District of Columbia Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out District Of Columbia Social Worker Agreement - Self-Employed Independent Contractor?

If you need to comprehensive, download, or print out legitimate record layouts, use US Legal Forms, the biggest collection of legitimate types, which can be found on-line. Take advantage of the site`s easy and handy look for to get the documents you need. Different layouts for company and personal functions are sorted by categories and says, or key phrases. Use US Legal Forms to get the District of Columbia Social Worker Agreement - Self-Employed Independent Contractor within a handful of click throughs.

When you are currently a US Legal Forms customer, log in to the account and click the Acquire option to have the District of Columbia Social Worker Agreement - Self-Employed Independent Contractor. Also you can accessibility types you earlier delivered electronically in the My Forms tab of your respective account.

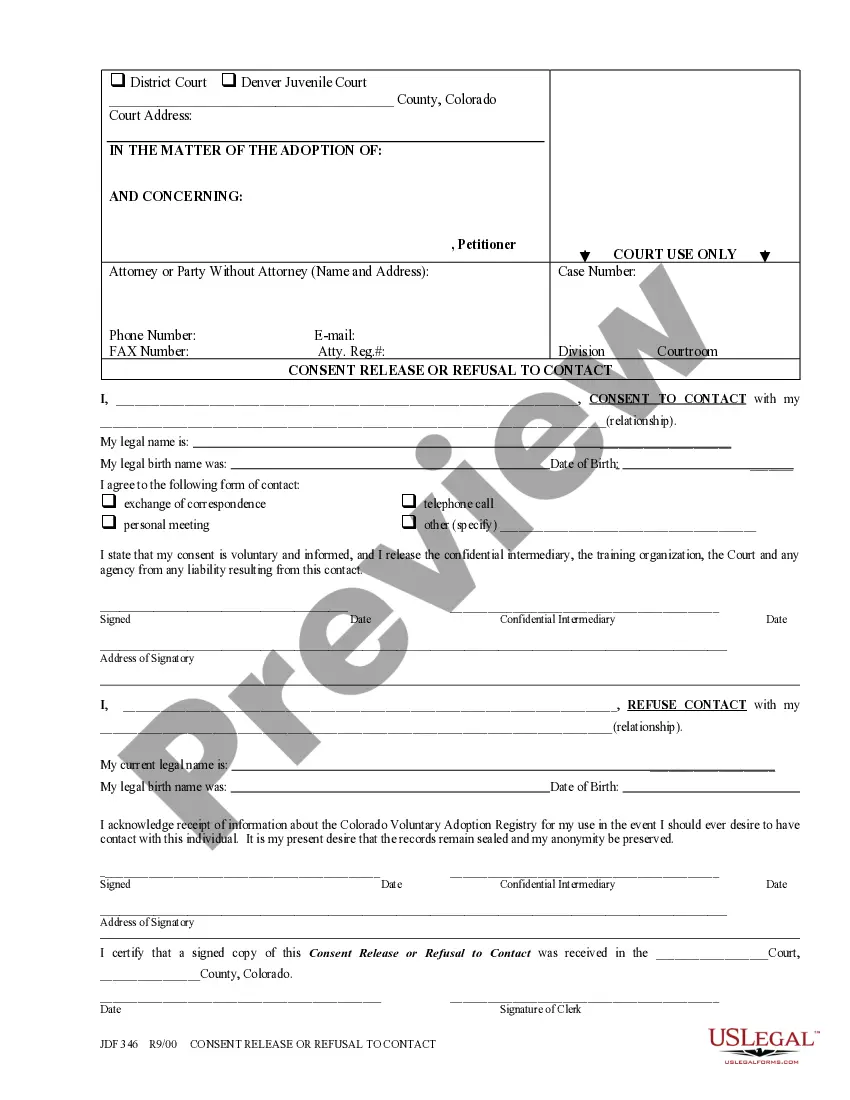

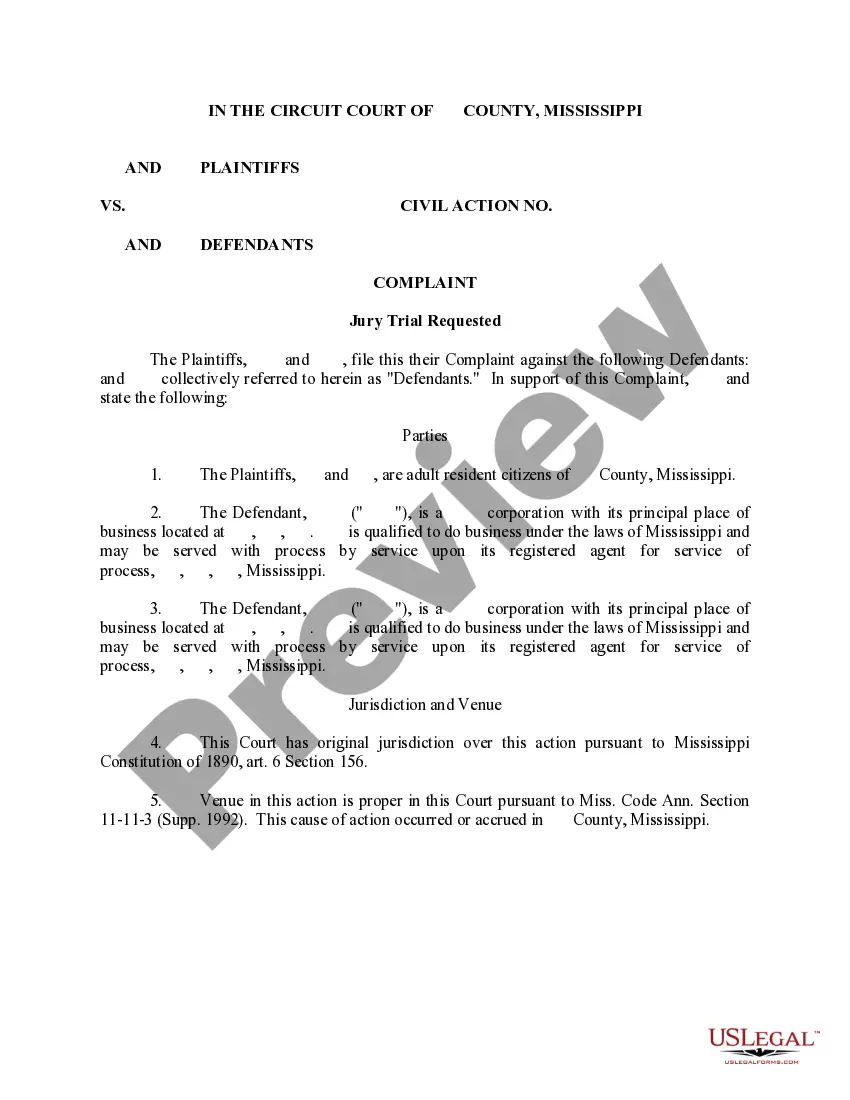

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the form to the proper metropolis/nation.

- Step 2. Take advantage of the Review choice to look through the form`s information. Do not forget to read through the description.

- Step 3. When you are not satisfied with the form, use the Research industry towards the top of the display to find other models in the legitimate form format.

- Step 4. After you have located the form you need, select the Get now option. Choose the rates program you prefer and add your references to sign up for an account.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Select the format in the legitimate form and download it on your own product.

- Step 7. Complete, modify and print out or indicator the District of Columbia Social Worker Agreement - Self-Employed Independent Contractor.

Each legitimate record format you get is the one you have permanently. You may have acces to each and every form you delivered electronically in your acccount. Click the My Forms segment and choose a form to print out or download once again.

Contend and download, and print out the District of Columbia Social Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many skilled and status-specific types you can utilize for your company or personal requirements.

Form popularity

FAQ

Control and Agency The primary difference between an agency and an independent contractor is that the principal is not liable for the actions of the independent contractor but may very well be liable for the actions of an agent.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

An employee has her job description dictated by the employer. She acts under the strict direction of the employer. An independent contractor is a separate person from the business and works independently by having a business arrangement with the individual/company that for instance provides a service.

For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

More info

Rocket Legal's lawyers are specialists in intellectual property law and have worked on.