District of Columbia Simple Agreement for Future Equity

Description

How to fill out Simple Agreement For Future Equity?

Choosing the best lawful papers web template can be a battle. Of course, there are plenty of layouts accessible on the Internet, but how do you obtain the lawful develop you require? Utilize the US Legal Forms web site. The support delivers thousands of layouts, like the District of Columbia Simple Agreement for Future Equity, that can be used for enterprise and private requirements. Every one of the varieties are examined by experts and meet up with state and federal needs.

Should you be previously listed, log in to your bank account and click on the Obtain switch to find the District of Columbia Simple Agreement for Future Equity. Utilize your bank account to look from the lawful varieties you might have purchased earlier. Proceed to the My Forms tab of the bank account and obtain an additional duplicate of your papers you require.

Should you be a fresh user of US Legal Forms, listed below are basic guidelines that you can stick to:

- Very first, make sure you have chosen the appropriate develop for the town/county. You are able to examine the shape while using Preview switch and look at the shape description to guarantee this is basically the best for you.

- If the develop will not meet up with your expectations, make use of the Seach area to obtain the appropriate develop.

- Once you are certain the shape is suitable, select the Purchase now switch to find the develop.

- Pick the pricing strategy you want and type in the essential details. Build your bank account and pay for your order making use of your PayPal bank account or bank card.

- Select the document formatting and acquire the lawful papers web template to your product.

- Total, edit and produce and signal the obtained District of Columbia Simple Agreement for Future Equity.

US Legal Forms may be the most significant library of lawful varieties in which you will find different papers layouts. Utilize the service to acquire professionally-created paperwork that stick to status needs.

Form popularity

FAQ

SAFEs are generally considered taxable at the time of the triggering event, when the SAFE converts into equity (i.e. stock in the company).

SAFE agreements are powerful investing tools. However, there are important terms in SAFE Agreements that you must understand. The five terms we'll consider in this article include discounts, valuation caps, pre-money or post-money, pro-rata rights, and the most favored nations provision.

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

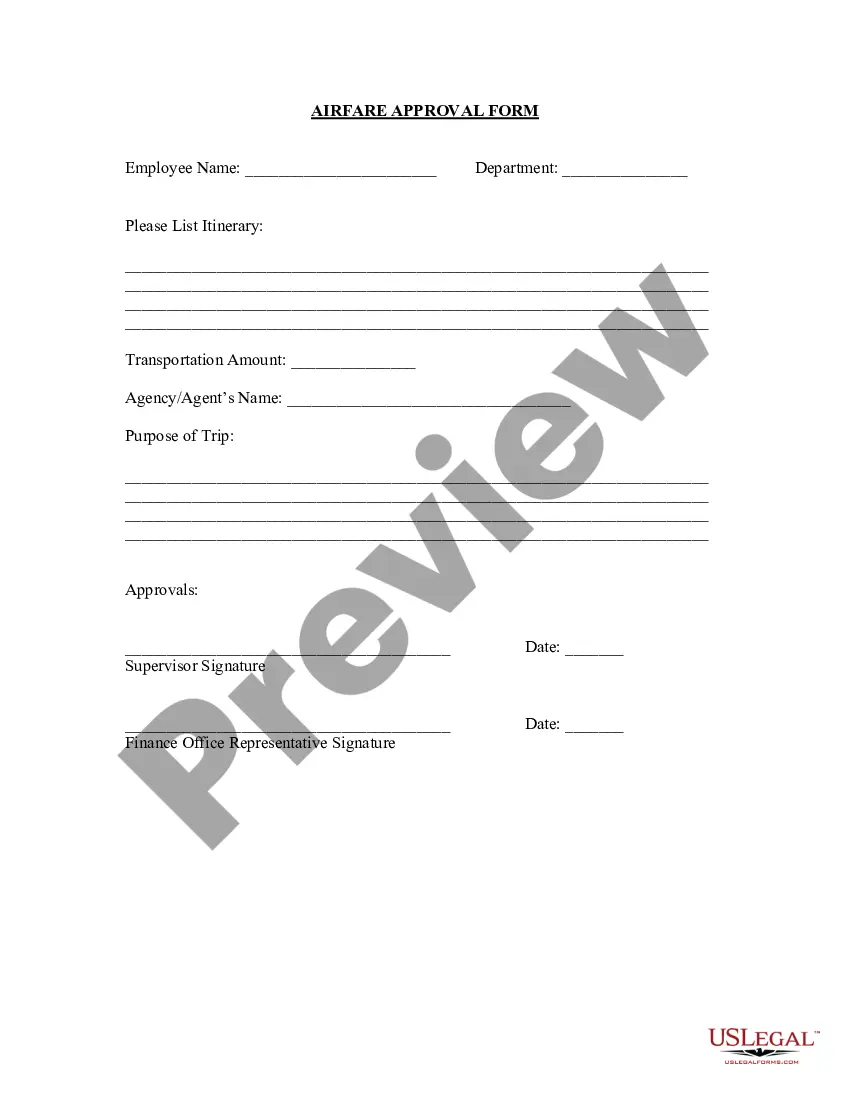

You hand over your investment now, and get stock sometime in the future. The great thing about the SAFE is that other than the name of the investor, company, and date, the only thing to fill in is the amount of the investment and the valuation cap or discount. Then sign and wire the money. That's it.

A SAFE note is a security that is going to convert to stock at a future point, usually at a pre-negotiated price cap. Let's look at an example. A person might invest in a SAFE note with a $10 million cap. If the company is bought for $100 million, that's great news.

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.