District of Columbia Investors Rights Agreement

Description

1. Information Rights

2. Restrictions on Transfer

3. Participation Right

4. Board of Directors

5. Covenants

6. General Provisions"

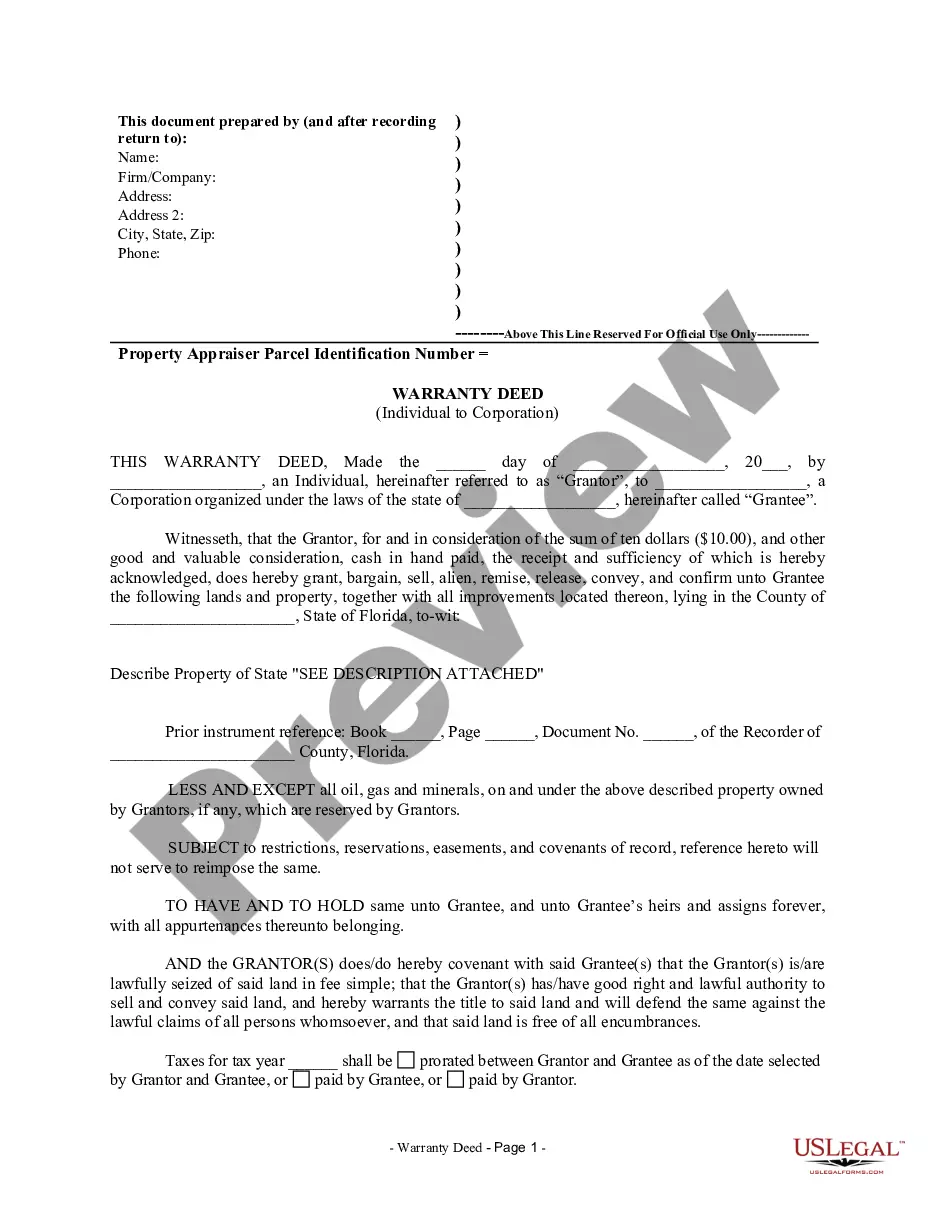

How to fill out Investors Rights Agreement?

US Legal Forms - one of several most significant libraries of lawful kinds in America - delivers a wide range of lawful document web templates it is possible to acquire or printing. Using the web site, you will get thousands of kinds for business and individual reasons, categorized by groups, suggests, or search phrases.You can get the latest models of kinds such as the District of Columbia Investors Rights Agreement within minutes.

If you already possess a membership, log in and acquire District of Columbia Investors Rights Agreement through the US Legal Forms collection. The Down load key will show up on every single kind you look at. You have access to all in the past acquired kinds within the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, allow me to share easy recommendations to help you get began:

- Make sure you have picked out the proper kind to your metropolis/state. Click on the Review key to examine the form`s content material. See the kind description to ensure that you have selected the correct kind.

- If the kind doesn`t match your specifications, make use of the Lookup industry at the top of the monitor to obtain the one who does.

- In case you are pleased with the shape, affirm your decision by visiting the Buy now key. Then, choose the prices plan you want and give your qualifications to sign up on an profile.

- Process the financial transaction. Make use of your Visa or Mastercard or PayPal profile to complete the financial transaction.

- Find the formatting and acquire the shape on your system.

- Make alterations. Fill out, edit and printing and indicator the acquired District of Columbia Investors Rights Agreement.

Each and every format you included in your account does not have an expiry day and is yours permanently. So, if you would like acquire or printing one more version, just proceed to the My Forms portion and then click around the kind you require.

Get access to the District of Columbia Investors Rights Agreement with US Legal Forms, the most substantial collection of lawful document web templates. Use thousands of expert and express-particular web templates that satisfy your business or individual requirements and specifications.

Form popularity

FAQ

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

Investor rights are the rights granted to shareholders in the corporation. Those rights include: The right to attend the annual general meeting (AGM) and any other called meetings. The right to vote on resolutions, both ordinary and special. The right to propose your own resolutions.

Investor agreements generally cover any transaction that gives other people or businesses ownership interest in the company. This could be of interest now or into the future and could be in exchange for anything of value such as cash, labor, an asset, and more.

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company.

DPA Triggering Rights means (i) ?control? (as defined in the DPA); (ii) access to any ?material non-public technical information? (as defined in the DPA) in the possession of the Company; (iii) membership or observer rights on the Board of Directors or equivalent governing body of the Company or the right to nominate ...