District of Columbia Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

Have you been inside a position that you will need papers for either enterprise or specific reasons virtually every day time? There are plenty of legal papers templates available online, but finding versions you can rely on is not easy. US Legal Forms provides 1000s of form templates, much like the District of Columbia Joint Filing of Rule 13d-1(f)(1) Agreement, which can be created to meet state and federal requirements.

In case you are currently familiar with US Legal Forms internet site and also have an account, just log in. Next, you are able to acquire the District of Columbia Joint Filing of Rule 13d-1(f)(1) Agreement design.

If you do not offer an account and wish to begin to use US Legal Forms, abide by these steps:

- Get the form you need and ensure it is to the right metropolis/county.

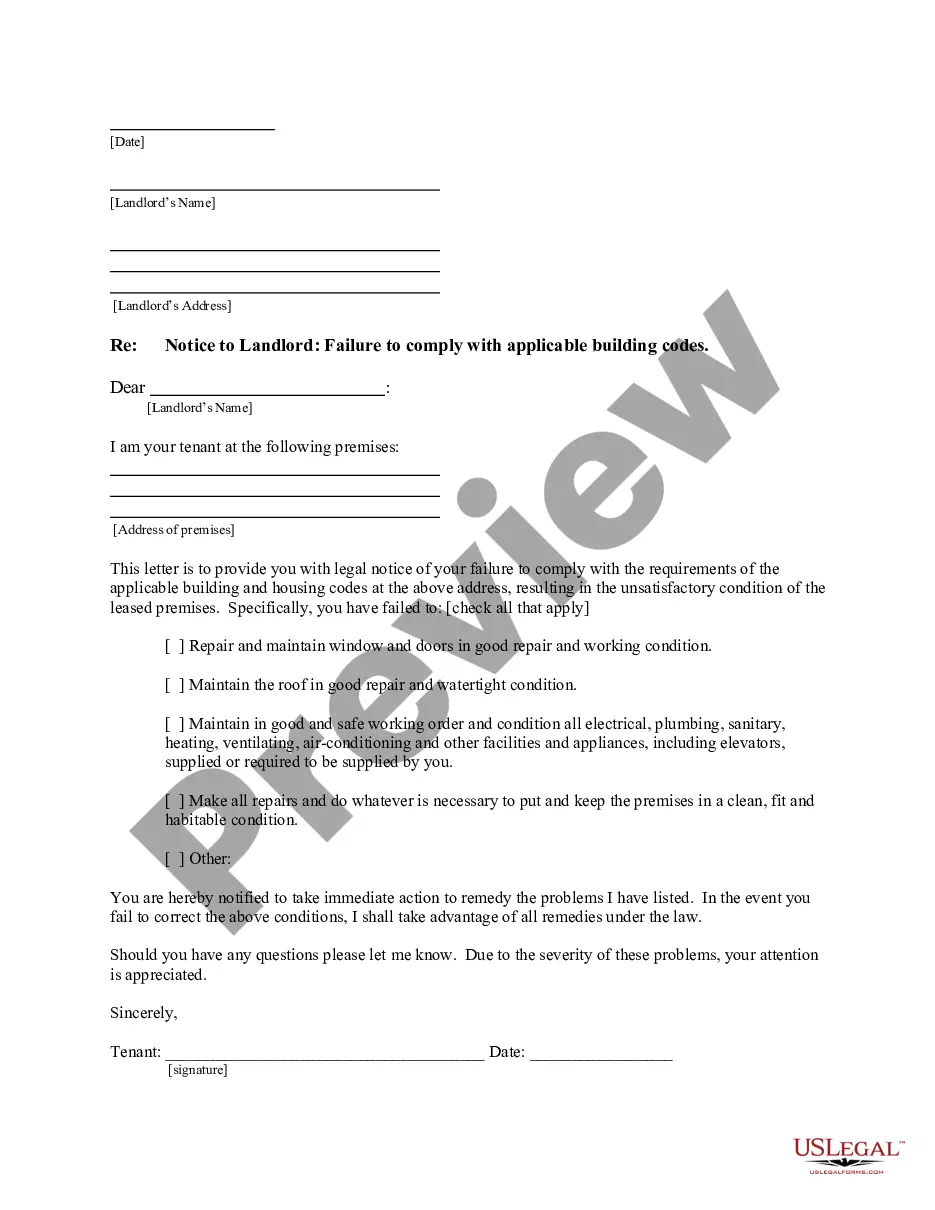

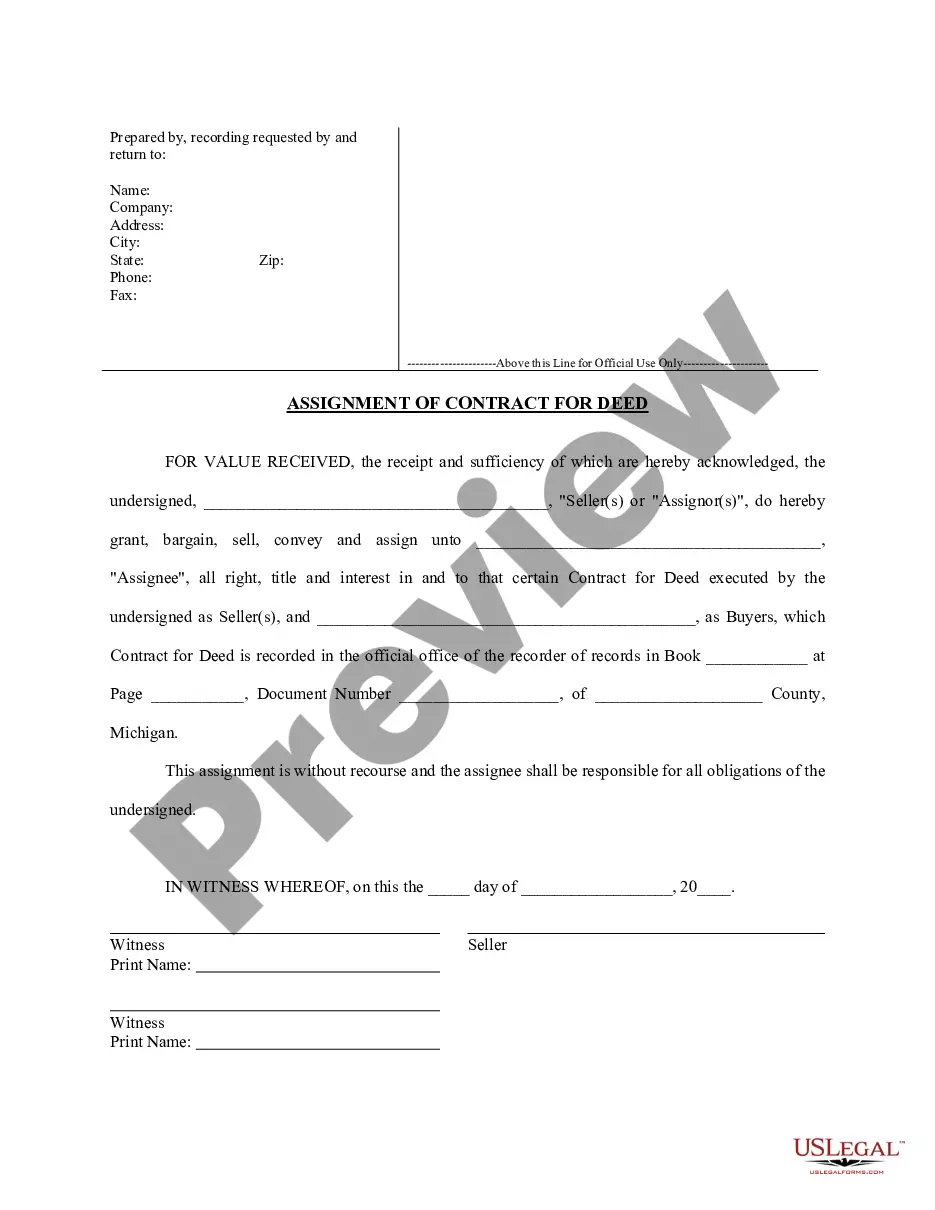

- Utilize the Review switch to analyze the form.

- See the description to actually have chosen the right form.

- When the form is not what you are searching for, use the Lookup field to find the form that meets your requirements and requirements.

- Whenever you obtain the right form, simply click Get now.

- Pick the pricing strategy you need, submit the desired information and facts to produce your money, and pay for an order using your PayPal or credit card.

- Choose a handy paper structure and acquire your version.

Locate all the papers templates you may have bought in the My Forms menus. You can aquire a further version of District of Columbia Joint Filing of Rule 13d-1(f)(1) Agreement any time, if needed. Just select the required form to acquire or printing the papers design.

Use US Legal Forms, one of the most extensive assortment of legal types, to conserve some time and avoid faults. The assistance provides appropriately manufactured legal papers templates which you can use for a variety of reasons. Produce an account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

A company subject to Section 13 or 15(d) of the US Securities Exchange Act of 1934 (Exchange Act), which requires the company to file periodic reports with the US Securities and Exchange Commission (SEC).

Rule 13d-1(b) is the ?Institutional Investor? exemption and provides that certain Institutional Investors (defined below) that acquire securities in the ordinary course of its business and not with the purpose nor with the effect of changing or influencing the control of the issuer (nor in connection with or as a ...

What's a Form 3? When a person becomes an insider (for example, when they are hired as an officer or director), they must file a Form 3 to initially disclose his or her ownership of the company's securities. Form 3 must be filed within 10 days after the person becomes an insider.

Section 13(d) of the Exchange Act requires any person (or group of persons) that owns or acquires beneficial ownership of more than 5% of any class of equity securities registered under the Exchange Act to file ownership reports with the SEC on a Schedule 13D.

What Is Schedule 13D? Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

A Schedule 13D is a document that must be filed with the Securities and Exchange Commission (SEC) within 10 days of the purchase of more than 5% of the shares of a public company by an investor or entity. It is sometimes referred to as a beneficial ownership report.

SEC Form 4: Statement of Changes in Beneficial Ownership is a document that must be filed with the Securities and Exchange Commission (SEC) whenever there is a material change in the holdings of company insiders.

A Schedule 13D is a document that must be filed with the Securities and Exchange Commission (SEC) within 10 days of the purchase of more than 5% of the shares of a public company by an investor or entity. It is sometimes referred to as a beneficial ownership report.

SEC Form 3: Initial Statement of Beneficial Ownership of Securities is a document filed by a company insider or major shareholder with the Securities and Exchange Commission (SEC).