District of Columbia Waiver Special Meeting of Shareholders

Description

How to fill out Waiver Special Meeting Of Shareholders?

Choosing the right legitimate record template might be a struggle. Naturally, there are a lot of layouts accessible on the Internet, but how can you obtain the legitimate kind you want? Make use of the US Legal Forms site. The support offers a huge number of layouts, such as the District of Columbia Waiver Special Meeting of Shareholders, that can be used for company and private demands. Each of the forms are checked by experts and fulfill state and federal demands.

When you are already authorized, log in in your account and then click the Acquire option to obtain the District of Columbia Waiver Special Meeting of Shareholders. Make use of your account to appear throughout the legitimate forms you possess purchased formerly. Check out the My Forms tab of your own account and have another copy of your record you want.

When you are a whole new consumer of US Legal Forms, listed below are simple recommendations so that you can follow:

- First, be sure you have selected the correct kind for the area/county. You can look through the shape making use of the Preview option and read the shape outline to guarantee this is basically the right one for you.

- If the kind does not fulfill your expectations, use the Seach area to get the proper kind.

- Once you are certain the shape would work, select the Get now option to obtain the kind.

- Opt for the pricing strategy you want and enter in the essential information and facts. Create your account and pay for the transaction utilizing your PayPal account or credit card.

- Choose the submit format and acquire the legitimate record template in your product.

- Comprehensive, modify and printing and indicator the received District of Columbia Waiver Special Meeting of Shareholders.

US Legal Forms is the most significant local library of legitimate forms in which you can discover numerous record layouts. Make use of the service to acquire professionally-made paperwork that follow state demands.

Form popularity

FAQ

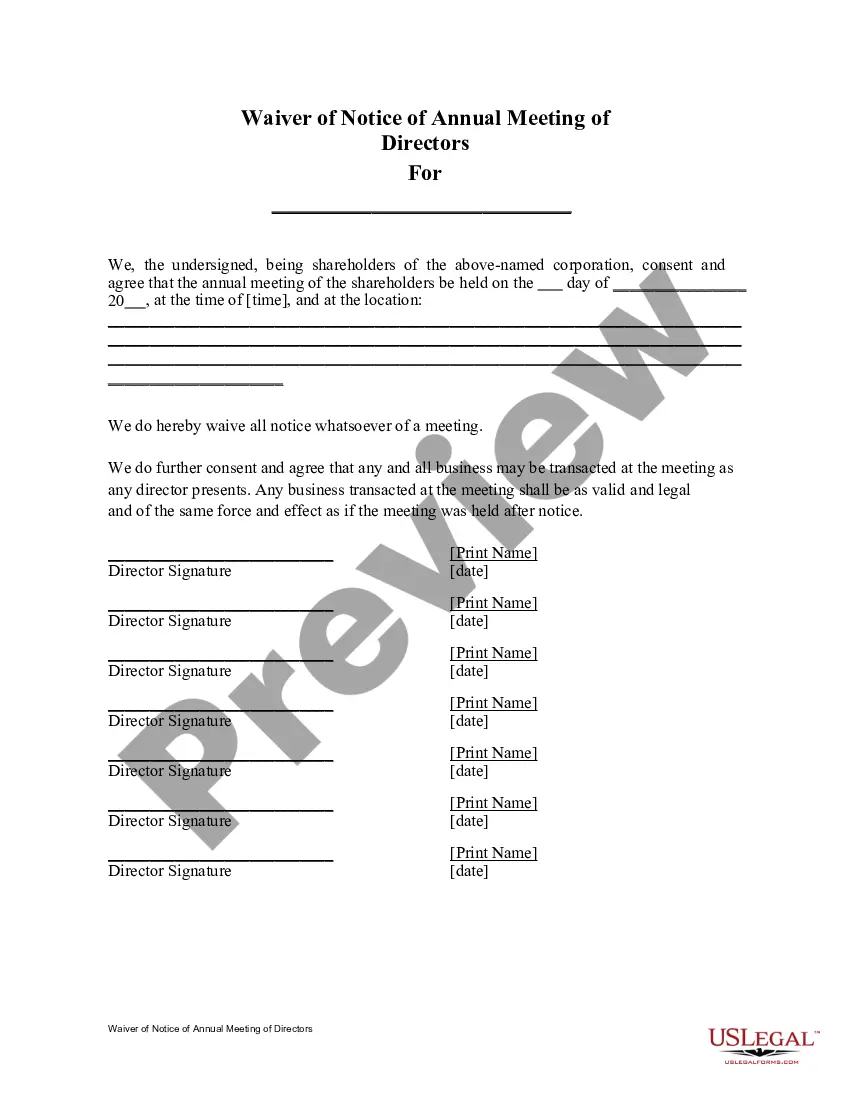

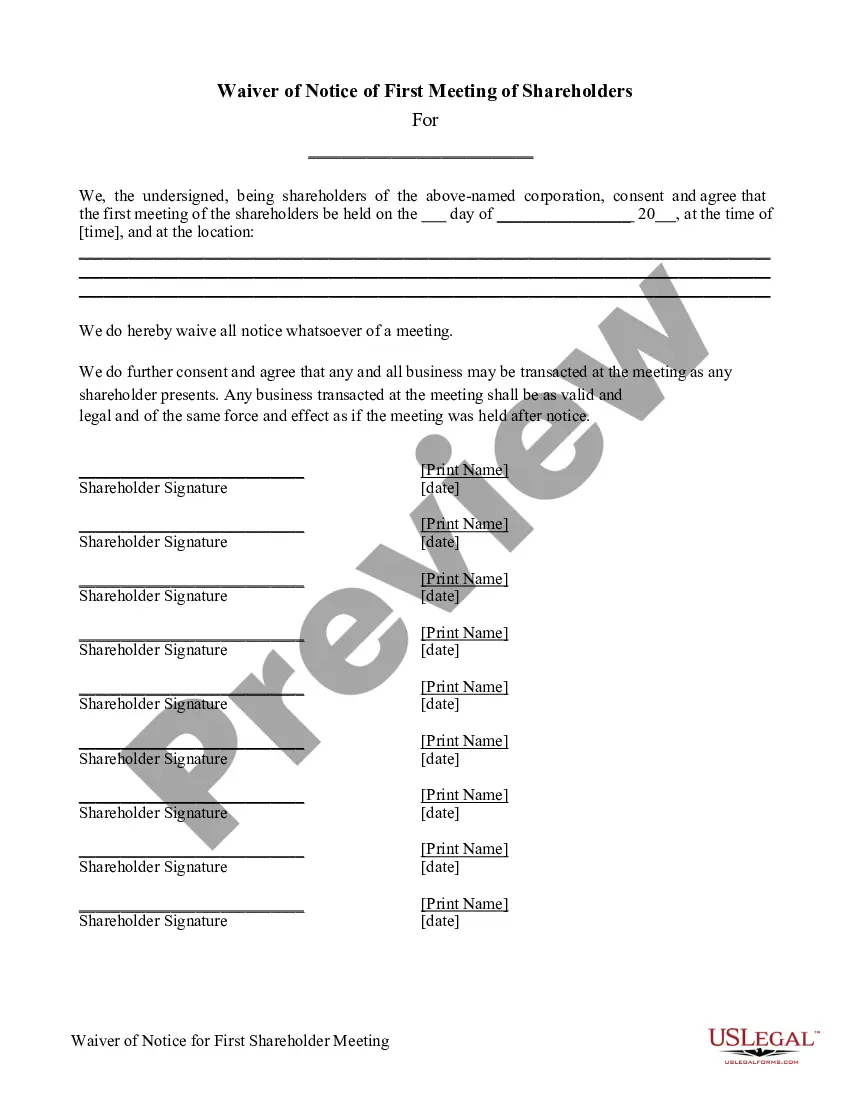

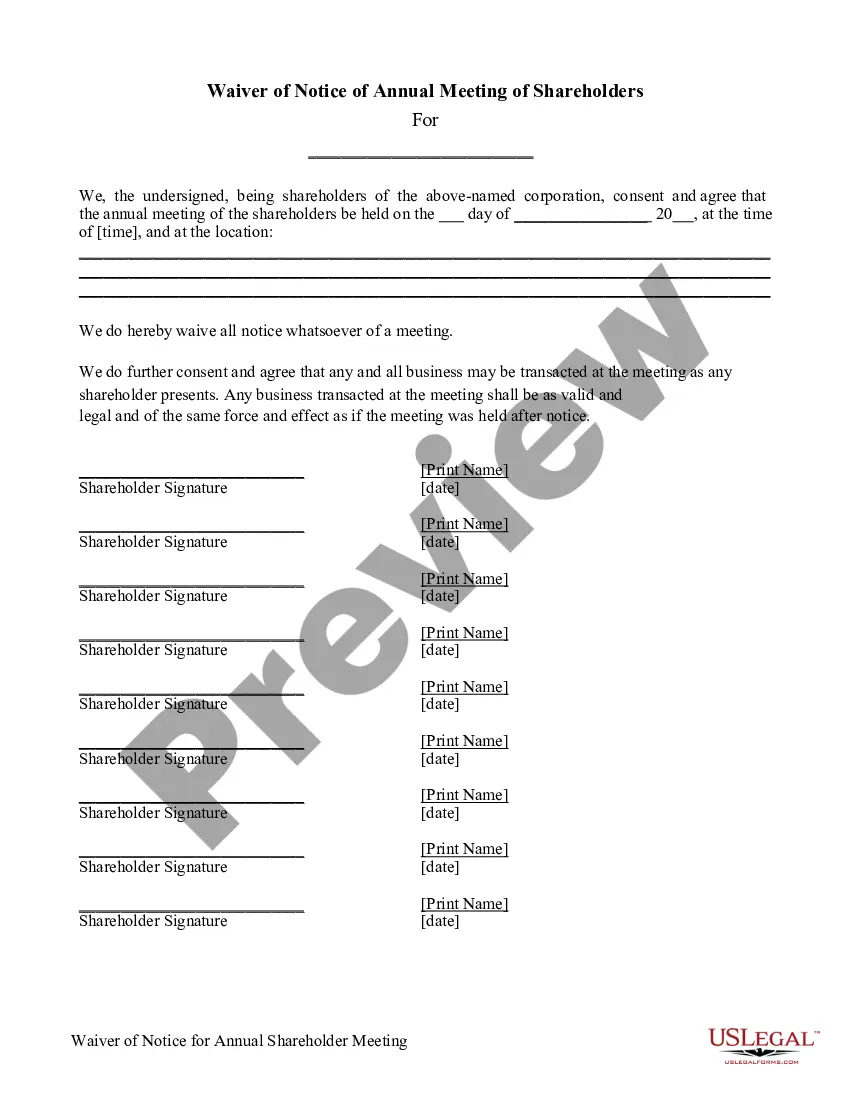

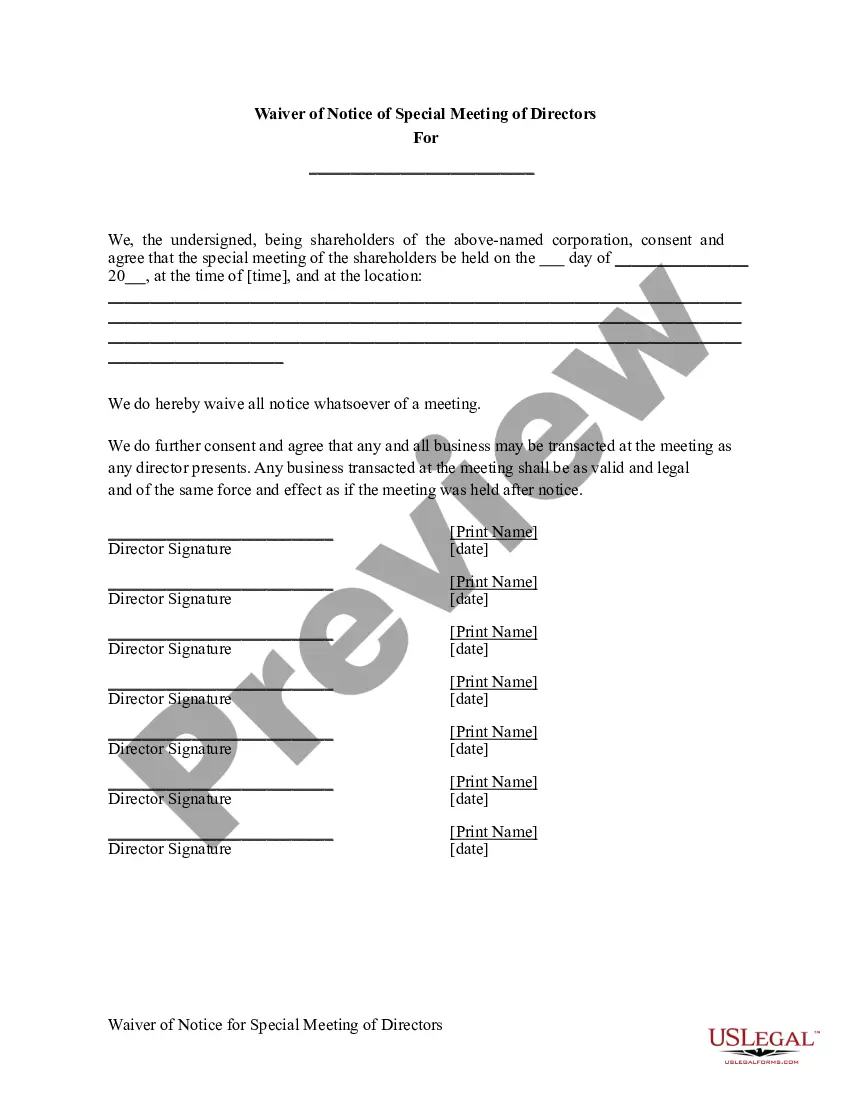

A waiver of notice is a written acknowledgment from people eligible to attend a company meeting stating that they are giving up their right to receive formal notice of the meeting.

If there's not enough time for a formal meeting notice, directors can opt to sign a waiver and hold the meeting without notice. The waiver ensures that all directors agree to hold the meeting and abide by the actions that take place.

A special meeting allows shareholders to remove the current board of directors and elect a new board. The following is an explanation of the procedures for calling a special meeting of the shareholders. Enclosed are copies of documents, which you can use for your meeting.

A waiver of notice is a document an individual signs that allows probate courts to proceed with will hearings in their absence. Waiver of notice are helpful in expediting the process, while cutting down on the often costly administrative court fees.

Corporations that don't consistently hold annual meetings may need to hold one without notice. The waiver of notice form is needed in order to document that all stockholders agree to the actions taken during the meeting, even though they may not have been present during it.

In the interest of time and efficiency, beneficiaries are often asked to sign a waiver so that the probate court doesn't need to schedule an initial hearing or provide ongoing notices of the proceedings.

It is an act of voluntarily giving up a right, and can apply to a variety of legal situations including knowingly giving up a legal right such as a speedy trial, a jury trial, giving up some rights in a settlement talk, or not enforcing a term of contract.