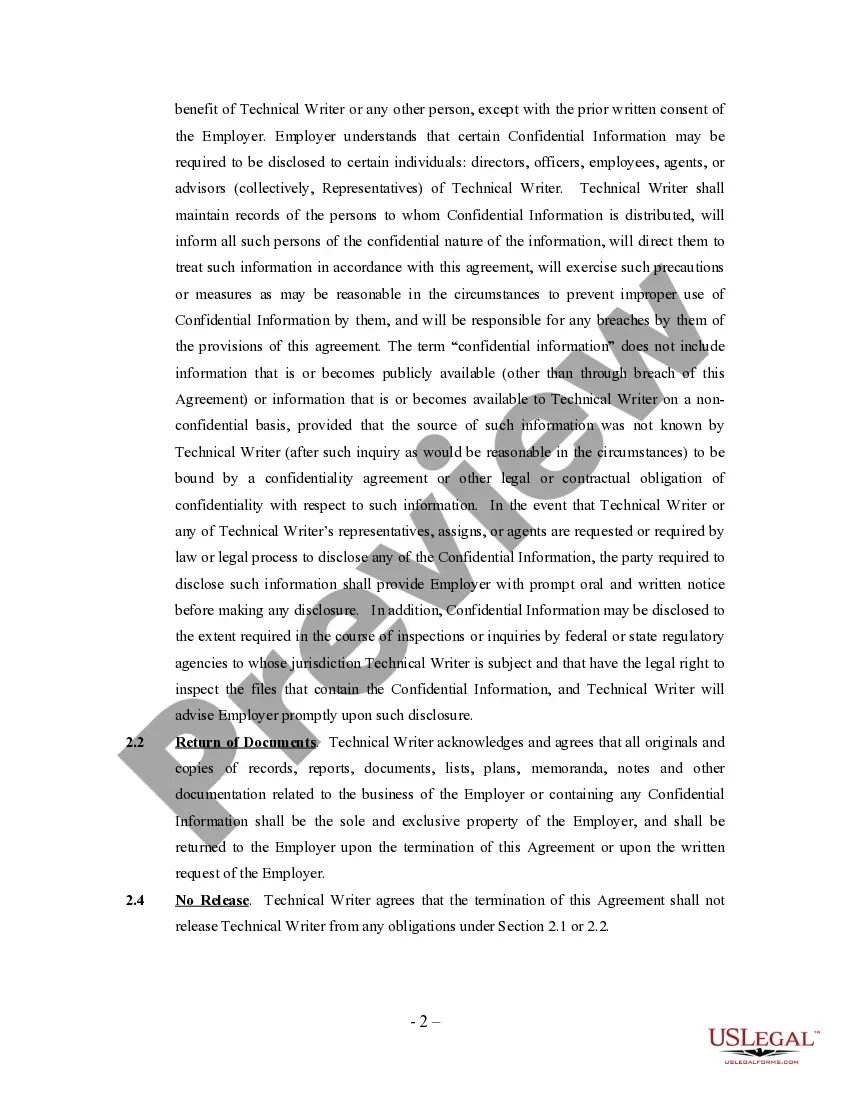

District of Columbia Technical Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out District Of Columbia Technical Writer Agreement - Self-Employed Independent Contractor?

Finding the right authorized document format could be a battle. Naturally, there are plenty of themes available on the Internet, but how will you find the authorized form you want? Utilize the US Legal Forms website. The service offers a large number of themes, such as the District of Columbia Technical Writer Agreement - Self-Employed Independent Contractor, which you can use for enterprise and personal demands. Every one of the kinds are checked by specialists and fulfill state and federal demands.

Should you be already listed, log in to the bank account and click the Acquire switch to obtain the District of Columbia Technical Writer Agreement - Self-Employed Independent Contractor. Utilize your bank account to check with the authorized kinds you have purchased formerly. Check out the My Forms tab of your bank account and obtain one more copy from the document you want.

Should you be a fresh consumer of US Legal Forms, listed here are straightforward guidelines that you should adhere to:

- Very first, be sure you have selected the correct form for your personal city/region. You may look through the shape using the Review switch and study the shape information to ensure this is basically the best for you.

- In the event the form fails to fulfill your preferences, make use of the Seach discipline to get the correct form.

- When you are sure that the shape would work, click on the Buy now switch to obtain the form.

- Pick the costs plan you want and type in the essential info. Make your bank account and pay money for your order making use of your PayPal bank account or bank card.

- Choose the document formatting and acquire the authorized document format to the system.

- Total, change and produce and signal the attained District of Columbia Technical Writer Agreement - Self-Employed Independent Contractor.

US Legal Forms is definitely the greatest library of authorized kinds in which you will find different document themes. Utilize the company to acquire appropriately-created documents that adhere to condition demands.

Form popularity

FAQ

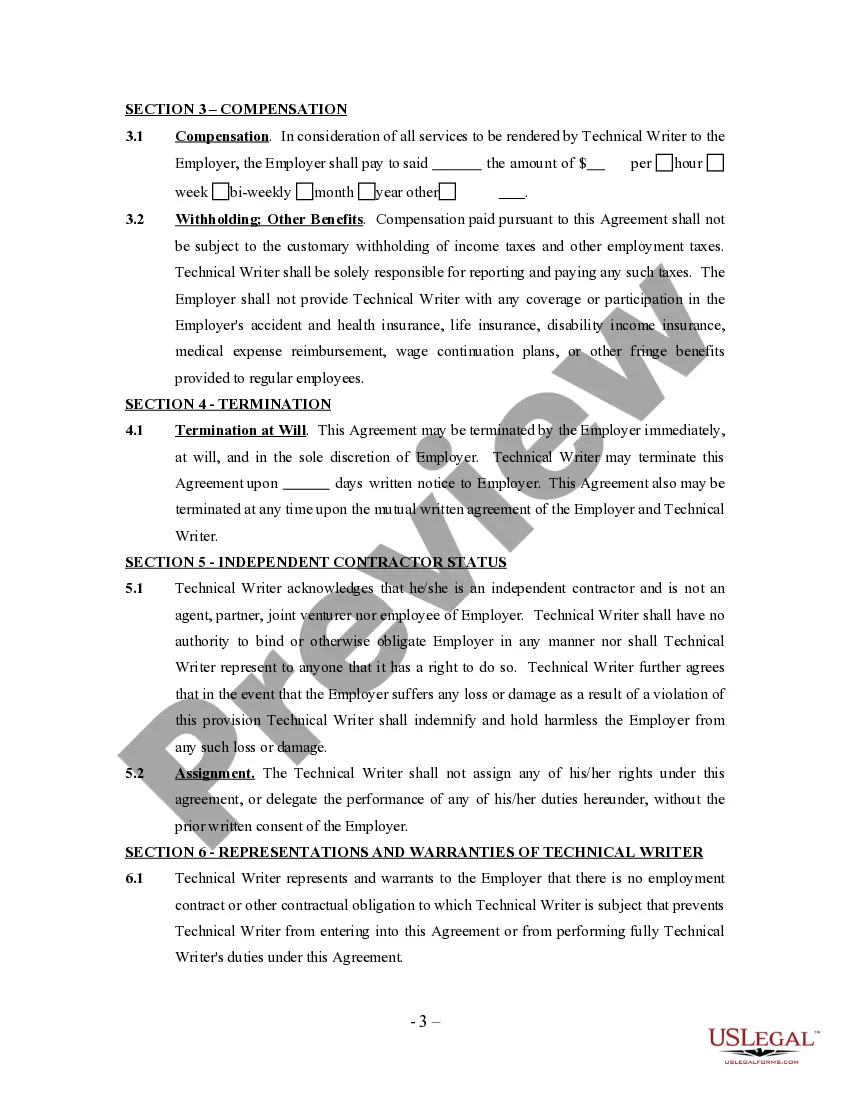

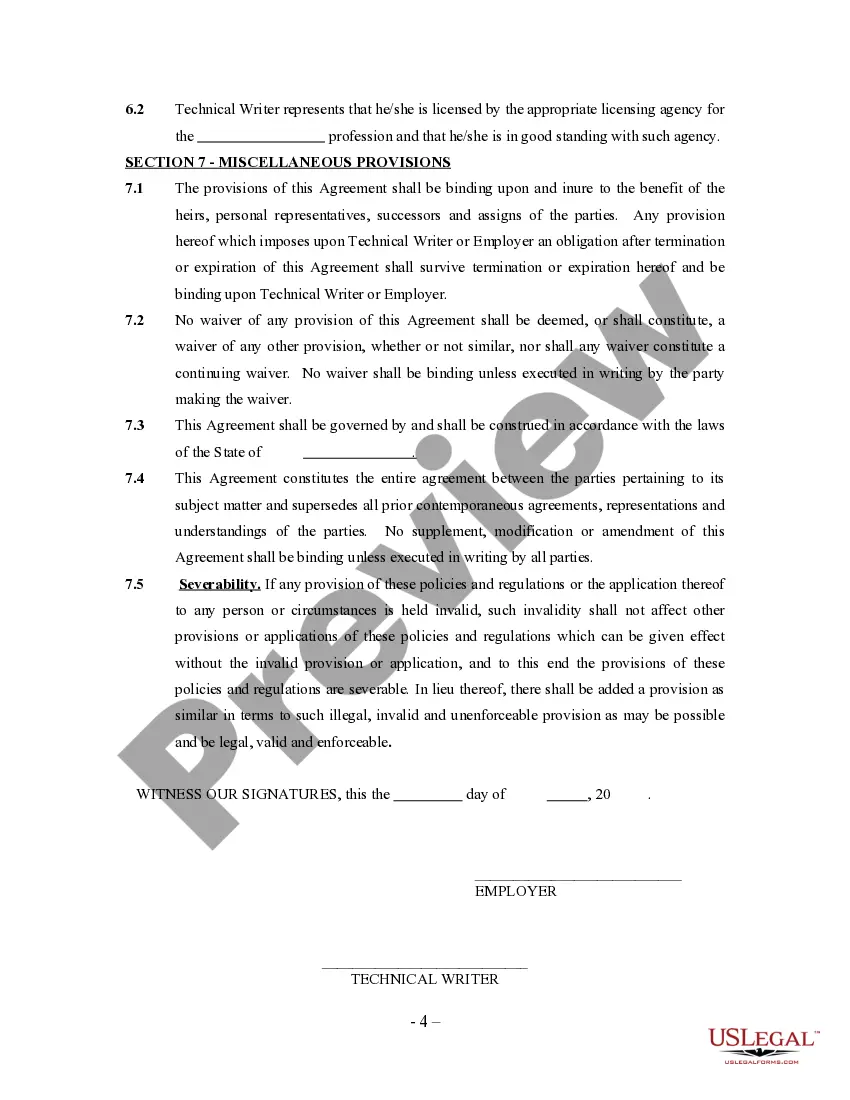

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.