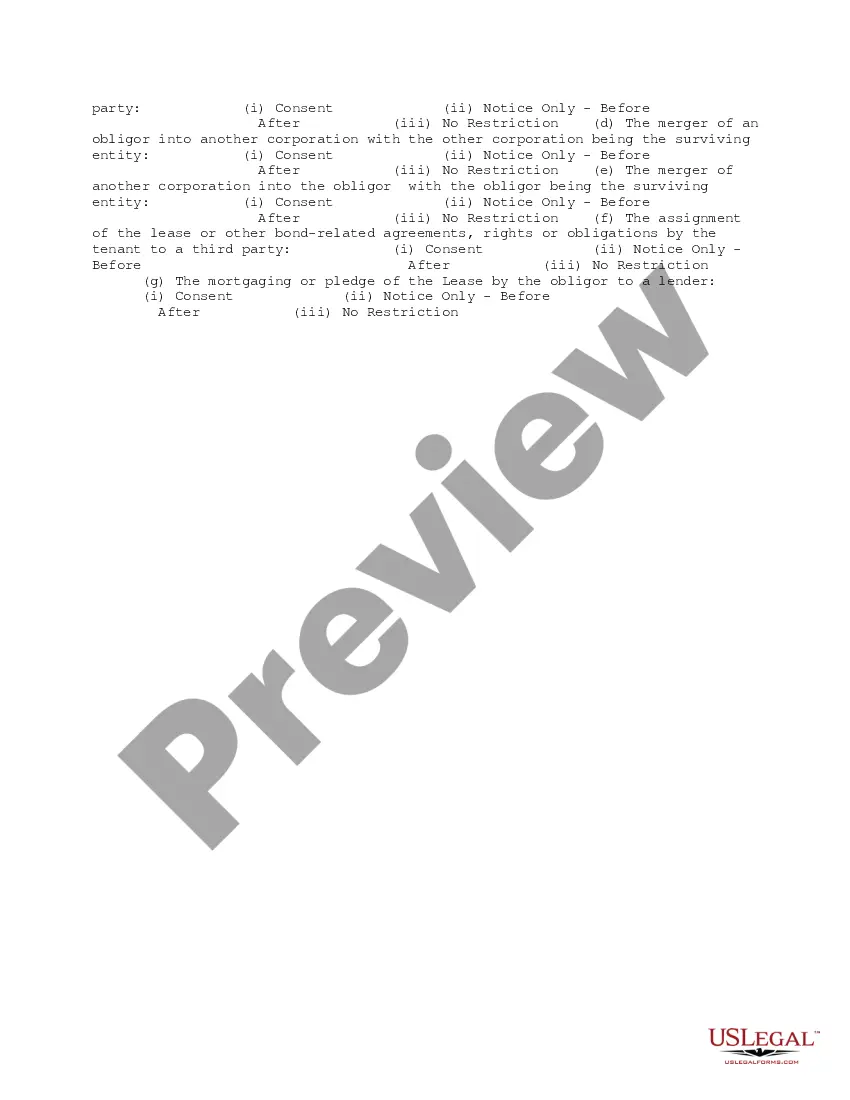

The District of Columbia Industrial Revenue Development Bond Work form refers to a set of documents and procedures necessary for the issuance, management, and repayment of industrial revenue development bonds (IRS) within the District of Columbia, United States. IRS is financial instruments typically used to fund construction or improvement of facilities by private companies or non-profit organizations. These bonds are issued by a state or local government agency, allowing the borrower to obtain financing at lower interest rates compared to traditional commercial loans. The District of Columbia Industrial Revenue Development Bond Work form encompasses a range of forms and requirements that both the issuing agency and borrower must fulfill. These documents are designed to ensure transparency, compliance with regulations, and facilitate effective communication between the parties involved. Here are some relevant keywords and components associated with this work form: 1. IRB Application: This is the initial form required by the District of Columbia industrial development authority (IDA). It contains information about the borrower, project details, financing requirements, and other relevant information necessary for the approval process. 2. Project Description: A detailed outline of the proposed project, including its purpose, location, size, scope, cost estimation, and economic impact. This helps the IDA evaluate the potential benefits to the District's economy and make an informed decision. 3. Feasibility Study: Often required as part of the work form, this entails a comprehensive analysis of the project's financial viability, market demand, potential risks, and potential economic benefits. This study assists the IDA in assessing the project's feasibility and evaluating its potential impact on the community. 4. Bond Resolution: A legally binding document that authorizes the issuance of IRS. It specifies the amount, interest rates, repayment terms, and other crucial aspects of the bonds. The bond resolution is usually approved by the IDA and constitutes a commitment between the issuer and the borrower. 5. Indenture Agreement: A contract between the borrower and the trustee that outlines the terms of the bond issue. It defines the responsibilities of each party, repayment schedules, default provisions, and the trustee's role in protecting the bondholders' interests. 6. Continuing Disclosure Agreement: This agreement requires the borrower to provide ongoing updates and financial information related to the project and the bonds. It ensures transparency and allows potential investors to make informed decisions. 7. Tax-Exempt Status Determination: IRS issued by the District of Columbia are typically exempt from federal income taxation. Therefore, the work form may include documentation to determine the bond's tax-exempt status under relevant Internal Revenue Service (IRS) regulations. There may be variations or additional requirements within the District of Columbia Industrial Revenue Development Bond Work form, depending on the specific nature of the project, the bond issuance terms, and other local regulations. It is always essential to consult the relevant authorities or legal professionals to ensure compliance with all necessary procedures and documentation.

District of Columbia Industrial Revenue Development Bond Workform

Description

How to fill out District Of Columbia Industrial Revenue Development Bond Workform?

You are able to spend several hours on the web looking for the authorized papers web template which fits the state and federal requirements you will need. US Legal Forms offers 1000s of authorized kinds that are examined by experts. It is simple to down load or print the District of Columbia Industrial Revenue Development Bond Workform from your assistance.

If you have a US Legal Forms account, you can log in and click the Down load key. Next, you can full, change, print, or signal the District of Columbia Industrial Revenue Development Bond Workform. Each and every authorized papers web template you acquire is the one you have eternally. To acquire an additional backup for any acquired kind, visit the My Forms tab and click the corresponding key.

If you are using the US Legal Forms web site initially, follow the basic directions below:

- First, ensure that you have chosen the right papers web template for that area/city of your choosing. Look at the kind explanation to ensure you have chosen the appropriate kind. If offered, use the Preview key to appear through the papers web template too.

- If you want to get an additional variation in the kind, use the Search area to discover the web template that meets your requirements and requirements.

- Once you have located the web template you would like, simply click Purchase now to move forward.

- Find the prices strategy you would like, type your qualifications, and sign up for a free account on US Legal Forms.

- Total the purchase. You should use your bank card or PayPal account to purchase the authorized kind.

- Find the format in the papers and down load it to your device.

- Make alterations to your papers if necessary. You are able to full, change and signal and print District of Columbia Industrial Revenue Development Bond Workform.

Down load and print 1000s of papers web templates using the US Legal Forms Internet site, that provides the greatest collection of authorized kinds. Use professional and state-particular web templates to deal with your small business or person requirements.