The District of Columbia Checklist — Certificate of Status as an Accredited Investor is an essential document for individuals or entities seeking to verify their status as accredited investors in the District of Columbia. This certification is required for participating in certain investment opportunities that are exclusively available to accredited investors. The District of Columbia recognizes various types of accredited investors, including individuals, certain employee benefit plans, trusts, partnerships, corporations, and limited liability companies. Here are a few distinct types of District of Columbia Checklist — Certificate of Status as an Accredited Investor: 1. Individual Investors: Individuals who meet specific income or net worth criteria can qualify as accredited investors. To qualify, they must have earned an annual income of at least $200,000 (or $300,000 combined with a spouse) for the past two years, and have a reasonable expectation of reaching the same income level in the current year. Alternatively, they must have a net worth exceeding $1 million, individually or jointly with their spouse, excluding the value of their primary residence. This category also includes directors, executive officers, or general partners of the issuer. 2. Entity Investors: Certain entities are eligible to be accredited investors, such as corporations, limited liability companies, partnerships, and employee benefit plans. These entities must have total assets exceeding $5 million or be owned entirely by accredited investors. Additionally, trusts with total assets exceeding $5 million, not formed for the specific purpose of acquiring the investment, are also considered accredited investors. 3. Institutional Investors: Institutional investors include banks, registered broker-dealers, insurance companies, investment advisers, and other similar entities. These entities are automatically recognized as accredited investors without any specific income or net worth requirements. Obtaining a District of Columbia Checklist — Certificate of Status as an Accredited Investor involves submitting the necessary documentation with the appropriate District of Columbia regulatory authorities. This documentation typically includes financial statements, tax returns, and other relevant supporting documents that demonstrate the individual's or entity's accredited investor status. It is crucial for individuals or entities interested in investment opportunities in the District of Columbia to obtain this certificate to ensure compliance with regulatory requirements and gain access to exclusive investment offerings. This certification provides a formal attestation of an investor's eligibility and allows for participation in a range of investment opportunities specifically reserved for accredited investors.

District of Columbia Checklist - Certificate of Status as an Accredited Investor

Description

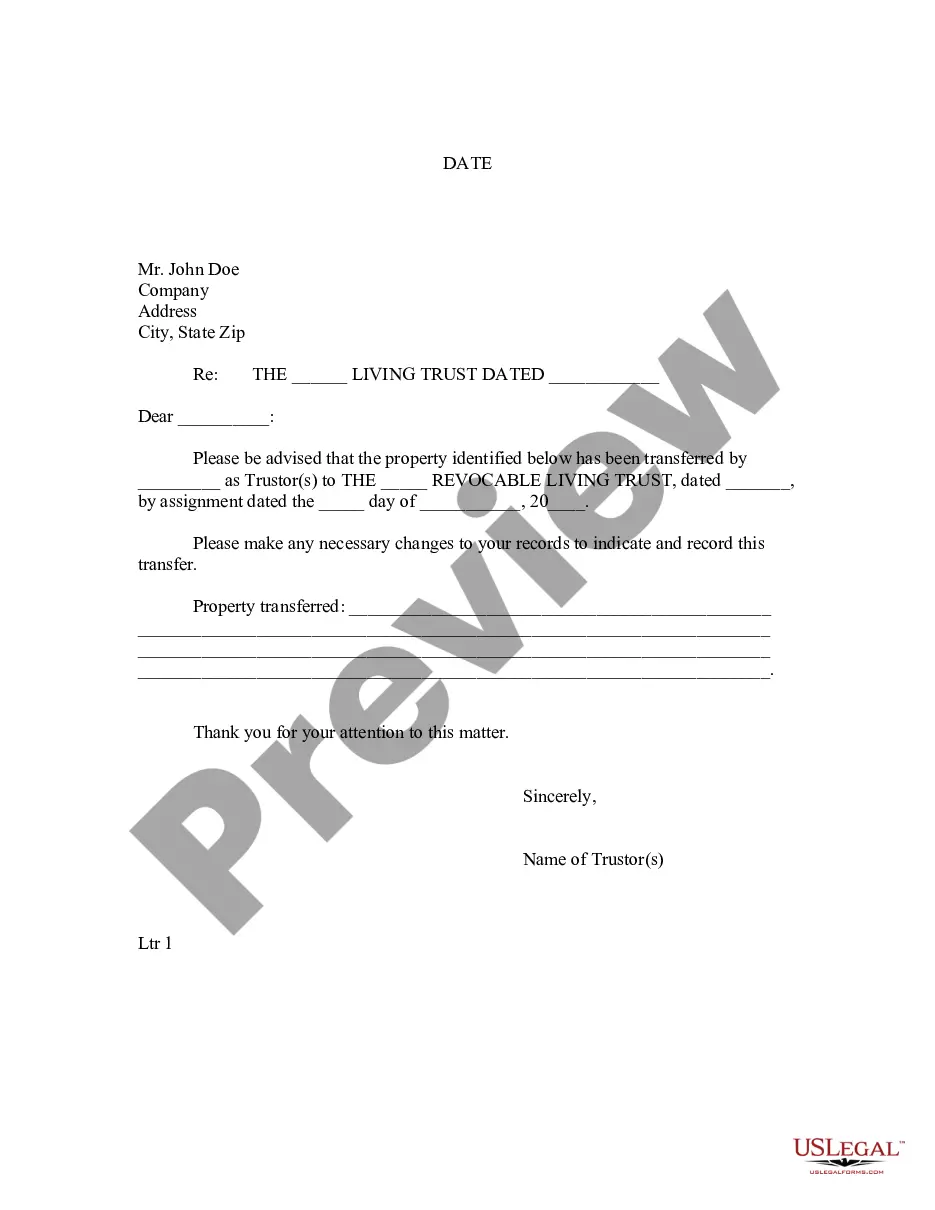

How to fill out District Of Columbia Checklist - Certificate Of Status As An Accredited Investor?

Are you currently within a position the place you need to have papers for both enterprise or specific functions just about every day time? There are a lot of legitimate file layouts accessible on the Internet, but locating types you can depend on is not effortless. US Legal Forms gives 1000s of type layouts, much like the District of Columbia Checklist - Certificate of Status as an Accredited Investor, which are created to satisfy federal and state demands.

When you are previously familiar with US Legal Forms internet site and also have your account, merely log in. Next, you are able to down load the District of Columbia Checklist - Certificate of Status as an Accredited Investor design.

Should you not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you require and ensure it is for that appropriate city/state.

- Make use of the Preview key to review the form.

- Look at the outline to actually have selected the right type.

- When the type is not what you are searching for, utilize the Lookup discipline to obtain the type that suits you and demands.

- If you get the appropriate type, click Acquire now.

- Opt for the pricing strategy you need, complete the necessary information and facts to make your bank account, and purchase the transaction making use of your PayPal or credit card.

- Decide on a practical data file structure and down load your copy.

Discover all the file layouts you have bought in the My Forms menus. You may get a more copy of District of Columbia Checklist - Certificate of Status as an Accredited Investor any time, if possible. Just click on the necessary type to down load or printing the file design.

Use US Legal Forms, by far the most extensive assortment of legitimate types, to conserve some time and stay away from mistakes. The assistance gives professionally created legitimate file layouts which can be used for a variety of functions. Produce your account on US Legal Forms and start generating your lifestyle easier.