To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

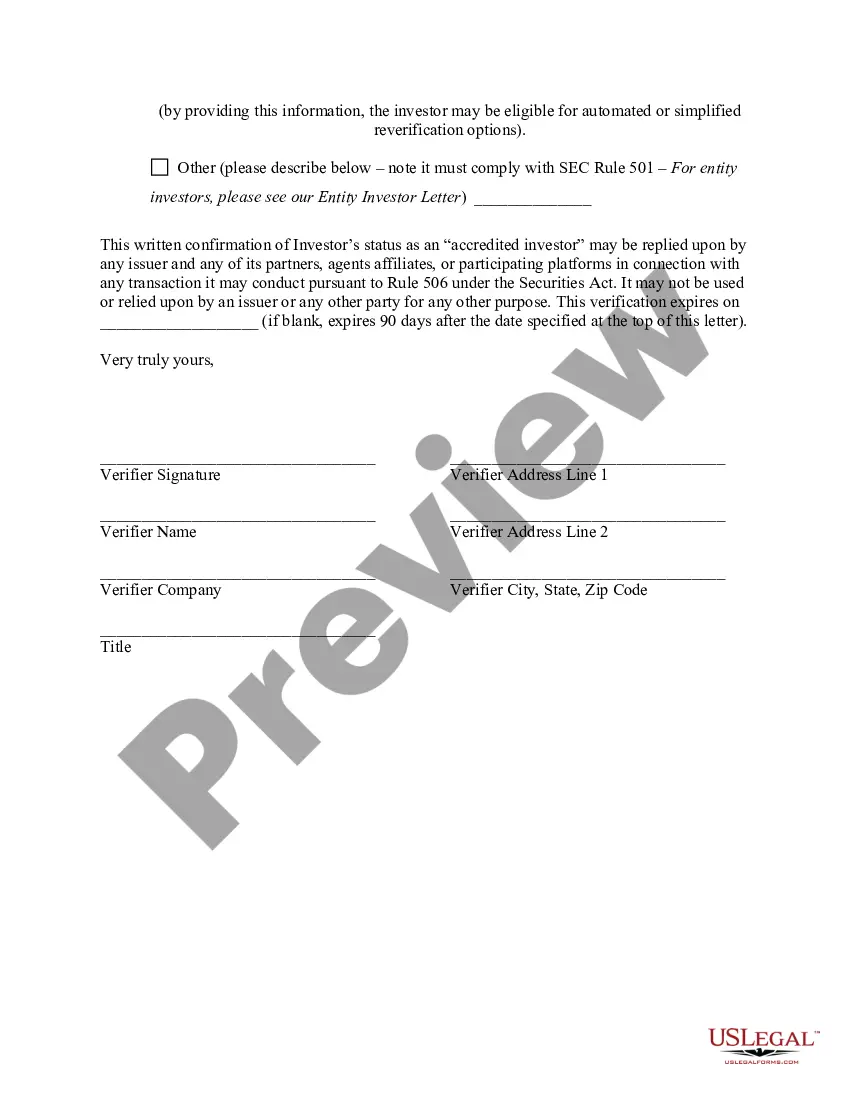

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

Title: District of Columbia Accredited Investor Verification Letter — Individual Investor Keywords: District of Columbia, Accredited Investor, Verification Letter, Individual Investor Description: A District of Columbia Accredited Investor Verification Letter is a crucial document used to confirm an individual investor's accredited investor status as defined by the District of Columbia regulations. This letter serves as proof that the investor meets the required criteria to participate in certain investment opportunities restricted to accredited investors. The letter verifies an investor's eligibility to participate in private placements, crowdfunding campaigns, hedge funds, venture capital funds, and other investment opportunities. It is typically requested by issuers, investment firms, or crowdfunding platforms to ensure compliance with securities laws and regulations. Types of District of Columbia Accredited Investor Verification Letters for Individual Investors: 1. District of Columbia Net Worth Verification Letter: This type of letter primarily focuses on an investor's net worth, ensuring they meet the District of Columbia's minimum net worth requirements. Net worth criteria typically involve evaluating an investor's assets, liabilities, and debts. The letter may require supporting documents, such as bank statements, investment account statements, real estate valuation reports, and business ownership documents. 2. District of Columbia Income Verification Letter: This letter concentrates on an individual investor's income level to determine their accredited investor status. It requires providing evidence of consistent and substantial income over a specified period, often the past two years. Supporting documents like tax returns, pay stubs, employment contracts, and bank statements may be required to authenticate the income claims. 3. District of Columbia Professional Designation Verification Letter: In certain cases, an investor's professional experience or credentials may qualify them as an accredited investor. This letter validates the investor's professional designation, such as a licensed attorney, certified public accountant (CPA), or chartered financial analyst (CFA). The document may require submitting relevant certifications, licenses, or membership documentation from professional organizations. 4. District of Columbia Business Entity Verification Letter: This letter relates to individual investors who operate as owners or executives of a business entity. It confirms the entity's accredited investor status and the investor's authority to make investment decisions on behalf of the organization. Supporting documentation may include business registration certificates, corporate tax returns, financial statements, and legal agreements outlining the investor's position within the entity. Note: It is essential to consult legal and financial professionals familiar with the District of Columbia securities laws and regulations to ensure compliance and accuracy when drafting or obtaining an Accredited Investor Verification Letter in the District of Columbia.