District of Columbia Notice of Assignment — Sale or Transfer of Servicing Right— - Mortgage Loans is a legal document used in Washington, D.C., to inform borrowers of the sale or transfer of their mortgage loan servicing rights to another entity. This notice is an essential communication that keeps borrowers informed about potential changes in the management and servicing of their mortgage. When a lender sells or transfers the servicing rights of a mortgage loan, it means that the borrower's future interactions, such as payments, inquiries, and other servicing-related matters, will be handled by a new mortgage service. The District of Columbia Notice of Assignment provides vital details to ensure transparency and rights protection for both lenders and borrowers in these transactions. The notice typically contains key information such as the effective date of transfer, the name and contact information of the new mortgage service, the borrower's loan number, and the loan's current balance. It may also include instructions on how to address future payments (such as new payment addresses), how to submit inquiries or disputes, and the effective date when borrowers should start dealing directly with the new mortgage service. Different types of District of Columbia Notice of Assignment — Sale or Transfer of Servicing Right— - Mortgage Loans may include: 1. Notice of Assignment — Partial Servicing Rights Transfer: This type of notice is issued when only a part of the servicing rights for a mortgage loan is transferred to another entity. In this case, the borrower will be informed about who will be responsible for which aspects of loan servicing. 2. Notice of Assignment — Full Servicing Rights Transfer: This notice is issued when the entire servicing rights for a mortgage loan are transferred to another entity. The borrower will be notified that all future servicing interactions should be directed to the new mortgage service. 3. Notice of Assignment — Internal Transfer: This type of notice is issued when a lender internally transfers the servicing rights of a mortgage loan to another department or subsidiary within the same organization. Borrowers will be informed about the change and provided with the necessary contact information. In summary, the District of Columbia Notice of Assignment — Sale or Transfer of Servicing Right— - Mortgage Loans is a crucial document that ensures borrowers are aware of changes regarding the management and servicing of their mortgage loans. It aims to provide transparency, protect the rights of both lenders and borrowers, and ensure a smooth transition between services.

District of Columbia Notice of Assignment - Sale or Transfer of Servicing Rights - Mortgage Loans

Description

How to fill out District Of Columbia Notice Of Assignment - Sale Or Transfer Of Servicing Rights - Mortgage Loans?

Choosing the right legal file format might be a battle. Of course, there are plenty of web templates available on the net, but how can you find the legal develop you want? Take advantage of the US Legal Forms internet site. The service gives a large number of web templates, like the District of Columbia Notice of Assignment - Sale or Transfer of Servicing Rights - Mortgage Loans, which can be used for enterprise and personal requires. All of the types are checked out by specialists and meet federal and state demands.

In case you are already listed, log in to the accounts and then click the Obtain option to have the District of Columbia Notice of Assignment - Sale or Transfer of Servicing Rights - Mortgage Loans. Make use of accounts to look with the legal types you have bought previously. Proceed to the My Forms tab of your accounts and obtain another duplicate in the file you want.

In case you are a whole new consumer of US Legal Forms, listed here are easy instructions for you to stick to:

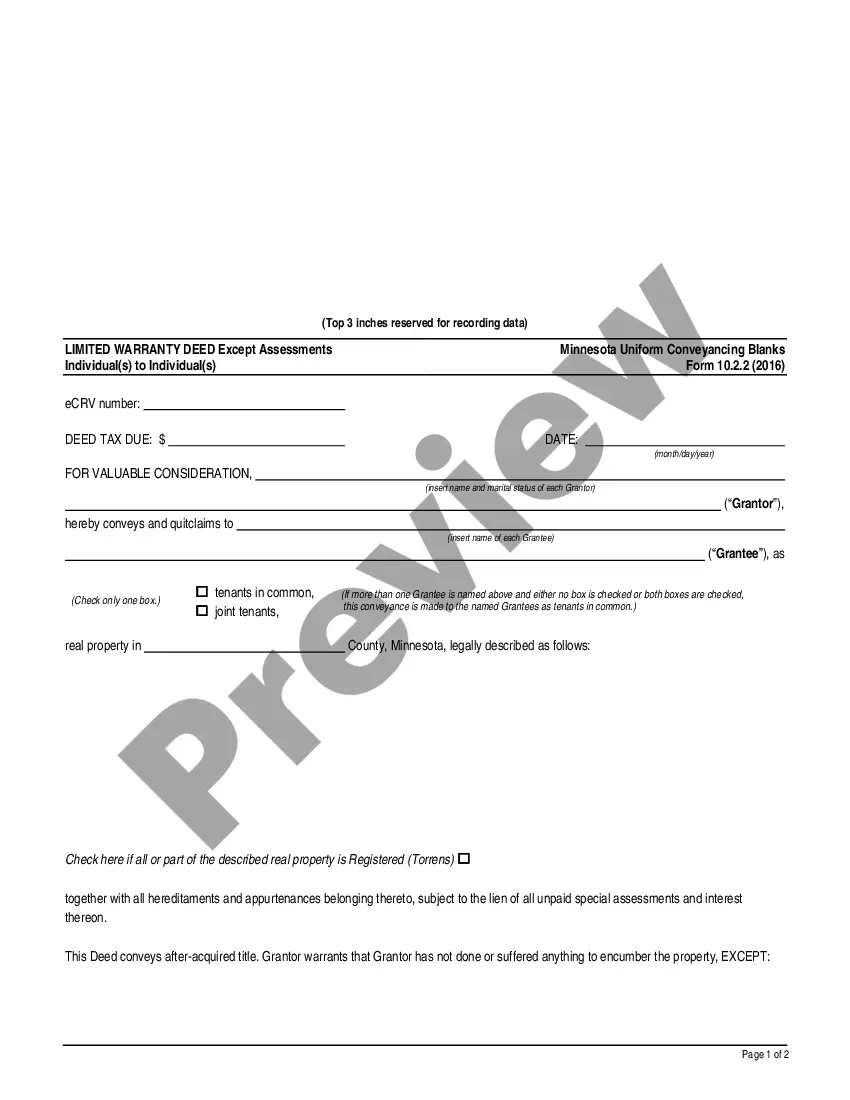

- Very first, be sure you have selected the correct develop for your city/area. You may look through the form while using Preview option and read the form outline to ensure this is basically the best for you.

- When the develop is not going to meet your requirements, make use of the Seach discipline to discover the right develop.

- When you are positive that the form is proper, click on the Purchase now option to have the develop.

- Opt for the pricing plan you would like and type in the required information and facts. Design your accounts and pay for an order with your PayPal accounts or Visa or Mastercard.

- Opt for the document formatting and down load the legal file format to the device.

- Complete, modify and print out and indicator the received District of Columbia Notice of Assignment - Sale or Transfer of Servicing Rights - Mortgage Loans.

US Legal Forms will be the greatest local library of legal types in which you can find various file web templates. Take advantage of the company to down load appropriately-created paperwork that stick to state demands.