District of Columbia Cook Services Contract - Self-Employed

Description

How to fill out District Of Columbia Cook Services Contract - Self-Employed?

It is possible to devote hours on-line trying to find the authorized papers design that meets the federal and state needs you want. US Legal Forms supplies 1000s of authorized varieties that happen to be analyzed by professionals. You can easily down load or print out the District of Columbia Cook Services Contract - Self-Employed from the service.

If you already have a US Legal Forms bank account, you can log in and then click the Download button. Afterward, you can total, revise, print out, or signal the District of Columbia Cook Services Contract - Self-Employed. Each and every authorized papers design you get is your own permanently. To acquire an additional duplicate of the bought type, go to the My Forms tab and then click the related button.

Should you use the US Legal Forms website for the first time, adhere to the easy directions below:

- First, be sure that you have chosen the correct papers design for that area/city of your liking. Browse the type description to ensure you have chosen the proper type. If readily available, use the Preview button to appear from the papers design also.

- In order to locate an additional variation of your type, use the Look for industry to obtain the design that meets your requirements and needs.

- After you have discovered the design you desire, simply click Get now to continue.

- Select the prices strategy you desire, type in your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal bank account to pay for the authorized type.

- Select the formatting of your papers and down load it to your system.

- Make alterations to your papers if necessary. It is possible to total, revise and signal and print out District of Columbia Cook Services Contract - Self-Employed.

Download and print out 1000s of papers web templates while using US Legal Forms web site, which offers the greatest collection of authorized varieties. Use specialist and condition-certain web templates to take on your business or specific needs.

Form popularity

FAQ

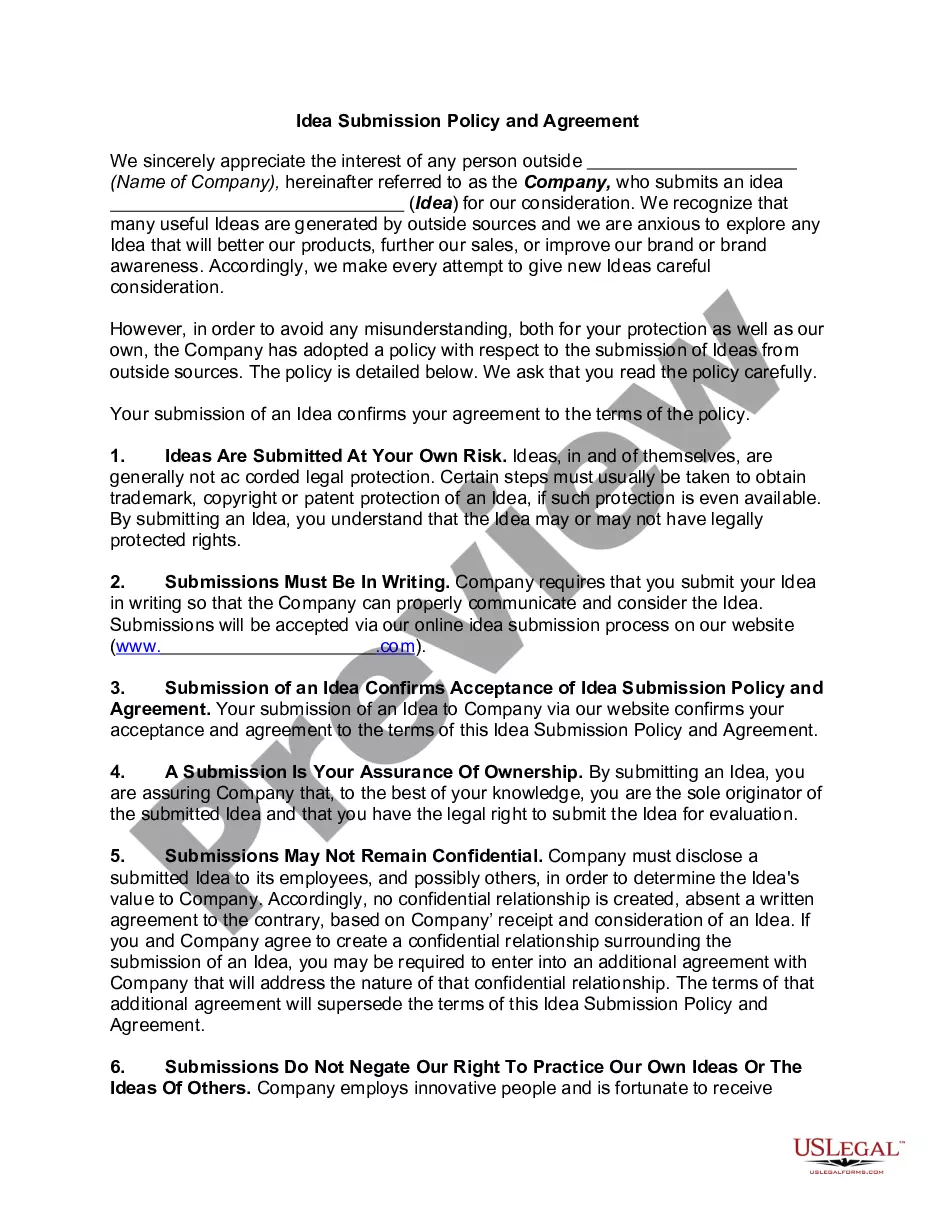

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

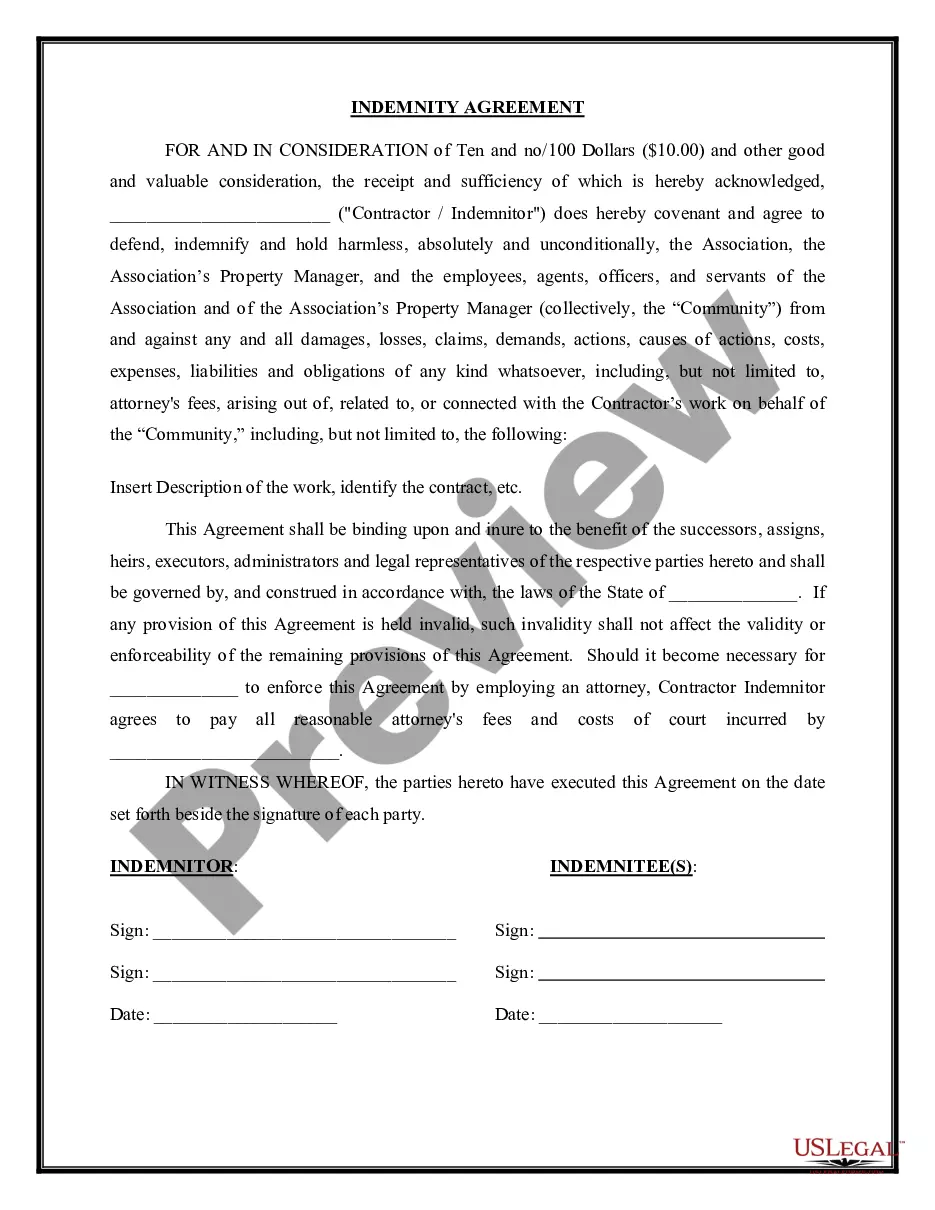

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Contract for service. A contract of service is an agreement between an employer and an employee. In a contract for service, an independent contractor, such as a self-employed person or vendor, is engaged for a fee to carry out an assignment or project.

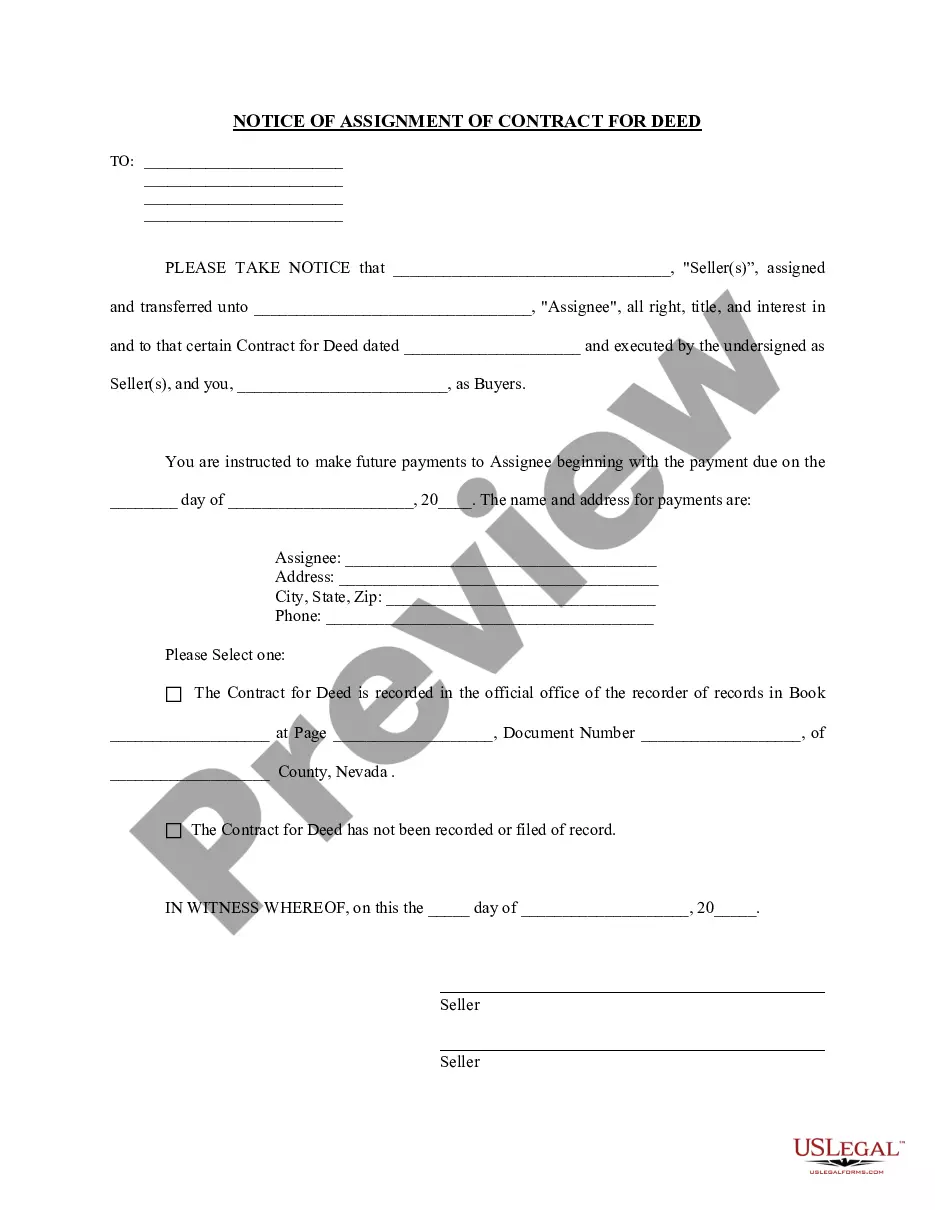

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.