District of Columbia Subscription Agreement and Shareholders' Agreement

Description

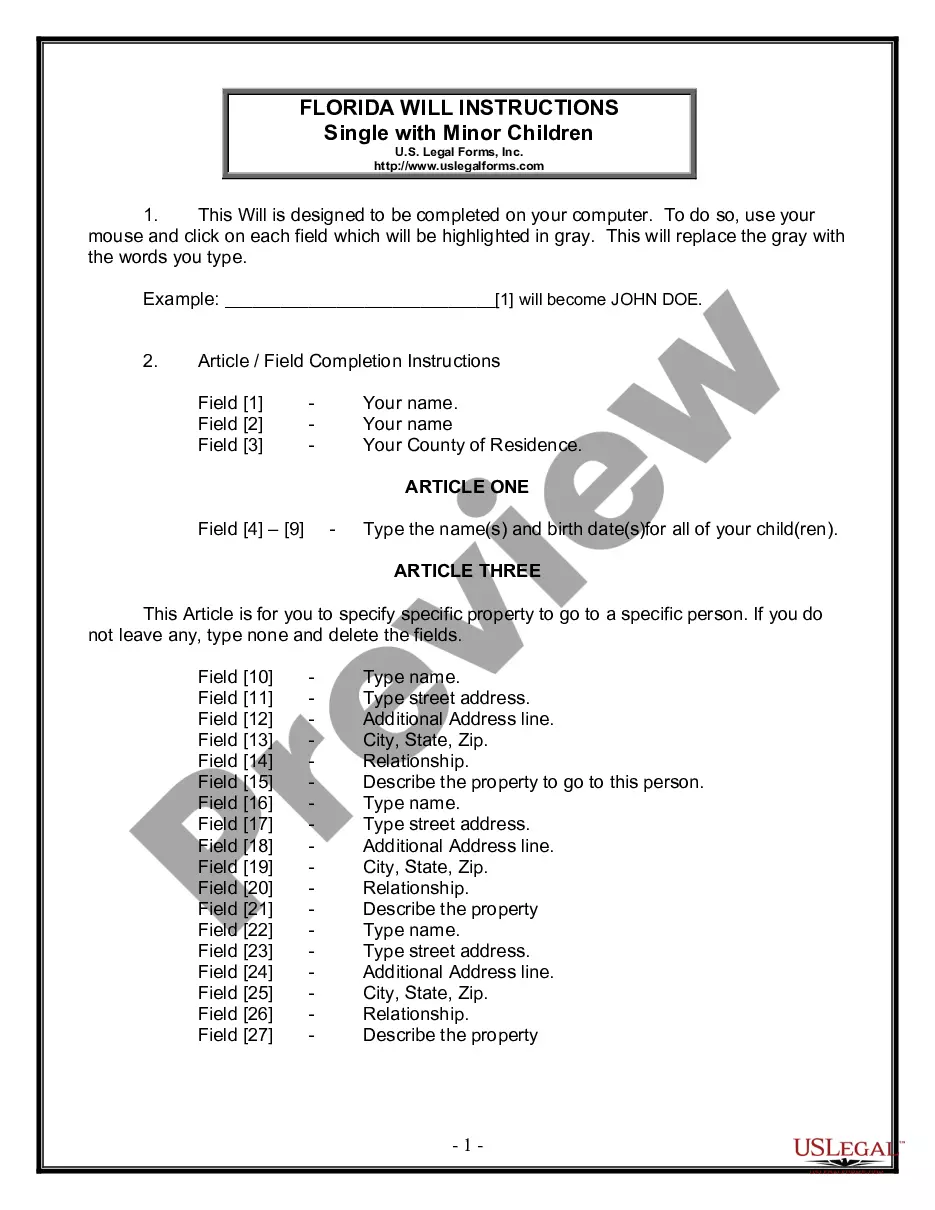

How to fill out Subscription Agreement And Shareholders' Agreement?

Are you currently within a situation in which you need to have documents for both organization or specific functions almost every day? There are tons of lawful record layouts available on the Internet, but getting versions you can rely on is not effortless. US Legal Forms gives thousands of develop layouts, such as the District of Columbia Subscription Agreement and Shareholders' Agreement, that happen to be written to fulfill state and federal needs.

If you are currently informed about US Legal Forms web site and also have an account, merely log in. After that, you may acquire the District of Columbia Subscription Agreement and Shareholders' Agreement design.

Should you not offer an accounts and want to begin using US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is to the right metropolis/county.

- Utilize the Review key to analyze the form.

- Read the explanation to actually have selected the appropriate develop.

- When the develop is not what you are seeking, utilize the Search field to obtain the develop that meets your needs and needs.

- When you find the right develop, click Buy now.

- Opt for the costs program you would like, complete the required info to create your bank account, and pay for your order with your PayPal or credit card.

- Decide on a handy document file format and acquire your copy.

Get all of the record layouts you might have purchased in the My Forms menu. You can get a more copy of District of Columbia Subscription Agreement and Shareholders' Agreement any time, if possible. Just go through the necessary develop to acquire or print out the record design.

Use US Legal Forms, probably the most substantial assortment of lawful forms, to save lots of some time and avoid faults. The services gives professionally made lawful record layouts which can be used for a variety of functions. Make an account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

What is an LLC Subscription Agreement? An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

Depending on the requirements of each company, a share subscription agreement can vary widely, but some common clauses are confidentiality, fulfillment of a precondition, tranches, and guarantee and indemnity. A share purchase agreement is an agreement made between two parties.

What is a Subscription Agreement? A master subscription agreement is a legal document that outlines the terms and conditions of a subscription-based relationship between a business and its users.