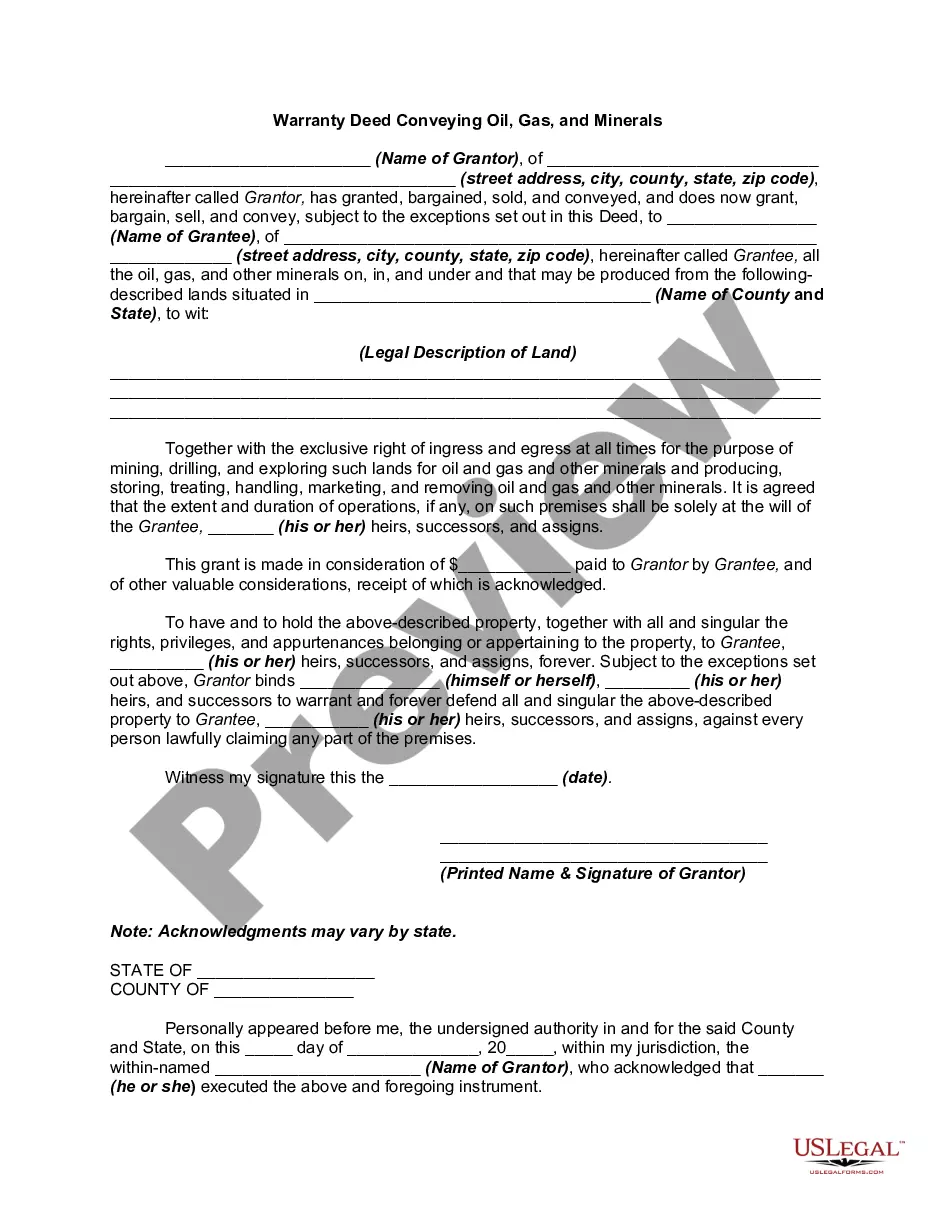

District of Columbia Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

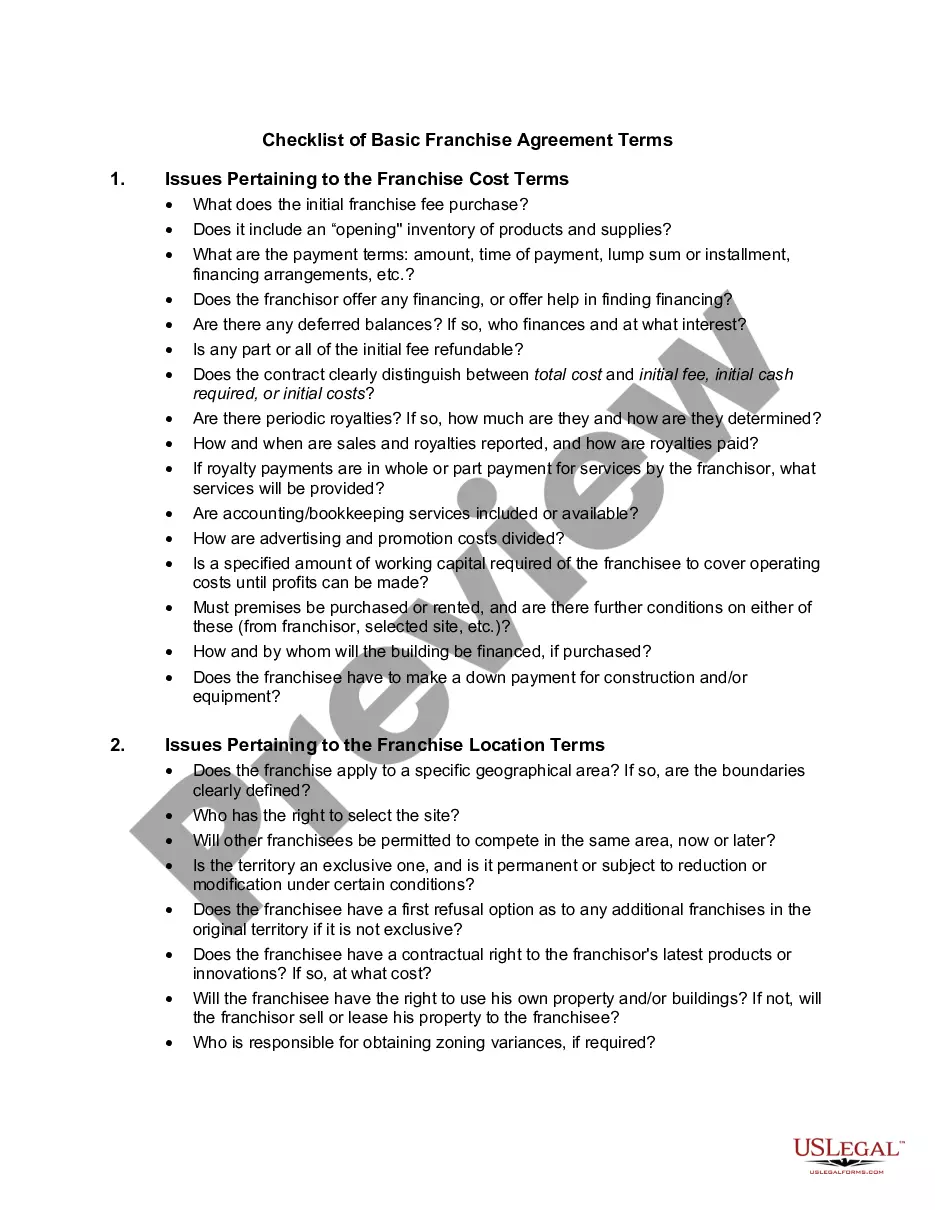

US Legal Forms - among the greatest libraries of legitimate forms in America - gives an array of legitimate papers layouts it is possible to download or produce. Utilizing the website, you can find thousands of forms for organization and personal purposes, categorized by types, suggests, or keywords.You can get the latest versions of forms such as the District of Columbia Gift Deed of Nonparticipating Royalty Interest with No Warranty in seconds.

If you currently have a subscription, log in and download District of Columbia Gift Deed of Nonparticipating Royalty Interest with No Warranty from the US Legal Forms library. The Obtain switch will show up on every develop you view. You have access to all earlier delivered electronically forms within the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, listed here are simple guidelines to help you started:

- Be sure you have chosen the best develop for the metropolis/state. Select the Preview switch to review the form`s articles. Browse the develop information to actually have chosen the right develop.

- In the event the develop doesn`t suit your specifications, make use of the Research area on top of the screen to get the one who does.

- Should you be happy with the shape, validate your selection by clicking the Get now switch. Then, pick the rates program you like and offer your credentials to register for the account.

- Process the transaction. Make use of charge card or PayPal account to perform the transaction.

- Pick the structure and download the shape on your device.

- Make alterations. Fill up, modify and produce and indicator the delivered electronically District of Columbia Gift Deed of Nonparticipating Royalty Interest with No Warranty.

Every format you included with your money does not have an expiration particular date which is your own property permanently. So, if you want to download or produce an additional copy, just go to the My Forms area and click on on the develop you need.

Gain access to the District of Columbia Gift Deed of Nonparticipating Royalty Interest with No Warranty with US Legal Forms, one of the most considerable library of legitimate papers layouts. Use thousands of expert and condition-certain layouts that meet your small business or personal requirements and specifications.

Form popularity

FAQ

You need to get a gift deed drafted by a lawyer then and then get that gift deed registered with the registrar or sub-registrar for making the gift deed valid and legal by paying the requisite stamp duty and registration charges.

Gift Deed. A grantor may make a gift of property to the grantee, and use a grant deed form or a quitclaim deed form for the purpose. Grantor may, but need not, say in the deed that grantor makes the transfer because of love and affection for the grantee.

Process for Gift Deed Registration Application: Fill information on LegalDocs website's gift deed form and create a draft. Stamp Duty Payment:Printing of the draft on stamp paper, calculating stamp duty and` signing of parties involved.

Both parties should mention all relevant information like address, name, date of birth and signature. A gift deed should have two witnesses and their signatures. A gift deed should be printed on stamp paper once the amount is paid. Once that is done, it should be registered at the registrar's or sub-registrar's office.

Stamp duty 2023 in Maharashtra on gift deed Conveyance deedStamp duty rateGift deed stamp duty Mumbai and other parts of Maharashtra3%Gift deed stamp duty for residential/agricultural property passed on to family membersRs 200Lease deed5%1 more row

The gift received is not taxable if the donee is a relative as defined in the income tax act, which includes a spouse, siblings, children, linear ascendants and descendants of the donee, etc.In case the shares are gifted to someone other than relatives as mentioned in the Income Tax Act, the same is tax-exempt if the ...

Good to know: Beware that a Gift Deed cannot be revoked. Once the property is given away, you cannot get it back unless the person who received it transfers it back.

Both parties should mention all relevant information like address, name, date of birth and signature. A gift deed should have two witnesses and their signatures. A gift deed should be printed on stamp paper once the amount is paid. Once that is done, it should be registered at the registrar's or sub-registrar's office.