District of Columbia Federal Consumer Leasing Act Disclosure Form

Description

How to fill out District Of Columbia Federal Consumer Leasing Act Disclosure Form?

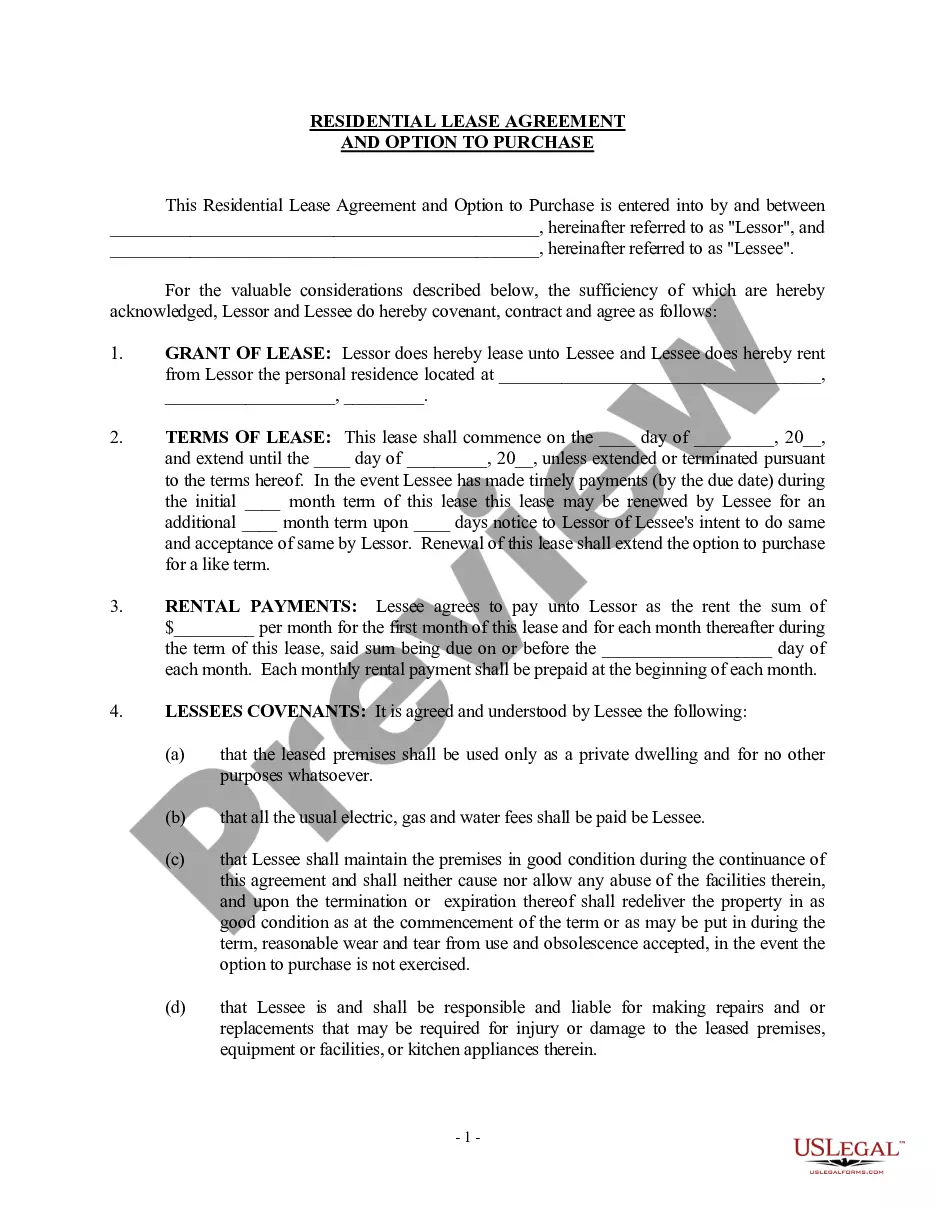

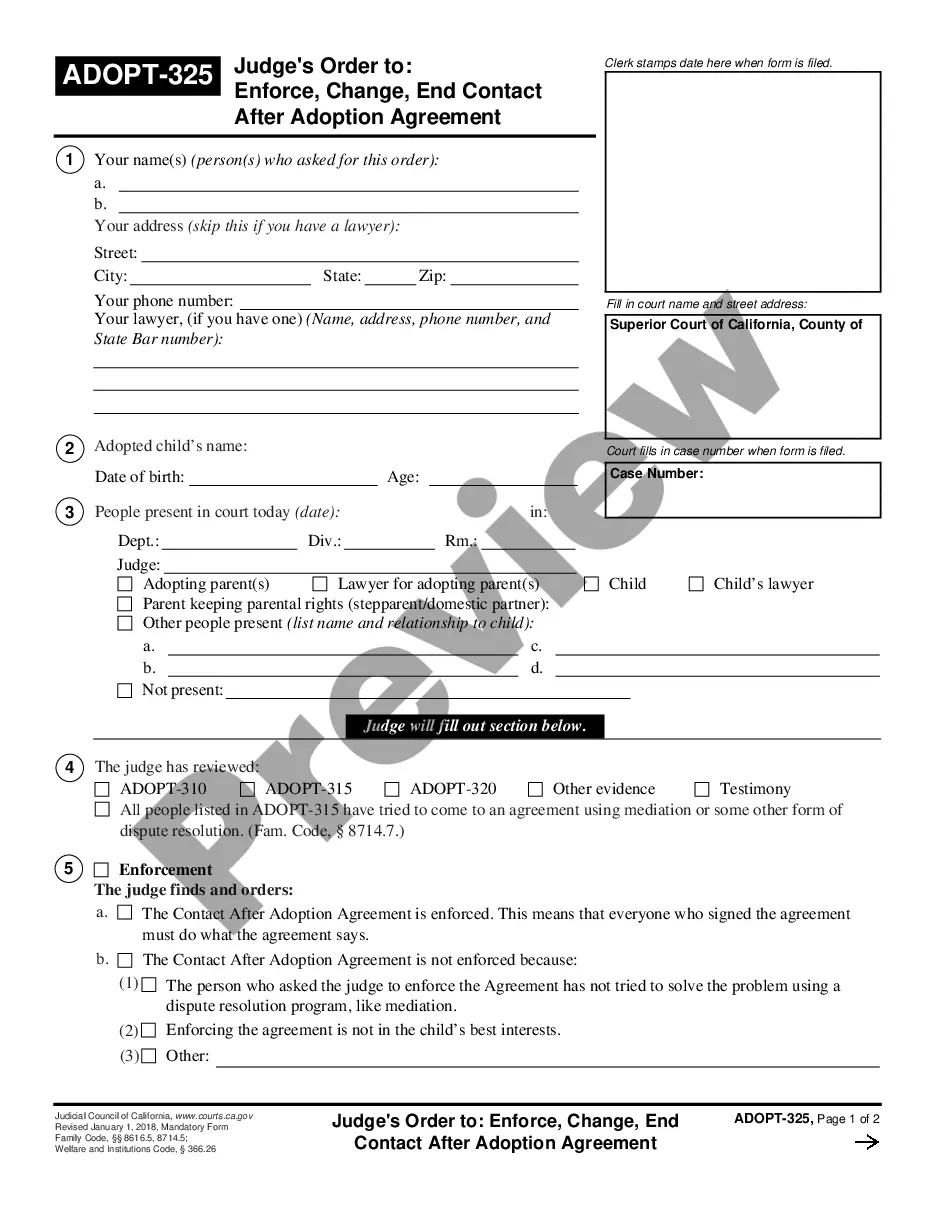

Discovering the right legal record design can be quite a have a problem. Needless to say, there are plenty of themes available online, but how do you find the legal form you need? Use the US Legal Forms site. The support gives a large number of themes, such as the District of Columbia Federal Consumer Leasing Act Disclosure Form, that you can use for company and private requirements. Every one of the kinds are inspected by pros and meet federal and state demands.

Should you be previously signed up, log in in your account and click on the Download switch to get the District of Columbia Federal Consumer Leasing Act Disclosure Form. Make use of your account to check with the legal kinds you might have purchased previously. Check out the My Forms tab of the account and have another backup in the record you need.

Should you be a fresh customer of US Legal Forms, allow me to share basic directions that you should comply with:

- Initially, make certain you have chosen the right form for your personal town/region. You may look over the shape making use of the Review switch and read the shape information to guarantee it will be the best for you.

- When the form does not meet your expectations, take advantage of the Seach area to find the right form.

- Once you are certain the shape is acceptable, click the Buy now switch to get the form.

- Pick the costs strategy you need and enter the needed information and facts. Design your account and pay for the order utilizing your PayPal account or charge card.

- Choose the submit structure and download the legal record design in your system.

- Total, edit and printing and indicator the acquired District of Columbia Federal Consumer Leasing Act Disclosure Form.

US Legal Forms may be the greatest catalogue of legal kinds for which you can find various record themes. Use the service to download expertly-created documents that comply with condition demands.

Form popularity

FAQ

A consumer lease is a contract for the hire (rental) of goods where the consumer has no right to purchase the goods. ( s. 169 NCC) Some examples of consumer leases: Car lease.

This Act, amending the Truth in Lending Act, regulates personal property leases that exceed four months in duration and that are made to consumers for personal, family, or household purposes.

The Truth in Lending Act (TILA) is implemented by the Board's Regulation Z (12 CFR Part 226). A principal purpose of TILA is to promote the informed use of consumer credit by requiring disclosures about its terms and cost.

Effective July 21, 2011, the Dodd-Frank Act requires that the protections of the Truth in Lending Act (TILA) and the Consumer Leasing Act (CLA) apply to consumer credit transactions and consumer leases up to $50,000, compared with $25,000 currently.

An automobile lease is the most common type of consumer lease covered by the CLA. Currently, a lease is exempt from the CLA if the consumer's total obligation exceeds $25,000.

The Truth in Lending Act (TILA) protects consumers in their dealings with lenders and creditors. The TILA applies to most kinds of consumer credit, including both closed-end credit and open-end credit. The TILA regulates what information lenders must make known to consumers about their products and services.

Consumer leases may include:Automobile leases, Furniture leases, & Other personal property leases. Closed-end (walk-away) leases. Open-end leases.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) increased the threshold in the Consumer Leasing Act (CLA) for exempt consumer leases, and the threshold in the Truth in Lending Act (TILA) for exempt consumer credit transactions, from $25,000 to $50,000, effective July 21, 2011.

For an advertisement accessed by the consumer in electronic form, the required disclosures may be provided to the consumer in electronic form in the advertisement, without regard to the consumer consent or other provisions of the E-Sign Act.

Regulation M consists of the following six rules: 2022 Rule 100 Definitions; 2022 Rule 101 Activities of Distribution Participants; Rule 102 Activities of Issuers and Selling Security Holders; Rule 103 nasdaq Passive Market Making; 2022 Rule 104 Stabilizing and Other Activities; and 2022 Rule 105 Short Selling.