District of Columbia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

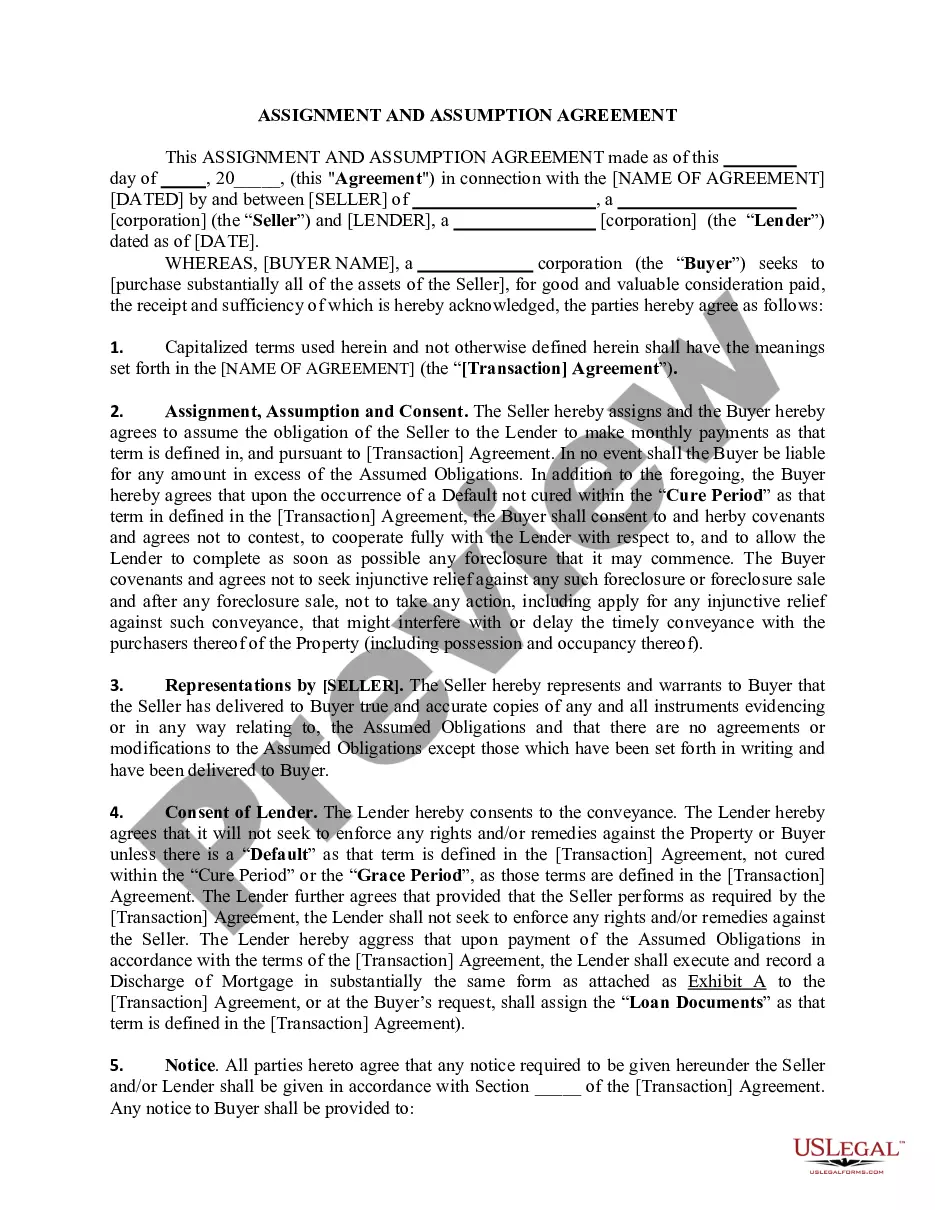

You may commit several hours online searching for the legal document web template that fits the state and federal demands you require. US Legal Forms supplies a large number of legal varieties that happen to be reviewed by professionals. You can easily obtain or printing the District of Columbia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits from our support.

If you already have a US Legal Forms profile, you are able to log in and click the Down load button. Next, you are able to complete, modify, printing, or indication the District of Columbia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits. Every legal document web template you get is the one you have forever. To acquire yet another copy of any bought type, proceed to the My Forms tab and click the related button.

If you are using the US Legal Forms internet site the very first time, follow the easy directions listed below:

- Very first, make sure that you have chosen the right document web template for the region/town of your liking. Look at the type description to make sure you have chosen the right type. If readily available, take advantage of the Review button to check throughout the document web template too.

- In order to get yet another model of the type, take advantage of the Research field to obtain the web template that suits you and demands.

- Once you have found the web template you desire, simply click Get now to move forward.

- Pick the costs program you desire, key in your qualifications, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal profile to cover the legal type.

- Pick the structure of the document and obtain it for your product.

- Make adjustments for your document if possible. You may complete, modify and indication and printing District of Columbia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

Down load and printing a large number of document themes utilizing the US Legal Forms Internet site, that provides the greatest collection of legal varieties. Use skilled and condition-certain themes to deal with your small business or specific needs.

Form popularity

FAQ

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.