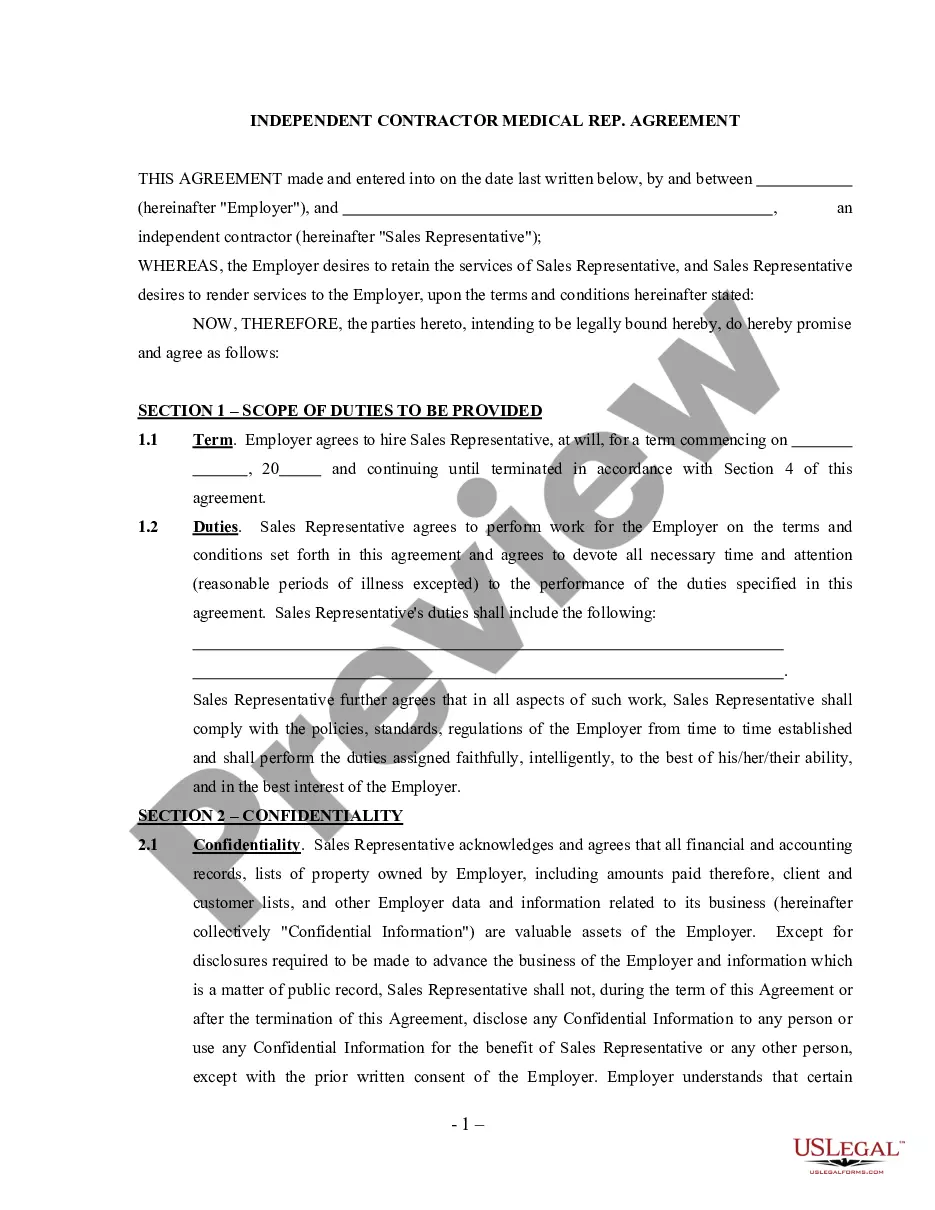

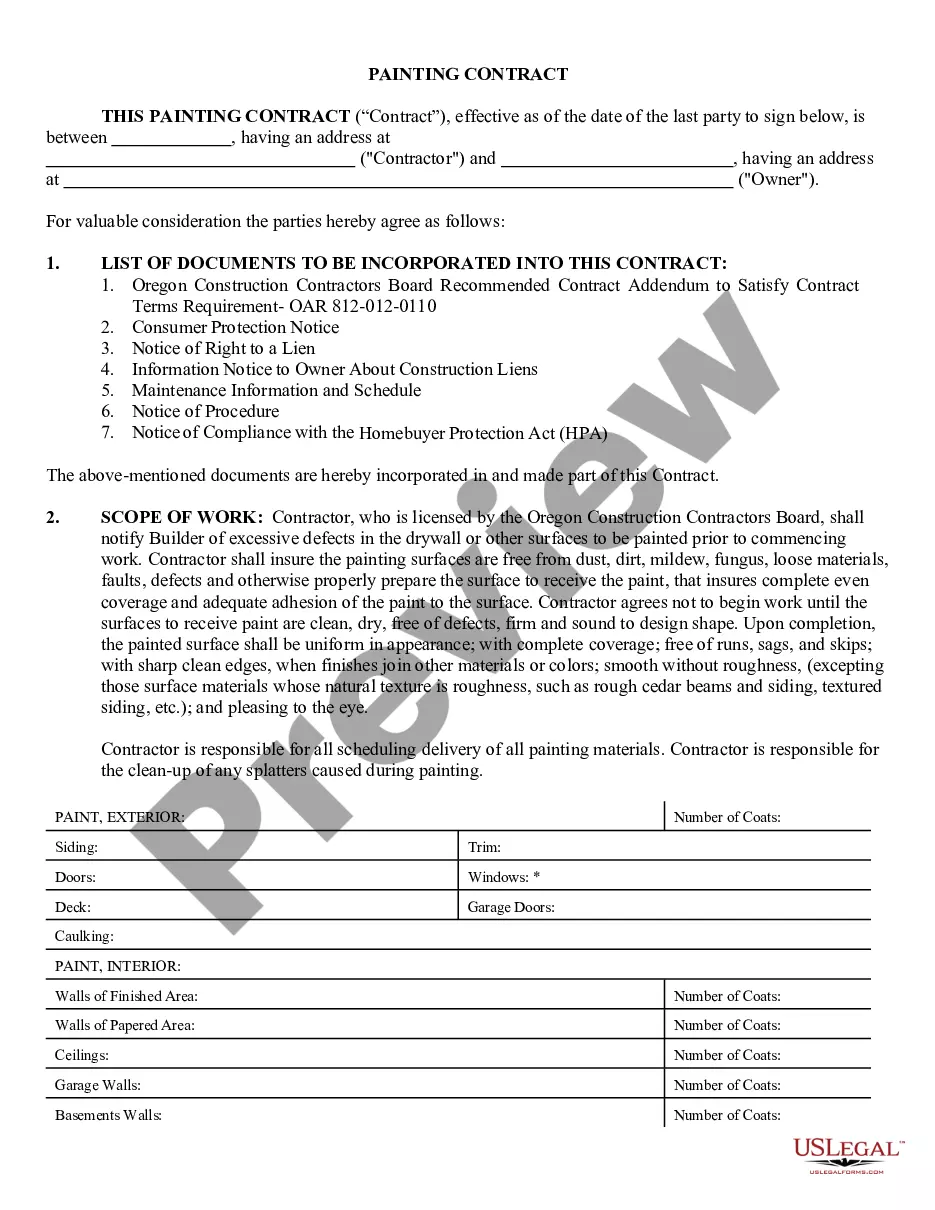

District of Columbia Self-Employed Route Sales Contractor Agreement

Description

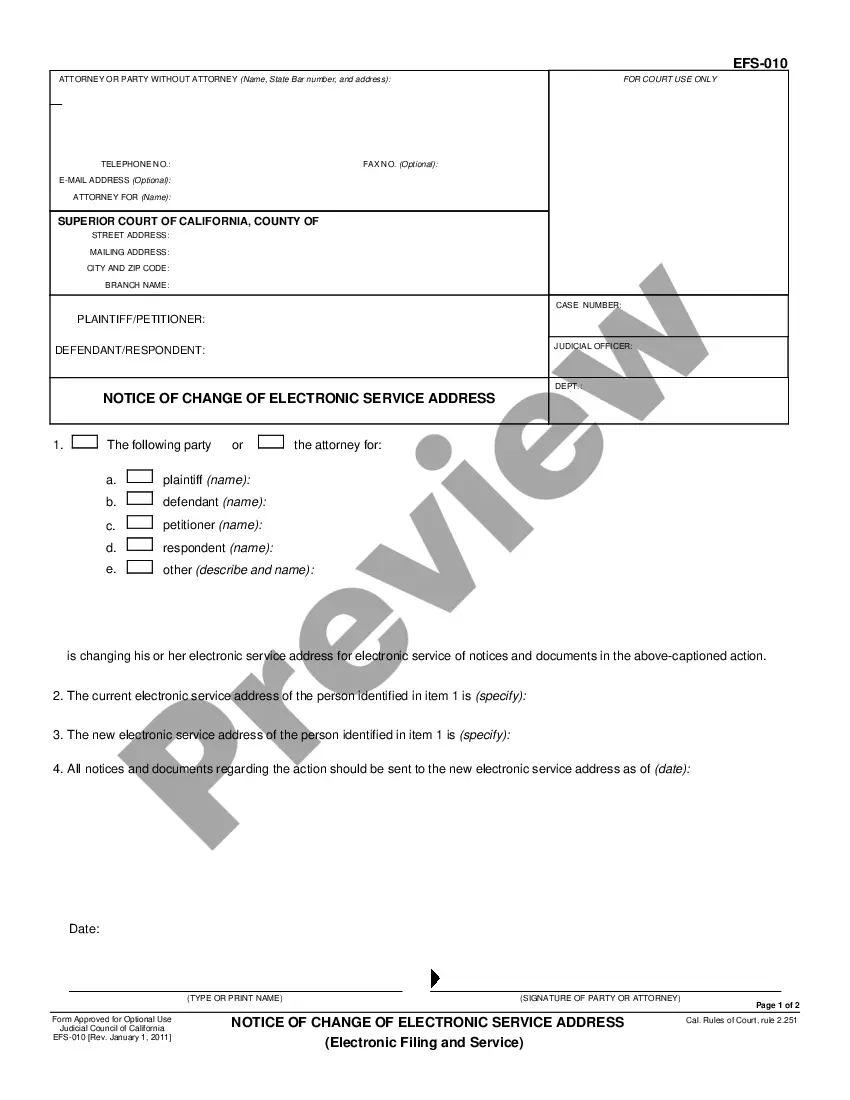

How to fill out District Of Columbia Self-Employed Route Sales Contractor Agreement?

Are you presently within a placement that you require files for both company or personal purposes nearly every day time? There are tons of legitimate document themes accessible on the Internet, but finding kinds you can trust is not straightforward. US Legal Forms offers a large number of form themes, like the District of Columbia Self-Employed Route Sales Contractor Agreement, which are written to fulfill federal and state needs.

Should you be previously acquainted with US Legal Forms web site and possess a merchant account, merely log in. Afterward, you may acquire the District of Columbia Self-Employed Route Sales Contractor Agreement format.

Should you not provide an profile and need to begin using US Legal Forms, abide by these steps:

- Get the form you want and make sure it is for the proper metropolis/county.

- Take advantage of the Preview key to review the shape.

- Look at the explanation to ensure that you have chosen the proper form.

- If the form is not what you are searching for, use the Research area to obtain the form that meets your needs and needs.

- Once you discover the proper form, click Acquire now.

- Opt for the prices strategy you need, complete the specified details to create your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Decide on a convenient data file format and acquire your duplicate.

Discover all of the document themes you may have bought in the My Forms menu. You can aquire a more duplicate of District of Columbia Self-Employed Route Sales Contractor Agreement any time, if needed. Just click the needed form to acquire or print the document format.

Use US Legal Forms, the most considerable variety of legitimate types, to save lots of efforts and steer clear of faults. The services offers appropriately made legitimate document themes which you can use for a selection of purposes. Produce a merchant account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

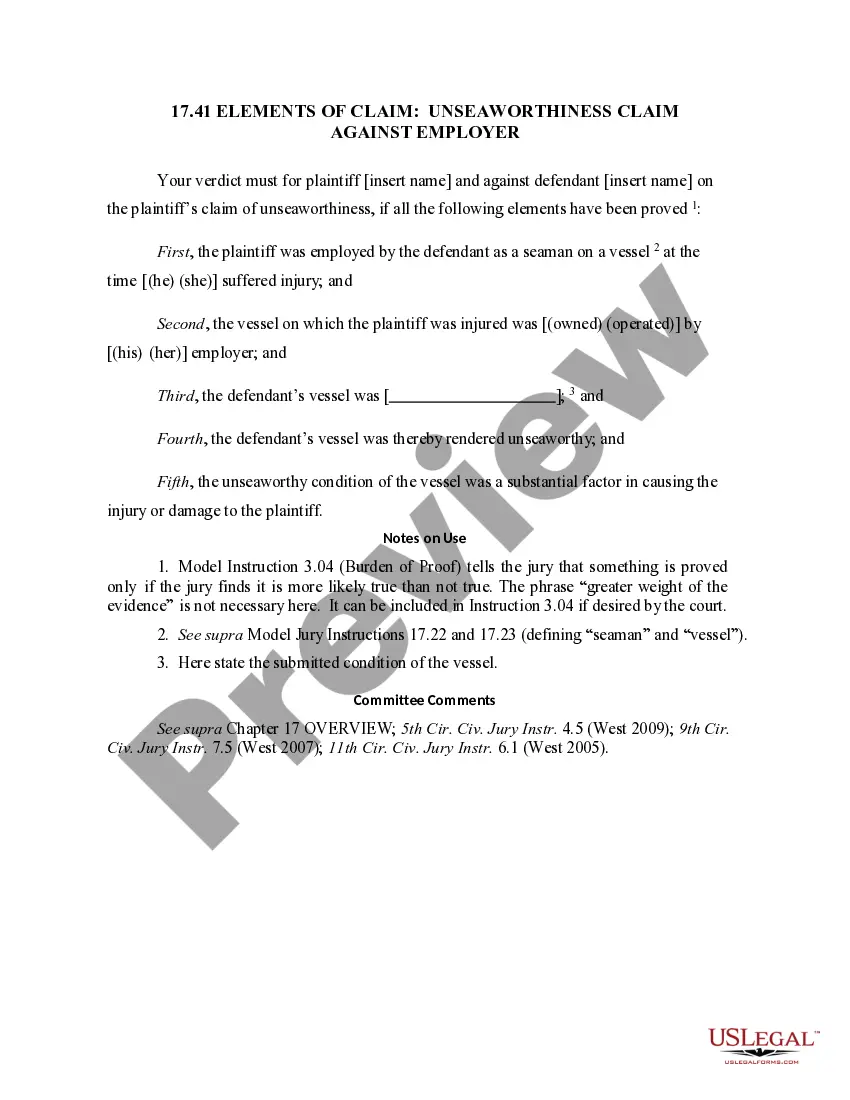

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

The IRS says that someone is self-employed if they meet one of these conditions: Someone who carries on a trade or business as a sole proprietor or independent contractor, A member of a partnership that carries on a trade or business, or. Someone who is otherwise in business for themselves, including part-time business

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business or a gig worker).

What is the $600 threshold? You are required to complete a 1099-MISC reporting form for an independent worker or unincorporated business if you paid that independent worker or business $600 or more.

Newspaper deliverers or news carriers: You are considered self-employed if you deliver or distribute newspapers or perform related tasks (such as soliciting customers), your pay is based on sales or other output and not on the number of hours you work, and you work under a contract which states that you are not an

The Internal Revenue Service's definition of self-employed is that you carry on a trade or business as a sole proprietor or independent contractor. The IRS also considers you self-employed if you are a partner in a business partnership, or if you are otherwise in business for yourself.