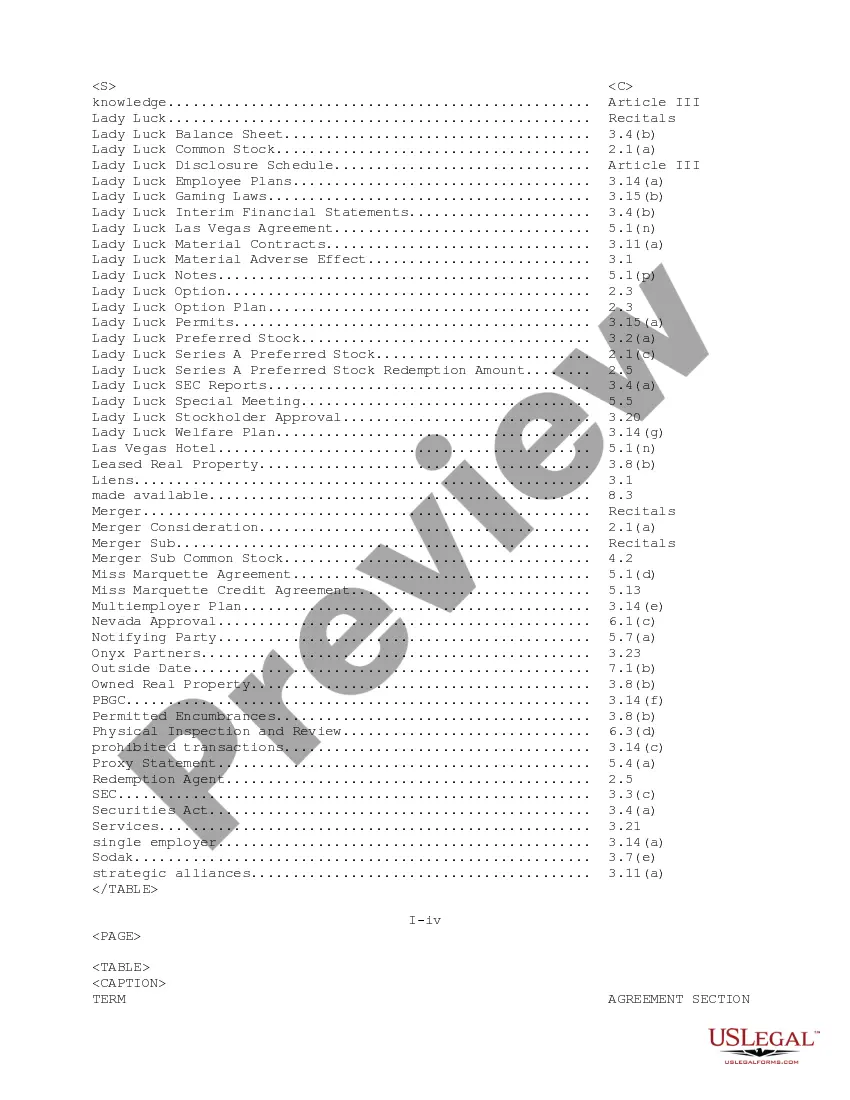

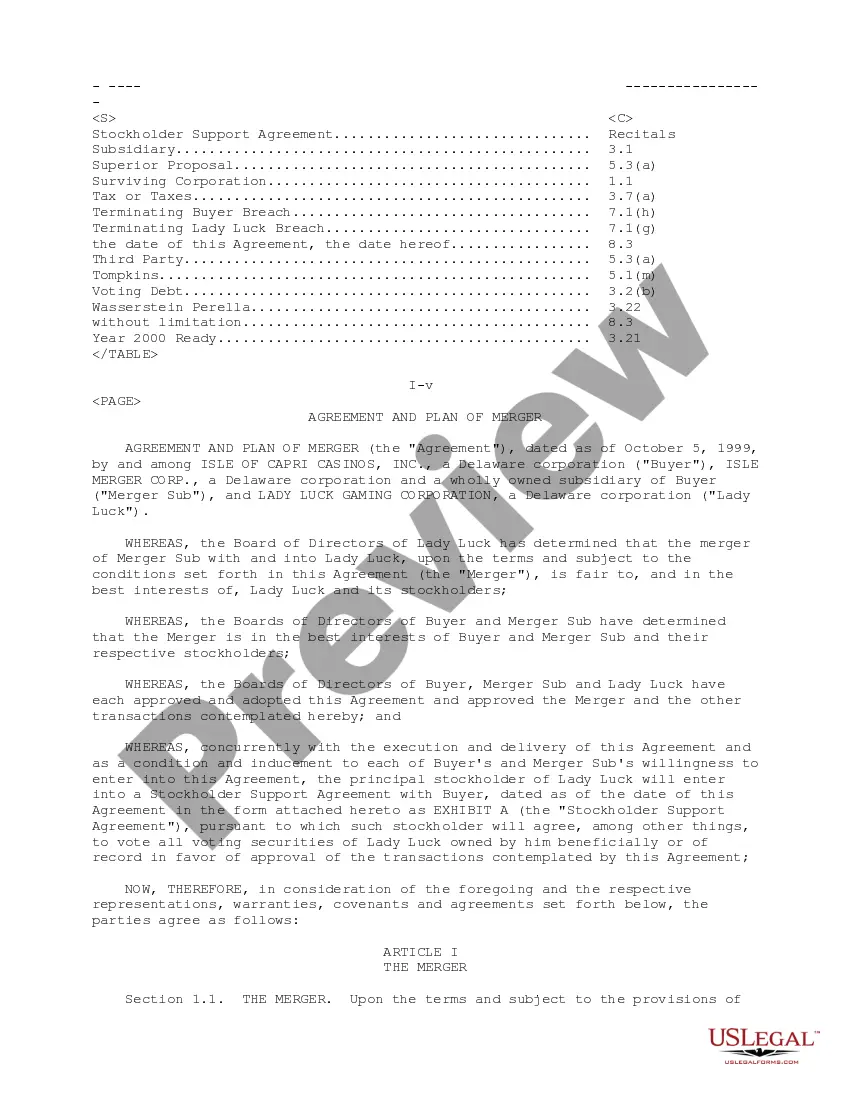

District of Columbia Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation

Description

How to fill out Plan Of Merger Between Isle Of Capri Casinos, Inc., Isle Merger Corporation And Lady Luck Gaming Corporation?

Finding the right legitimate record design might be a have difficulties. Obviously, there are a variety of web templates available on the Internet, but how will you discover the legitimate develop you will need? Take advantage of the US Legal Forms site. The support offers a huge number of web templates, for example the District of Columbia Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation, which you can use for organization and personal requires. All of the varieties are checked by professionals and meet up with federal and state specifications.

Should you be presently listed, log in to the bank account and click on the Download option to have the District of Columbia Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation. Use your bank account to search with the legitimate varieties you possess ordered formerly. Go to the My Forms tab of your own bank account and get yet another version of your record you will need.

Should you be a whole new user of US Legal Forms, here are basic instructions so that you can follow:

- Very first, be sure you have selected the proper develop for the metropolis/state. You can examine the form utilizing the Preview option and look at the form description to make sure this is the best for you.

- When the develop will not meet up with your preferences, utilize the Seach area to obtain the appropriate develop.

- Once you are sure that the form is acceptable, click the Buy now option to have the develop.

- Choose the pricing program you want and enter the needed details. Design your bank account and buy an order making use of your PayPal bank account or charge card.

- Pick the submit formatting and download the legitimate record design to the gadget.

- Total, edit and print and signal the obtained District of Columbia Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation.

US Legal Forms is the most significant local library of legitimate varieties where you can see different record web templates. Take advantage of the company to download expertly-manufactured paperwork that follow express specifications.

Form popularity

FAQ

Caesars Entertainment Inc. reinvented the former Isle of Capri Lake Charles into the land-based Horseshoe Lake Charles. Caesars is the parent company of Isle of Capri Lake Charles.

LAKE CHARLES/LAS VEGAS ? Caesars Entertainment - Since closing for more than two years due to the pandemic and damage from Hurricane Laura, the former Isle of Capri Lake Charles will officially come ashore in a brand-new, land-based build out as Horseshoe Lake Charles on Dec. 12, 2022.

Isle of Capri Hotel Lake Charles ? Lake Charles, Louisiana (Now owned by Caesars Entertainment)

Isle of Capri s (acquired by Eldorado Resorts, Inc.)

Isle of Capri Hotel Bossier City ? Bossier City, Louisiana.

Twin River Worldwide Holdings Inc., which recently purchased Kansas City's lowest performing , plans to rebrand the venue as ? KC.? The company closed on the purchase of the earlier this month from Eldorado Resorts, which merged with Ceasars Entertainment.