District of Columbia Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company

Description

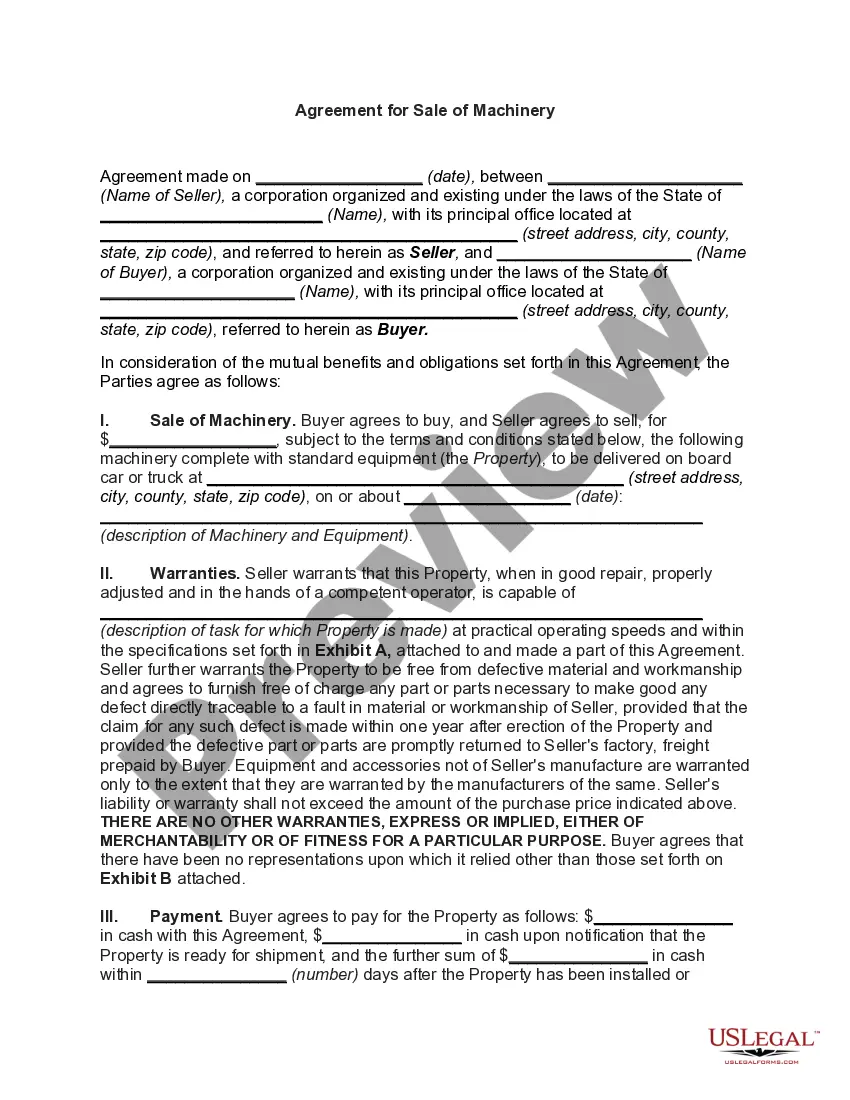

How to fill out Registration Rights Agreement Between Visible Genetics, Inc. And The Purchasers Of Common Shares Of The Company?

US Legal Forms - among the biggest libraries of legitimate kinds in America - offers an array of legitimate file layouts you may obtain or printing. While using internet site, you will get thousands of kinds for company and personal reasons, categorized by categories, says, or search phrases.You can get the latest versions of kinds much like the District of Columbia Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company within minutes.

If you currently have a registration, log in and obtain District of Columbia Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company in the US Legal Forms collection. The Acquire button will appear on every single kind you look at. You have accessibility to all earlier downloaded kinds within the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed below are easy recommendations to get you started:

- Be sure to have picked out the best kind for your personal metropolis/region. Go through the Review button to analyze the form`s content. Read the kind outline to ensure that you have chosen the correct kind.

- In the event the kind doesn`t satisfy your requirements, make use of the Search discipline at the top of the display screen to discover the one who does.

- When you are content with the shape, affirm your selection by clicking on the Purchase now button. Then, pick the rates strategy you favor and provide your accreditations to register to have an bank account.

- Process the financial transaction. Make use of credit card or PayPal bank account to perform the financial transaction.

- Pick the structure and obtain the shape on your own system.

- Make alterations. Load, modify and printing and sign the downloaded District of Columbia Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company.

Every format you added to your money does not have an expiration date and it is your own property for a long time. So, if you wish to obtain or printing another copy, just go to the My Forms area and then click in the kind you require.

Get access to the District of Columbia Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company with US Legal Forms, the most substantial collection of legitimate file layouts. Use thousands of skilled and state-specific layouts that meet up with your organization or personal requirements and requirements.