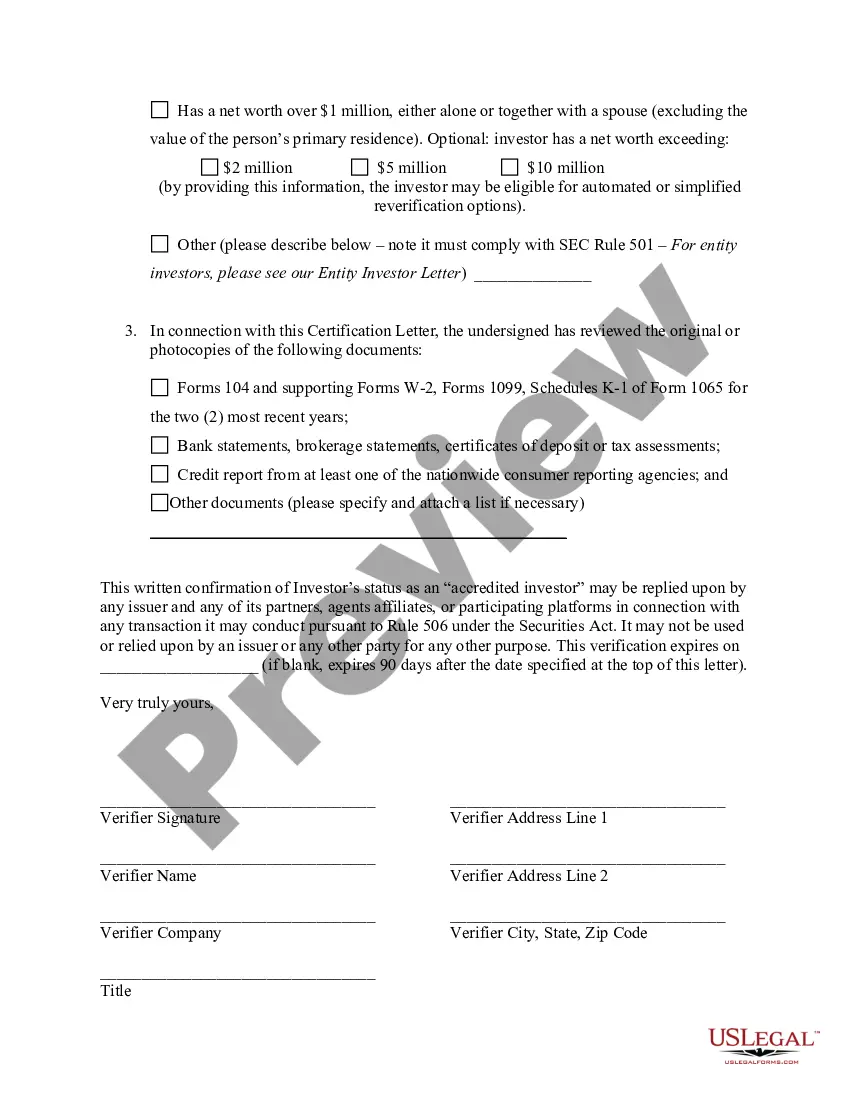

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

The District of Columbia Accredited Investor Verification Letter — Individual Investor serves as an important document in the financial industry, specifically for individuals wishing to prove their status as an accredited investor in the District of Columbia. Accredited investors are classified as high-net-worth individuals or entities with a certain level of financial expertise, enabling them to participate in investments that are not available to the public. The District of Columbia has specific criteria for determining accredited investor status, including meeting income and net worth thresholds, professional certifications, or holding specific positions in financial institutions. To verify their accredited investor status, individuals may need to provide a District of Columbia Accredited Investor Verification Letter. This verification letter, issued by a trusted authority such as a certified public accountant (CPA) or attorney, should include various essential details. Firstly, the letter should clearly state the purpose of the document, acknowledging that it is a District of Columbia Accredited Investor Verification Letter for an individual investor. It should mention that the letter is being provided to meet the requirements set forth by the District of Columbia securities laws and regulations. The letter should then include the individual investor's personal information, such as their full name, address, contact details, and social security number. It may also require the investor to provide their unique identification number or any other identifying details required by the District of Columbia regulatory agencies. In addition to personal information, the verification letter should outline the specific criteria that qualify the individual investor as an accredited investor in the District of Columbia. This may include their income level, net worth, professional certifications, or other credentials that establish their financial expertise. The letter should provide detailed information about how the investor meets these criteria, such as current income documentation, financial statements, or proof of professional qualifications. The District of Columbia Accredited Investor Verification Letter should be dated and signed by the authorized signatory, usually a CPA or attorney. The signatory should include their professional credentials and contact information for further verification if required by regulatory agencies or investment institutions. It is worth mentioning that specific types or variations of the District of Columbia Accredited Investor Verification Letter for individual investors may exist, addressing different circumstances and requirements. Some examples could include verification letters for individuals applying for specific investment opportunities, letters for individuals seeking to invest in real estate or venture capital, or letters for individuals with unique professional qualifications in finance or related industries. In summary, the District of Columbia Accredited Investor Verification Letter — Individual Investor is a crucial document that allows individuals to prove their status as accredited investors in the District of Columbia. It provides detailed information about the investor's qualifications and meets the regulatory requirements set forth by the District of Columbia securities laws and regulations.