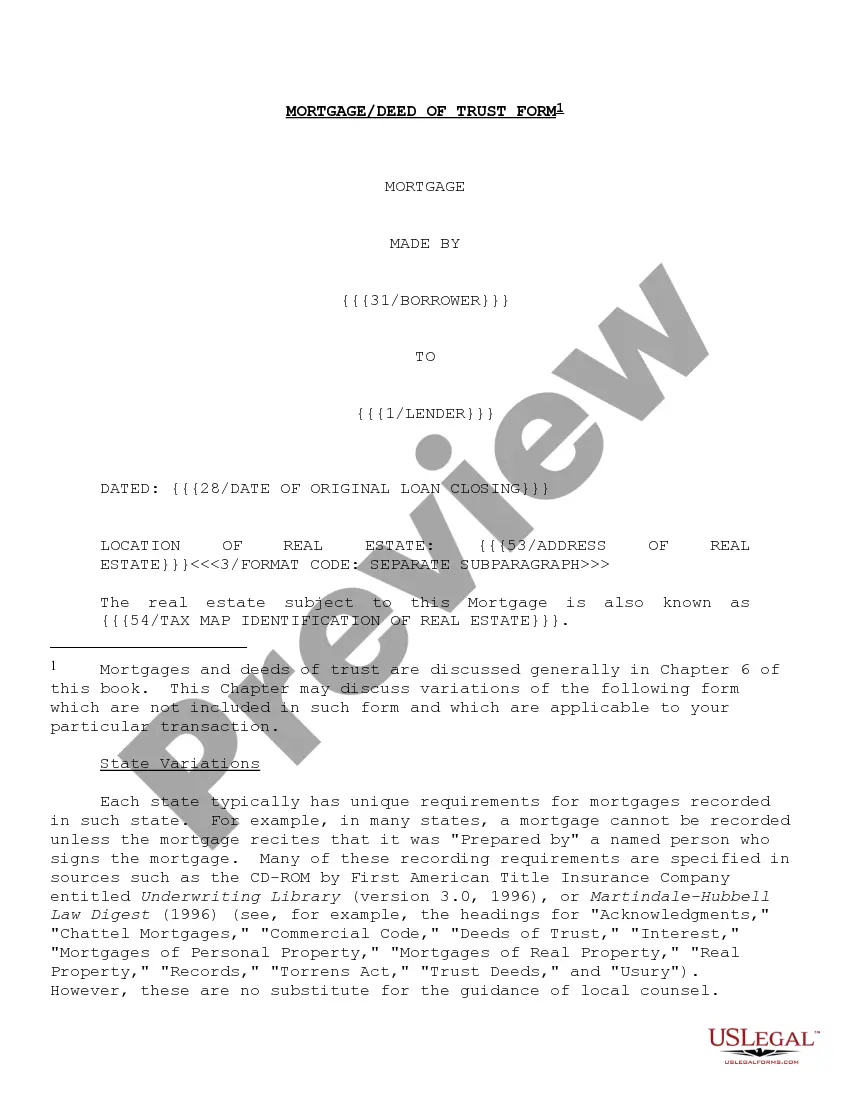

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

District of Columbia Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

It is possible to invest time on the web searching for the lawful document web template which fits the federal and state requirements you want. US Legal Forms provides a huge number of lawful kinds which can be evaluated by specialists. You can easily acquire or produce the District of Columbia Form of Mortgage Deed of Trust and Variations from our service.

If you already possess a US Legal Forms accounts, you can log in and then click the Download key. Following that, you can full, modify, produce, or indicator the District of Columbia Form of Mortgage Deed of Trust and Variations. Each and every lawful document web template you buy is your own property eternally. To get yet another version associated with a bought form, check out the My Forms tab and then click the related key.

Should you use the US Legal Forms internet site for the first time, follow the simple directions under:

- First, make sure that you have chosen the right document web template for your county/city of your liking. Look at the form description to ensure you have selected the correct form. If readily available, utilize the Preview key to check with the document web template at the same time.

- If you want to find yet another version in the form, utilize the Search field to get the web template that suits you and requirements.

- After you have found the web template you would like, click on Purchase now to move forward.

- Choose the pricing strategy you would like, key in your accreditations, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal accounts to cover the lawful form.

- Choose the format in the document and acquire it in your system.

- Make changes in your document if required. It is possible to full, modify and indicator and produce District of Columbia Form of Mortgage Deed of Trust and Variations.

Download and produce a huge number of document web templates making use of the US Legal Forms Internet site, that provides the biggest collection of lawful kinds. Use expert and state-distinct web templates to tackle your organization or personal needs.

Form popularity

FAQ

A Grant Deed is an instrument that reflects a change in ownership of real property. A Deed of Trust is an instrument that secures a debt to real property.

But a deed of trust adds a third party into the agreement: a trustee, an unbiased third party that holds the property's title while the loan is being repaid. This setup can make a big difference as to what happens if the borrower defaults.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

Deed vs mortgage? which is more important? A house deed and a mortgage are both important aspects of owning a home. However, when it comes to establishing home ownership, the deed is more important. When a person has their name on the deed, it means that they hold title to the property.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

A Security Affidavit is required on all Residential Deeds of Trust and Modifications. All Judgments, Orders, etc. must be certified by the DC Superior Court. All notarized documents must include the notary seal (if applicable), signature, name and expiration date.