This guide provides an overview of the Fair Credit and Reporting Act Red Flags rule and gives step-by-step guidance on how businesses may develop a program to comply with the law's requirements. Links to additional resources for developing an Identity Theft Prevention Program are included.

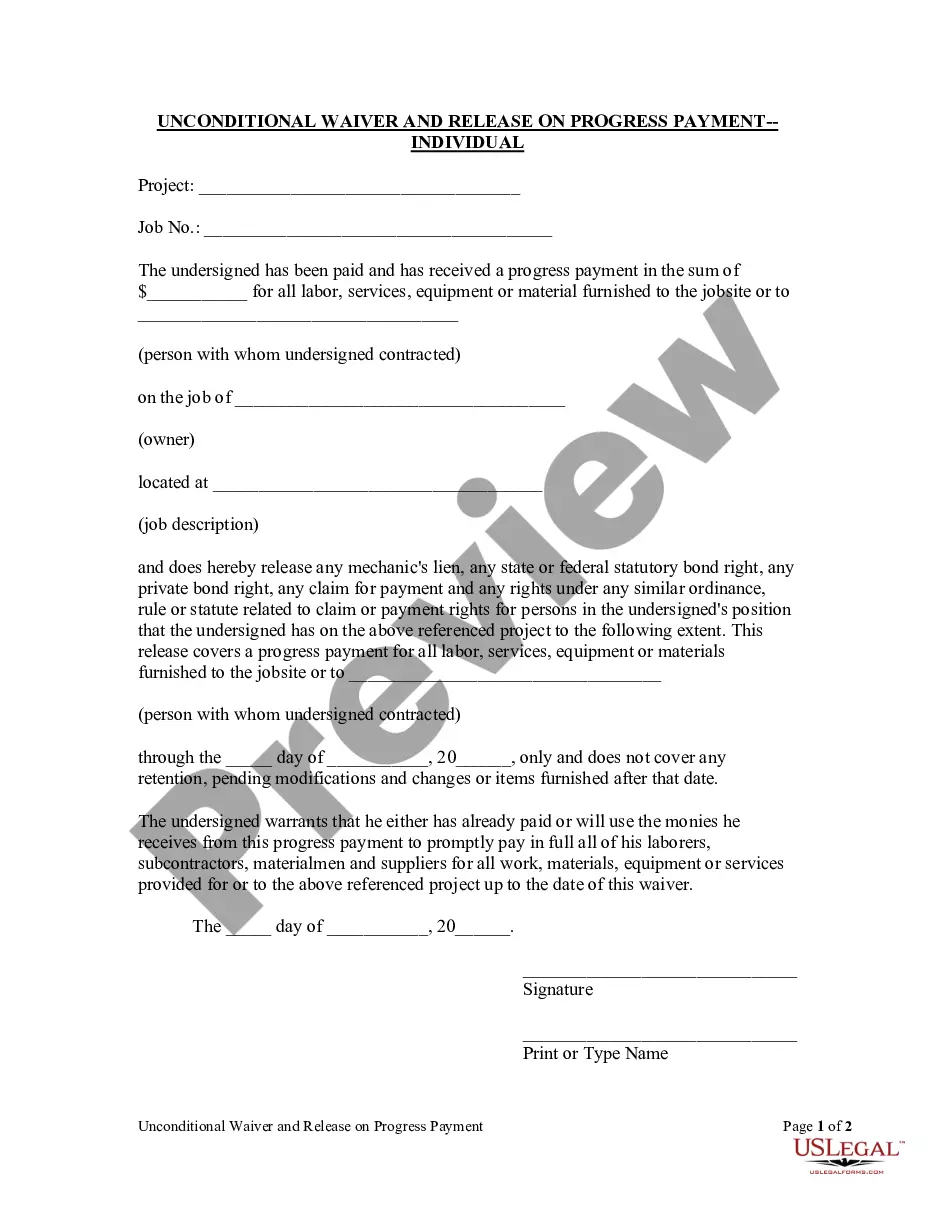

Note: The preview only shows the 1st two pages of the document.

Title: District of Columbia How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule Introduction: In the District of Columbia, combating fraud and identity theft requires a comprehensive understanding of the Fair Credit Reporting Act (FCRA) and the Federal Trade Commission's (FTC) Red Flags Rule, mandated by the Fair and Accurate Credit Transactions Act (FACT). This detailed guide aims to provide individuals in the District of Columbia with essential information and step-by-step instructions to protect themselves against financial fraud and identity theft. We will explore key concepts and offer practical tips on recognizing red flags, reporting suspicious activity, and utilizing legal provisions for safeguarding personal information. 1. Understanding the FCRA: — Overview of the Fair Credit Reporting Act (FCRA) — Rights and protections provided under the FCRA — Accessing free annual credit report— - Correcting errors on credit reports — Placing fraud alerts and security freezes on credit files 2. Introduction to the Red Flags Rule: — Explanation of the Federal Trade Commission's Red Flags Rule — Identifying "red flags" that signal potential fraud or identity theft — Designing a customized Identity Theft Prevention Program (IPP) — Steps for mitigating risks and proactively managing red flags 3. Implementing the FCRA and Red Flags Rule: — Establishing identity theft prevention policies and procedures — Training staff and employees on identifying red flags — Conducting ongoing risk assessments and updates to the IPP — Ensuring compliance with required regulations and deadlines 4. Reporting Fraud or Identity Theft: — Steps to take if you suspect fraud or identity theft — Contacting relevant authorities in the District of Columbia — Filing complaints with the Federal Trade Commission (FTC) — Cooperating with law enforcement agencies and financial institutions 5. Special Considerations for Different Industries: — District of ColumbiWHWh— - Industry-specific red flags and prevention strategies — Financial institutions anbankingin— - Healthcare providers and insurers — Educational institutions and student loans — Government agencies and social security offices — Retail businesses and e-commerce platforms 6. Enhanced Protection Measures: — Exploring advanced methods to enhance personal information security — Establishing strong passwords and using two-factor authentication — Safeguarding personal information online and offline — Monitoring credit reports and employing credit monitoring services Conclusion: In the ever-evolving landscape of fraud and identity theft, understanding the FCRA and FACT Red Flags Rule is vital to protect oneself in the District of Columbia. By staying informed, recognizing red flags, and implementing necessary safeguards, individuals can minimize the risk of fraudulent activities and identity theft. When armed with knowledge and proactive prevention measures, residents of the District of Columbia can confidently navigate the challenges posed by fraudsters and maintain their financial well-being.

Title: District of Columbia How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule Introduction: In the District of Columbia, combating fraud and identity theft requires a comprehensive understanding of the Fair Credit Reporting Act (FCRA) and the Federal Trade Commission's (FTC) Red Flags Rule, mandated by the Fair and Accurate Credit Transactions Act (FACT). This detailed guide aims to provide individuals in the District of Columbia with essential information and step-by-step instructions to protect themselves against financial fraud and identity theft. We will explore key concepts and offer practical tips on recognizing red flags, reporting suspicious activity, and utilizing legal provisions for safeguarding personal information. 1. Understanding the FCRA: — Overview of the Fair Credit Reporting Act (FCRA) — Rights and protections provided under the FCRA — Accessing free annual credit report— - Correcting errors on credit reports — Placing fraud alerts and security freezes on credit files 2. Introduction to the Red Flags Rule: — Explanation of the Federal Trade Commission's Red Flags Rule — Identifying "red flags" that signal potential fraud or identity theft — Designing a customized Identity Theft Prevention Program (IPP) — Steps for mitigating risks and proactively managing red flags 3. Implementing the FCRA and Red Flags Rule: — Establishing identity theft prevention policies and procedures — Training staff and employees on identifying red flags — Conducting ongoing risk assessments and updates to the IPP — Ensuring compliance with required regulations and deadlines 4. Reporting Fraud or Identity Theft: — Steps to take if you suspect fraud or identity theft — Contacting relevant authorities in the District of Columbia — Filing complaints with the Federal Trade Commission (FTC) — Cooperating with law enforcement agencies and financial institutions 5. Special Considerations for Different Industries: — District of ColumbiWHWh— - Industry-specific red flags and prevention strategies — Financial institutions anbankingin— - Healthcare providers and insurers — Educational institutions and student loans — Government agencies and social security offices — Retail businesses and e-commerce platforms 6. Enhanced Protection Measures: — Exploring advanced methods to enhance personal information security — Establishing strong passwords and using two-factor authentication — Safeguarding personal information online and offline — Monitoring credit reports and employing credit monitoring services Conclusion: In the ever-evolving landscape of fraud and identity theft, understanding the FCRA and FACT Red Flags Rule is vital to protect oneself in the District of Columbia. By staying informed, recognizing red flags, and implementing necessary safeguards, individuals can minimize the risk of fraudulent activities and identity theft. When armed with knowledge and proactive prevention measures, residents of the District of Columbia can confidently navigate the challenges posed by fraudsters and maintain their financial well-being.