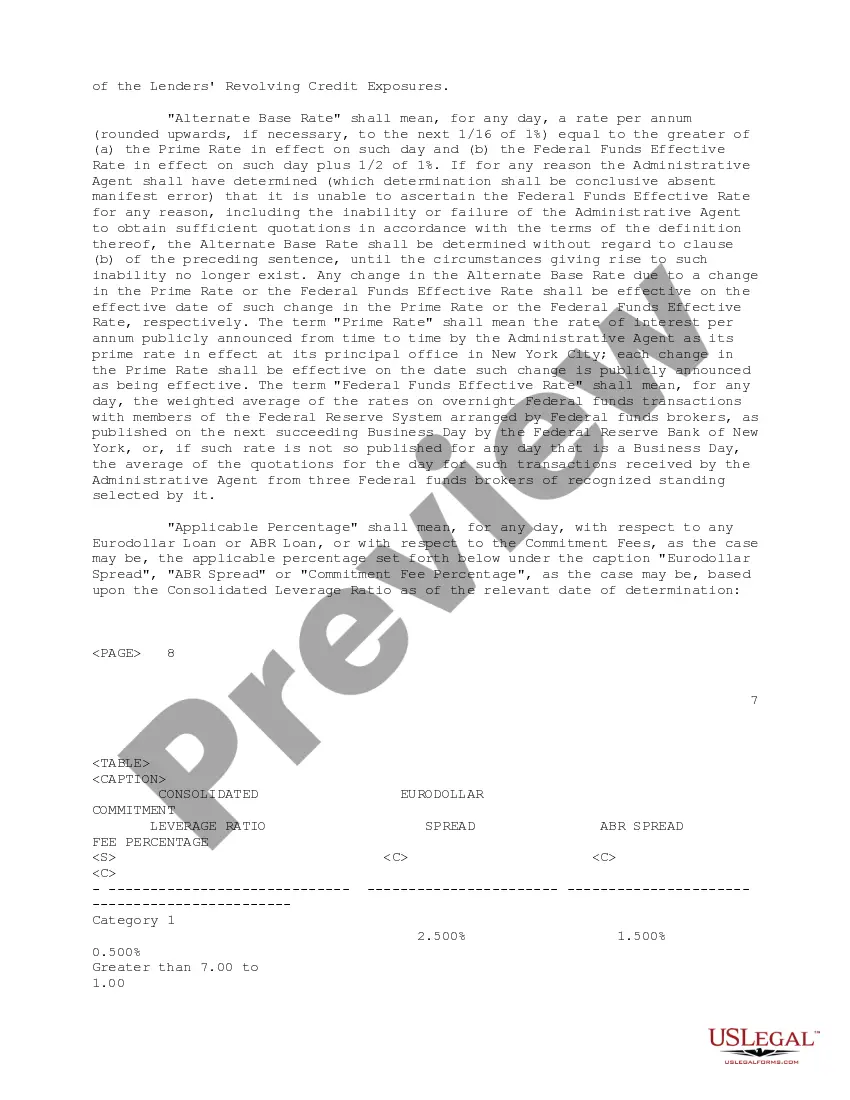

The District of Columbia Credit Agreement regarding the extension of credit is a formal legal document that outlines the terms and conditions under which credit will be extended to individuals or entities within the jurisdiction of the District of Columbia. This agreement serves as a legally binding contract between the creditor and the borrower, ensuring transparency and protection for both parties involved. The District of Columbia Credit Agreement provides detailed information about the extension of credit, including the specific terms of repayment, interest rates, late payment penalties, and any collateral or security required. It also outlines the obligations and responsibilities of both the creditor and the borrower, ensuring that both parties are aware of their rights and obligations. Keywords: District of Columbia, credit agreement, extension of credit, legal document, terms and conditions, creditor, borrower, transparency, protection, repayment terms, interest rates, late payment penalties, collateral, security, obligations, responsibilities. Different types of District of Columbia Credit Agreements regarding the extension of credit may include: 1. Personal Credit Agreement: This type of agreement is designed for individuals who are seeking credit for personal use, such as purchasing a car, renovating a home, or financing education. 2. Business Credit Agreement: This agreement is tailored for businesses or organizations that require credit for various purposes, such as expansion, equipment purchase, or working capital. 3. Mortgage Credit Agreement: This type of agreement specifically pertains to credit extended for the purpose of financing real estate properties, including residential or commercial mortgages. 4. Revolving Credit Agreement: This agreement allows the borrower to access a pre-approved credit limit and make multiple withdrawals or repayments within that limit. It is commonly used for credit cards or lines of credit. 5. Installment Credit Agreement: This agreement establishes fixed repayment terms, including regular monthly installments, and is often used for financing purchases such as vehicles or appliances. 6. Trade Credit Agreement: This type of agreement is typically used between businesses, allowing them to extend credit to each other for the purchase of goods or services without immediate payment. 7. Secured Credit Agreement: This agreement involves the use of collateral or security to reduce the risk to the creditor. It ensures that the creditor has a claim on specific assets in case of default. Remember, it is always advisable to consult legal professionals familiar with the laws and regulations of the District of Columbia to ensure that credit agreements comply with local legislation and requirements.

District of Columbia Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Are you currently in the position in which you require files for possibly company or specific uses nearly every day? There are tons of legitimate record themes available on the net, but locating kinds you can rely isn`t straightforward. US Legal Forms provides a large number of type themes, like the District of Columbia Credit Agreement regarding extension of credit, which are written in order to meet federal and state specifications.

In case you are previously knowledgeable about US Legal Forms site and have an account, basically log in. Following that, you are able to acquire the District of Columbia Credit Agreement regarding extension of credit format.

Unless you have an bank account and need to begin using US Legal Forms, abide by these steps:

- Find the type you require and make sure it is to the correct area/area.

- Use the Review option to check the shape.

- Browse the information to ensure that you have chosen the correct type.

- In case the type isn`t what you are seeking, use the Lookup industry to find the type that meets your needs and specifications.

- If you obtain the correct type, just click Buy now.

- Opt for the pricing strategy you desire, complete the specified information to produce your money, and buy the order with your PayPal or charge card.

- Select a handy file file format and acquire your version.

Find each of the record themes you may have bought in the My Forms menu. You may get a more version of District of Columbia Credit Agreement regarding extension of credit any time, if needed. Just go through the needed type to acquire or print the record format.

Use US Legal Forms, one of the most substantial selection of legitimate varieties, to conserve some time and steer clear of errors. The services provides skillfully manufactured legitimate record themes that can be used for a range of uses. Generate an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

(y) Notwithstanding any other law or court rule, no person shall be imprisoned or jailed for failure to pay a consumer debt, nor shall any person be imprisoned or jailed for contempt of court or otherwise for failure to comply with a court order to pay a consumer debt in part or in full.

The CFPB is issuing this advisory opinion to affirm that: (1) the FDCPA and its implementing Regulation F prohibit a debt collector, as that term is defined in the statute and regulation, from suing or threatening to sue to collect a time-barred debt; and (2) this prohibition applies even if the debt collector neither ...

It establishes requirements for debt collectors initiating a cause of action against a consumer for consumer debt. It allows for the collection of damages and other fees to a consumer for a violation of this bill.

One significant amendment in the bill passed Tuesday clarifies that a debt collector or debt buyer may only send text messages, emails or private messages on social media after sending the required written notice to consumers.

Generally, a debt collector must bring an action to sue you on the debt within three years of when you made your last payment on the account.

Extension of consumer credit means the right to defer payment of debt offered or granted primarily for personal, family, or household purposes or to incur the debt and defer its payment.

Statute of Limitations The Statute of limitations in the District of Columbia for open accounts and writings, such as contracts and promissory notes, is three (3) years from the date of breach. Generally, a renewed promise that can be proved to pay an old debt renews the limitations period.