District of Columbia Accredited Investor Status Certification Letter

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

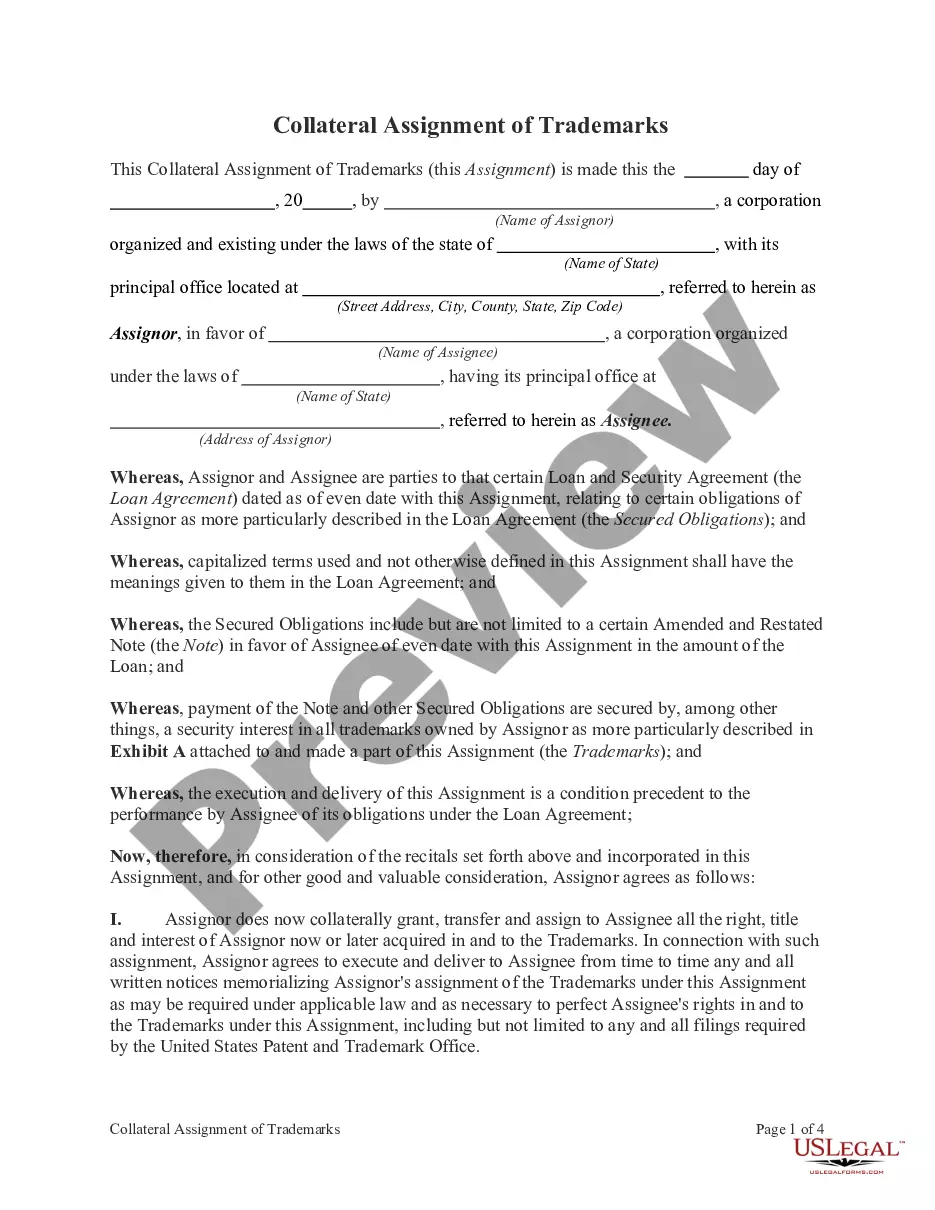

How to fill out Accredited Investor Status Certification Letter?

You may invest several hours on the web attempting to find the lawful file template that fits the federal and state specifications you want. US Legal Forms provides a huge number of lawful kinds which can be evaluated by specialists. You can easily down load or print out the District of Columbia Accredited Investor Status Certification Letter from the services.

If you already possess a US Legal Forms accounts, you may log in and click on the Down load button. Afterward, you may complete, edit, print out, or signal the District of Columbia Accredited Investor Status Certification Letter. Each lawful file template you get is your own property for a long time. To get yet another backup of any obtained type, check out the My Forms tab and click on the corresponding button.

If you use the US Legal Forms web site initially, keep to the easy guidelines below:

- Very first, ensure that you have chosen the proper file template for your region/metropolis of your choice. Read the type description to ensure you have picked out the correct type. If readily available, take advantage of the Preview button to check from the file template as well.

- In order to find yet another edition in the type, take advantage of the Look for field to obtain the template that fits your needs and specifications.

- When you have identified the template you would like, click Acquire now to continue.

- Select the prices plan you would like, enter your qualifications, and register for your account on US Legal Forms.

- Total the purchase. You may use your charge card or PayPal accounts to cover the lawful type.

- Select the file format in the file and down load it to your system.

- Make modifications to your file if possible. You may complete, edit and signal and print out District of Columbia Accredited Investor Status Certification Letter.

Down load and print out a huge number of file themes while using US Legal Forms site, which offers the greatest variety of lawful kinds. Use specialist and state-distinct themes to tackle your organization or specific needs.

Form popularity

FAQ

? Self-certified investors are treated in a ?generally similar manner? to accredited investors. and are able to invest alongside them. ? May also be of interest to listed issuers. ? Further facilitating their capital raising efforts by private placement.

After all, qualified purchasers must be capable of investing $5 million or more on their own, which means they will likely meet the $1 million net worth requirement to be considered an accredited investor. Granted, the two don't always go hand in hand, but they do align more often than not.

Investors - How to Order Self-Verification With VerifyInvestor.com, you can obtain accredited investor self certification, submit accredited investor proof, get verification of accredited investor status, and get an eligible accredited investor certificate quickly, confidentially, and cost-effectively.

Accredited Investor Verification In a Rule 506(b) offering, the issuer may take the investor's word that he, she, or it is accredited, unless the issuer has reason to believe the investor is lying. In a Rule 506(c) offering, the issuer must take reasonable steps to verify that every investor is accredited.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Among other categories, the SEC now defines accredited investors to include the following: Individuals who have certain professional certifications, designations, or credentials. Individuals who are ?knowledgeable employees? of a private fund. SEC- and state-registered investment advisers5.

These documents are used to show your net or joint net worth as well as your financial knowledge to become accredited. Aside from third-party websites, you can also ask a CPA to write a letter verifying your accreditation.

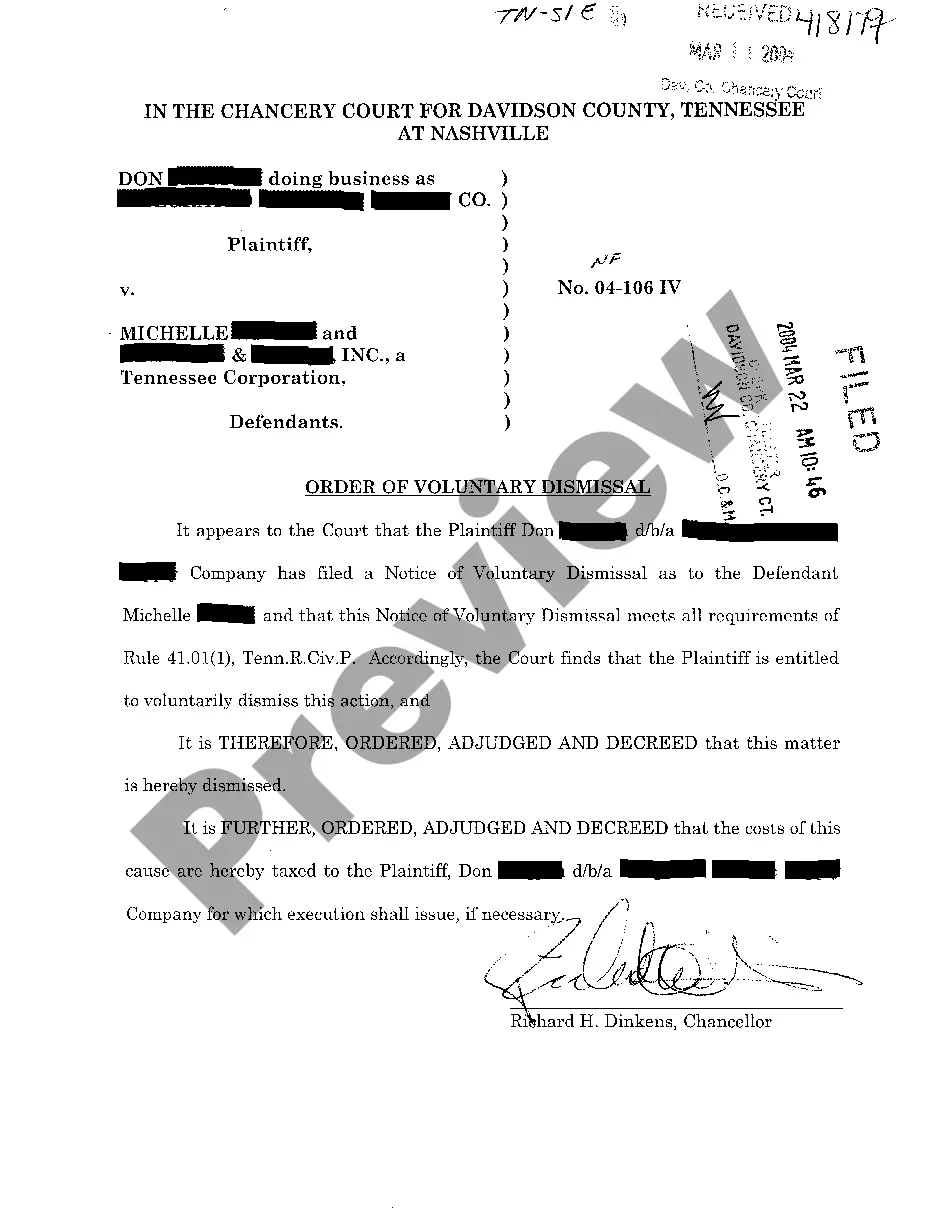

This written confirmation of Investor's status as an ?accredited investor? may be relied upon by any issuer and any of its partners, agents, affiliates, or participating platforms in connection with any transaction it may conduct pursuant to Rule 506 under the. Securities Act.