District of Columbia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.

Description

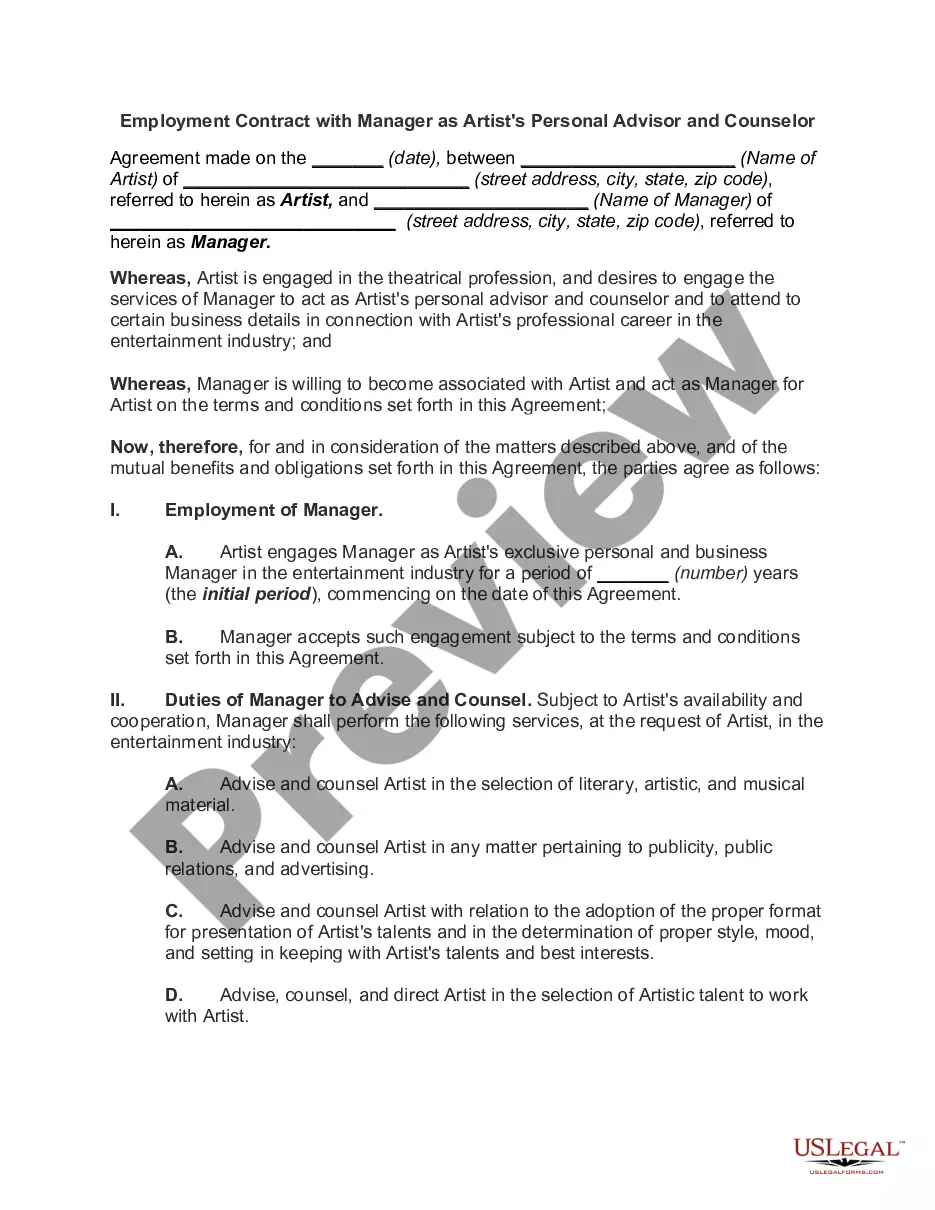

How to fill out Pledge Agreement Between ADAC Laboratories And ABN AMRO Bank, N.V.?

Are you in a place the place you will need files for sometimes company or specific functions nearly every day? There are a variety of authorized document templates available online, but locating versions you can depend on isn`t effortless. US Legal Forms provides a large number of type templates, just like the District of Columbia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V., that are composed to meet federal and state specifications.

Should you be previously informed about US Legal Forms internet site and also have an account, just log in. Afterward, you may down load the District of Columbia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V. design.

Unless you have an bank account and would like to begin using US Legal Forms, follow these steps:

- Get the type you need and make sure it is for the right area/state.

- Use the Review key to examine the shape.

- Read the explanation to ensure that you have chosen the right type.

- If the type isn`t what you`re searching for, take advantage of the Research discipline to find the type that meets your requirements and specifications.

- Once you find the right type, just click Purchase now.

- Select the prices program you desire, complete the required details to make your bank account, and buy the order using your PayPal or charge card.

- Choose a hassle-free paper formatting and down load your copy.

Get all the document templates you might have purchased in the My Forms food list. You may get a extra copy of District of Columbia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V. anytime, if needed. Just click on the required type to down load or print out the document design.

Use US Legal Forms, one of the most considerable selection of authorized kinds, to save time and prevent faults. The support provides skillfully produced authorized document templates that you can use for an array of functions. Create an account on US Legal Forms and initiate making your lifestyle easier.