District of Columbia Closing Agreement

Description

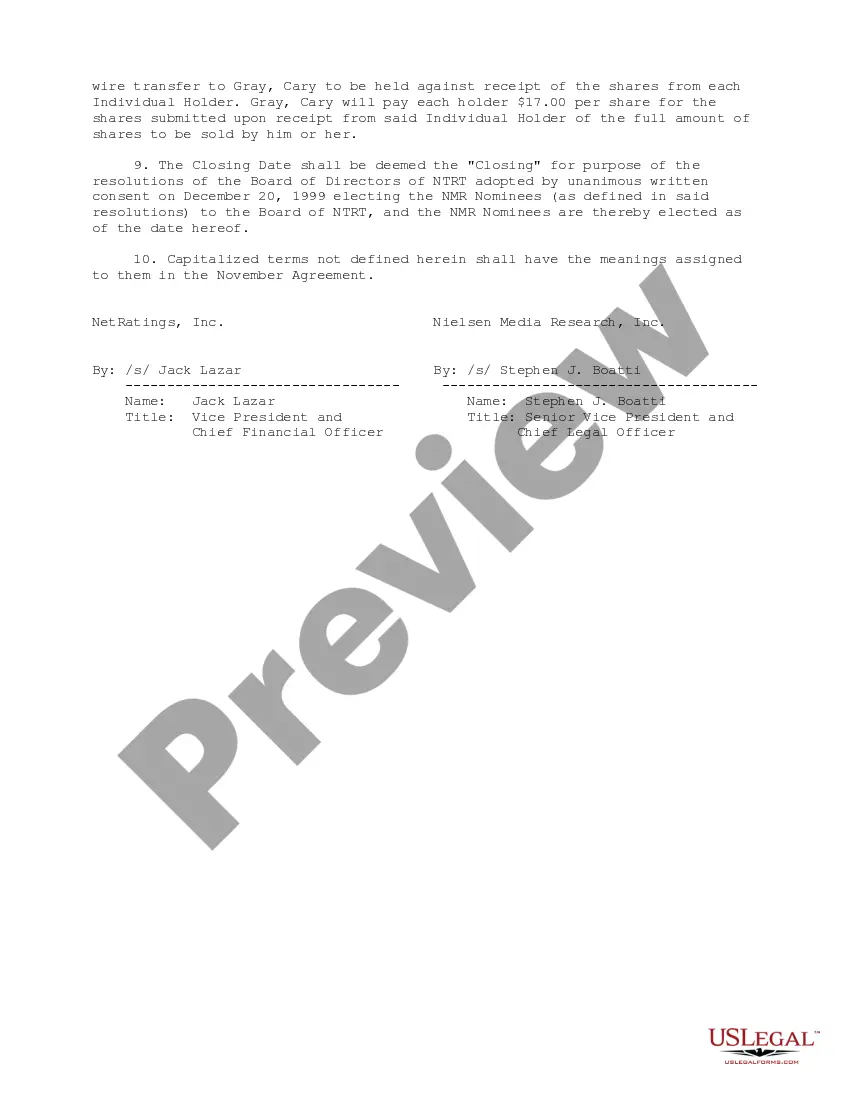

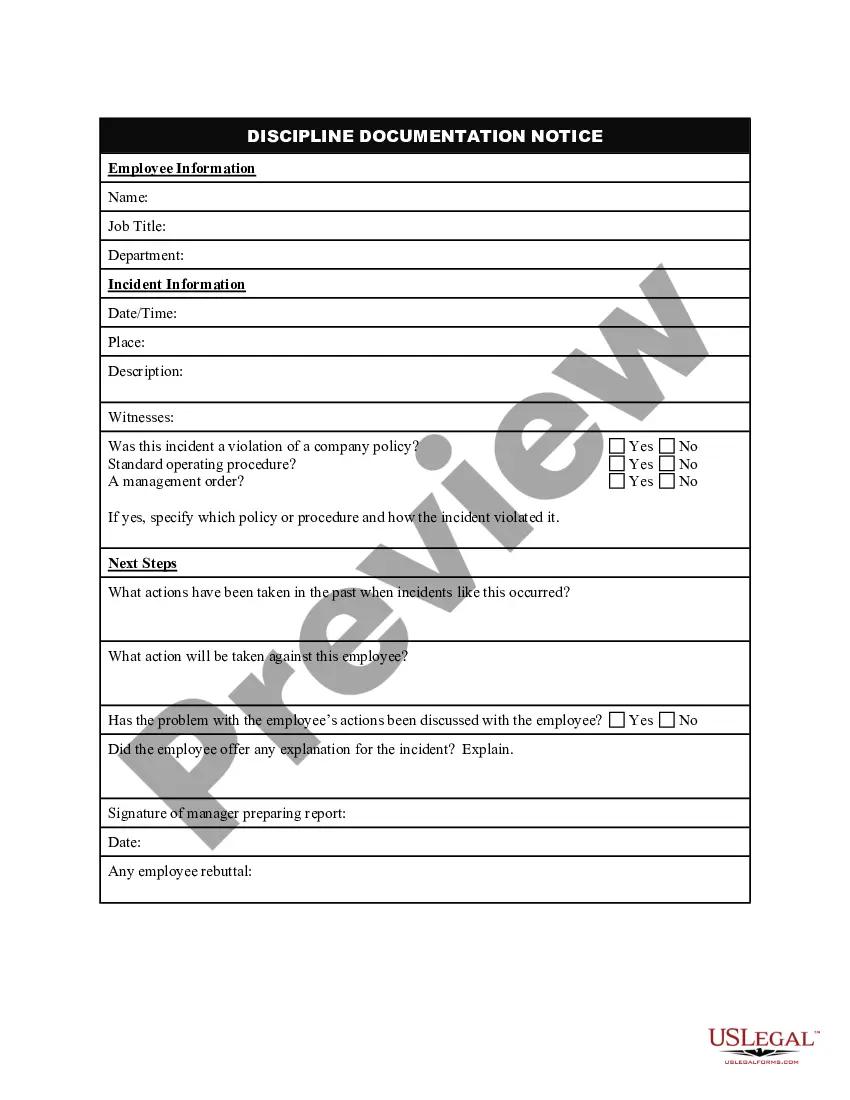

How to fill out Closing Agreement?

US Legal Forms - among the most significant libraries of lawful types in the USA - offers a variety of lawful papers templates you can acquire or produce. Utilizing the site, you can get a large number of types for enterprise and specific uses, categorized by categories, says, or keywords.You can find the most recent variations of types just like the District of Columbia Closing Agreement in seconds.

If you have a subscription, log in and acquire District of Columbia Closing Agreement from the US Legal Forms catalogue. The Down load option will appear on each kind you see. You have access to all formerly downloaded types in the My Forms tab of your own account.

If you wish to use US Legal Forms the first time, listed here are easy instructions to obtain began:

- Be sure you have selected the right kind for your town/region. Click on the Review option to analyze the form`s content. Browse the kind explanation to actually have selected the appropriate kind.

- When the kind doesn`t match your demands, make use of the Search area at the top of the screen to find the one which does.

- Should you be happy with the form, verify your choice by visiting the Get now option. Then, select the rates strategy you favor and provide your accreditations to register on an account.

- Method the transaction. Make use of your credit card or PayPal account to perform the transaction.

- Pick the structure and acquire the form on your gadget.

- Make modifications. Fill out, modify and produce and signal the downloaded District of Columbia Closing Agreement.

Every single web template you put into your bank account does not have an expiry date and is yours eternally. So, if you want to acquire or produce yet another copy, just check out the My Forms portion and then click about the kind you need.

Gain access to the District of Columbia Closing Agreement with US Legal Forms, the most comprehensive catalogue of lawful papers templates. Use a large number of specialist and condition-distinct templates that fulfill your company or specific requirements and demands.

Form popularity

FAQ

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

Department of Consumer and Regulatory Affairs You must file Articles of Dissolution to dissolve most types of businesses in the District of Columbia. The information required in the document will vary ing to your business ownership structure.

Appendix D - USPS State Abbreviations and FIPS Codes StatePostal Abbr.FIPS CodeDistrict of ColumbiaDC11FloridaFL12GeorgiaGA13HawaiiHI1523 more rows

Periods (abbreviations) Don't use periods for multi-word abbreviations, such as DC (not D.C.) and US (not U.S.).

The beginning of a sentence, city is not capitalized: The city is one of the first locations to have an intra-governmental link. city council: Use the Council of the District of Columbia or DC Council rather than DC city council or city council.

No, put ?Washington? as the city and ?DC? (no periods) as the state. Even though the District of Columbia (D.C.) is not a state for constitutional purposes, it is treated as if it were a state for many other purposes, including post office addresses.

A comma should always separate ?Washington? and ?D.C.? as in ?Washington, D.C.? with a comma after ?D.C.? if the sentence continues. Example: ?In Washington, D.C., students visited the Smithsonian museum.? When referring to a major city, there is no need for the state abbreviation.

Except for partnerships required to file an unincorporated business fran- chise tax return, DC Form D-30, or corporation franchise tax return, DC Form D-20, or an LLC, or publicly traded partnership that filed a federal corporation return, all partnerships engaged in any trade or business in DC or which received income ...