District of Columbia Appliance Refinish Services Contract - Self-Employed

Description

How to fill out District Of Columbia Appliance Refinish Services Contract - Self-Employed?

Have you been within a situation that you need to have papers for possibly business or personal reasons just about every time? There are tons of legitimate document web templates accessible on the Internet, but discovering kinds you can depend on is not easy. US Legal Forms offers a huge number of type web templates, such as the District of Columbia Appliance Refinish Services Contract - Self-Employed, that happen to be composed in order to meet state and federal needs.

When you are previously acquainted with US Legal Forms site and have your account, basically log in. Next, you are able to download the District of Columbia Appliance Refinish Services Contract - Self-Employed format.

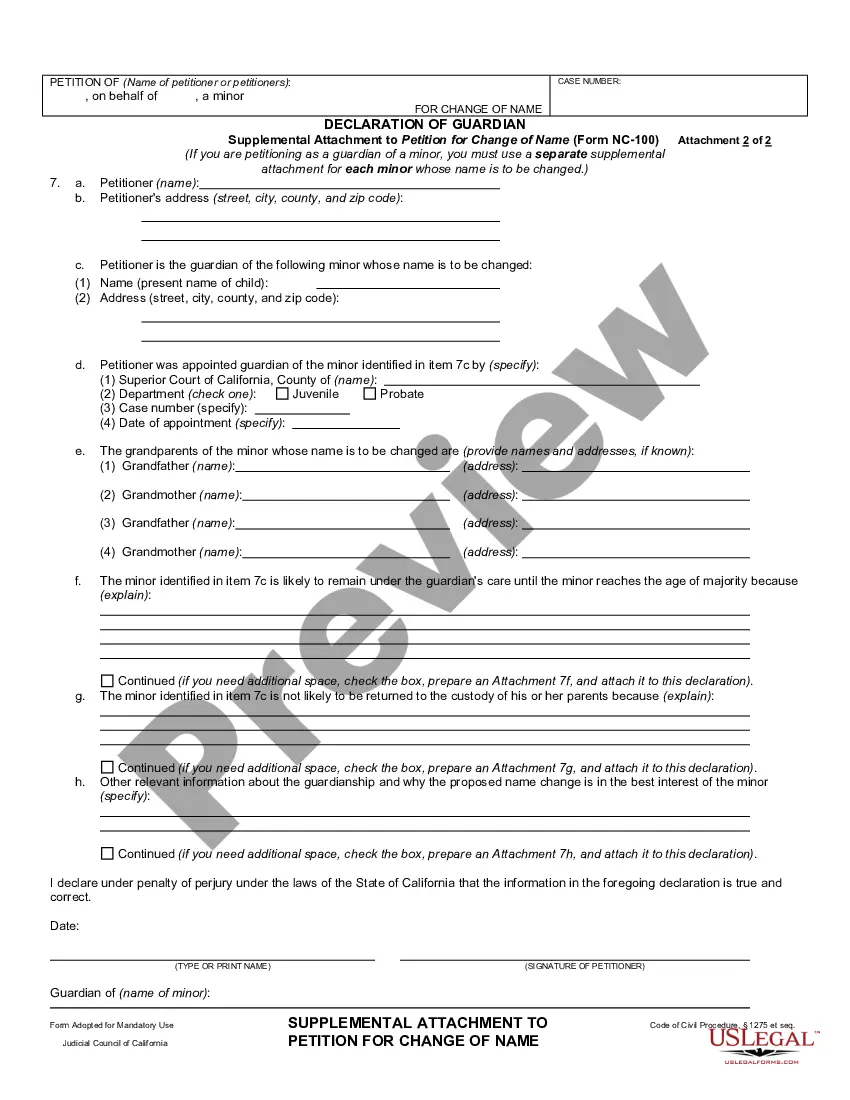

Unless you have an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for the appropriate city/region.

- Utilize the Review switch to examine the form.

- See the description to ensure that you have chosen the proper type.

- In the event the type is not what you`re trying to find, use the Look for industry to obtain the type that fits your needs and needs.

- When you find the appropriate type, click on Purchase now.

- Pick the rates prepare you desire, submit the desired information and facts to produce your account, and pay for your order using your PayPal or credit card.

- Choose a convenient file formatting and download your version.

Get every one of the document web templates you possess bought in the My Forms food selection. You can aquire a more version of District of Columbia Appliance Refinish Services Contract - Self-Employed at any time, if needed. Just click on the required type to download or produce the document format.

Use US Legal Forms, probably the most comprehensive collection of legitimate kinds, to save efforts and steer clear of blunders. The support offers skillfully made legitimate document web templates that you can use for an array of reasons. Create your account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

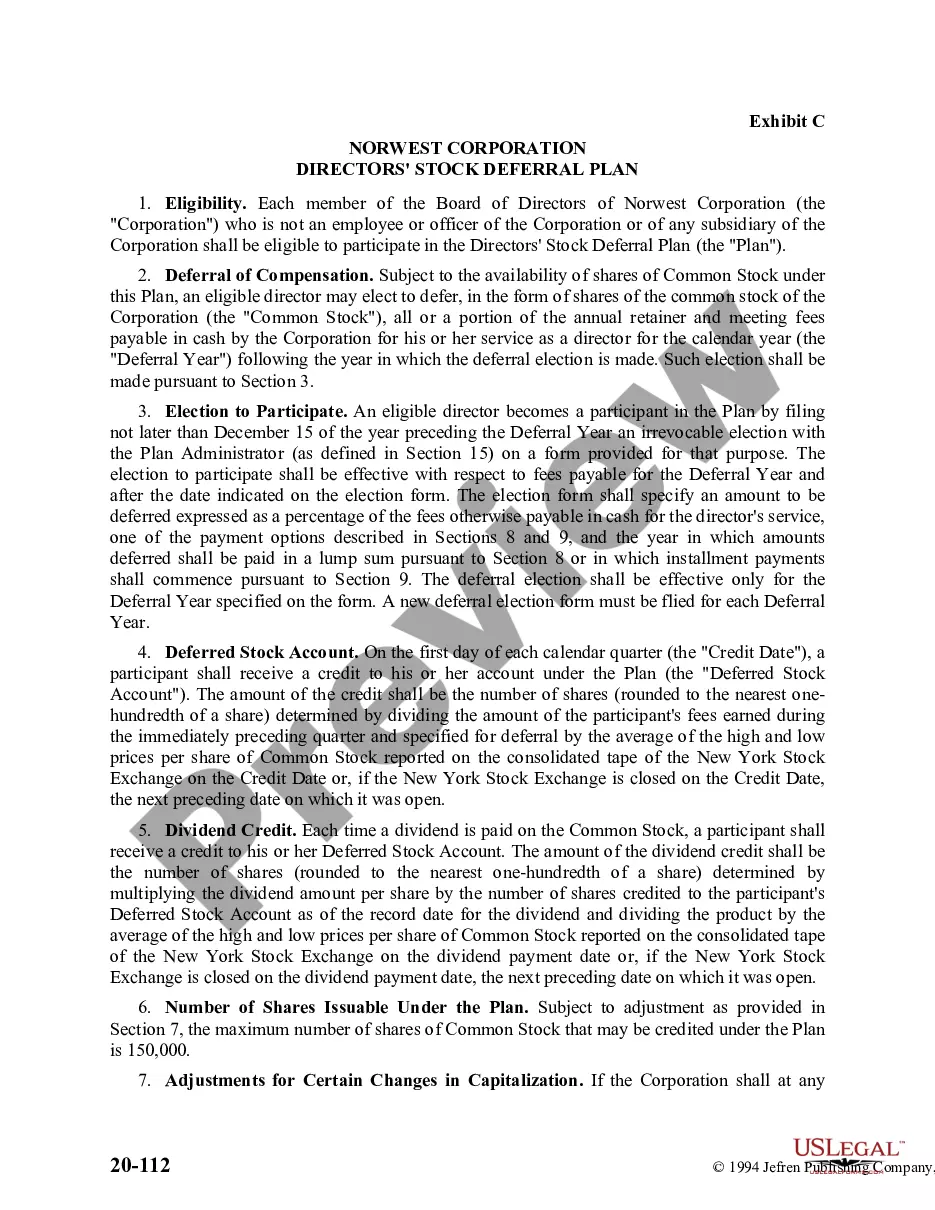

Services to individuals and businesses things like haircuts, medical bills, consultant fees, etc. are not personal property, and most services are not subject to sales tax.

Requirements for Doing Business with the DistrictProvide a Federal Identification Number and Dun and Bradstreet Number.Prove Tax Compliance.Show Proof of Unemployment Tax Compliance.Submit an Affirmative Action Plan.Register in ARIBA eSourcing.Show Proof of Valid Business License.

Washington D.C. requires businesses to collect sales tax on the sale of digital goods or services.

Traditional Goods or Services Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

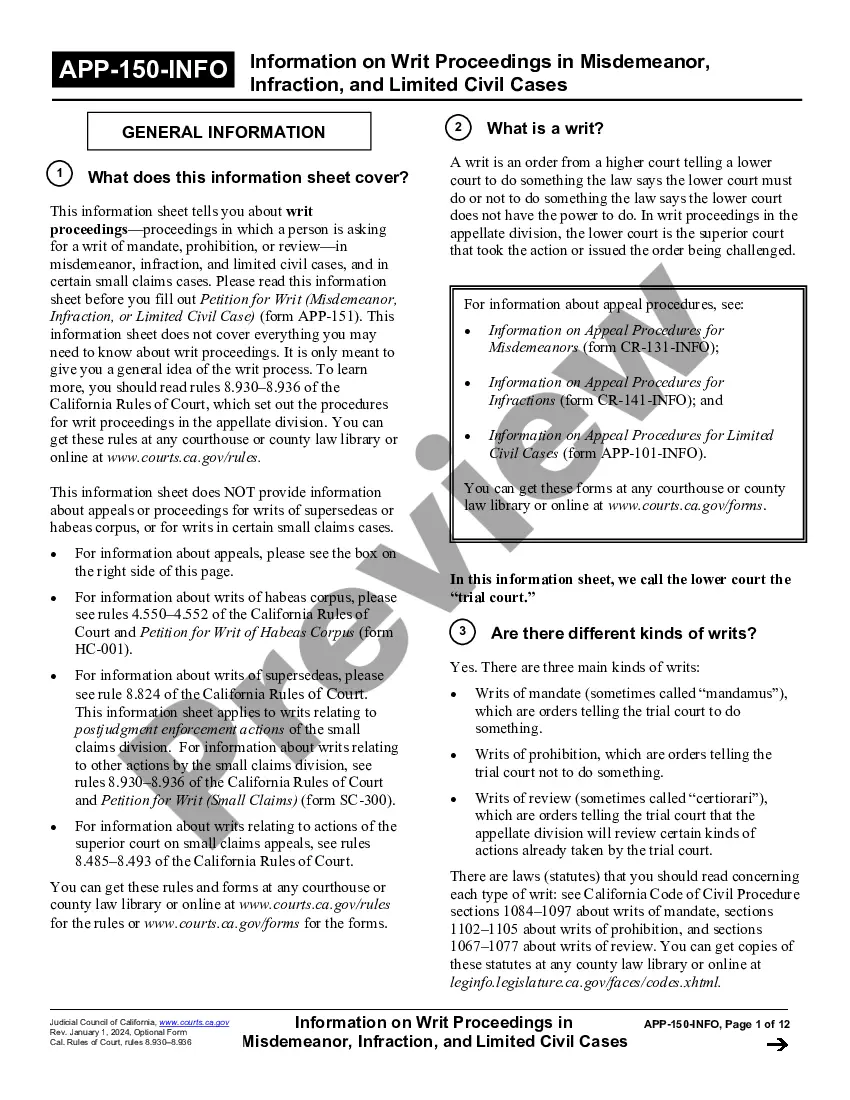

California law restricts the application of sales or use tax to transfers or consumption of tangible personal property or physical property other than real estate. Unlike many other states, California does not tax services unless they are an integral part of a taxable transfer of property.

Sales tax at the rate of 5.75 percent is imposed on charges for providing information services.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

Sales tax at the rate of 5.75 percent is imposed on charges for providing information services.

Are services subject to sales tax in District of Columbia? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In District of Columbia, specified services are taxable.