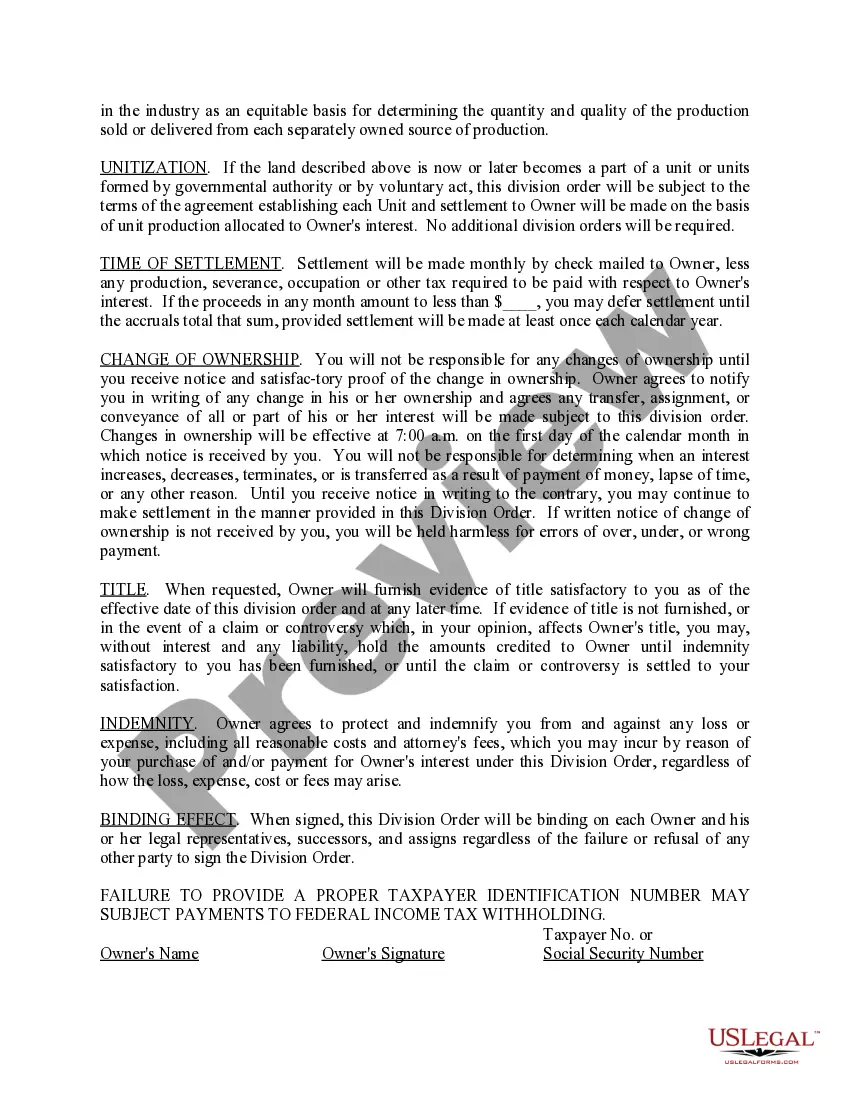

District of Columbia Oil and Gas Division Order

Description

How to fill out Oil And Gas Division Order?

US Legal Forms - among the largest libraries of lawful varieties in the United States - gives a variety of lawful papers layouts you may acquire or print out. Using the internet site, you can find a large number of varieties for business and personal purposes, sorted by categories, suggests, or keywords.You will find the most recent versions of varieties such as the District of Columbia Oil and Gas Division Order in seconds.

If you currently have a subscription, log in and acquire District of Columbia Oil and Gas Division Order in the US Legal Forms collection. The Acquire option will show up on every develop you see. You get access to all formerly downloaded varieties in the My Forms tab of your bank account.

If you want to use US Legal Forms initially, here are easy recommendations to obtain started:

- Ensure you have picked out the best develop to your town/state. Click the Preview option to review the form`s information. Look at the develop information to ensure that you have chosen the appropriate develop.

- In case the develop does not fit your demands, utilize the Lookup discipline at the top of the display to get the one which does.

- When you are satisfied with the shape, verify your selection by clicking the Acquire now option. Then, select the pricing program you like and supply your qualifications to sign up for the bank account.

- Approach the transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Select the format and acquire the shape on your own product.

- Make adjustments. Fill out, edit and print out and signal the downloaded District of Columbia Oil and Gas Division Order.

Every single template you put into your bank account lacks an expiration day and it is yours for a long time. So, if you would like acquire or print out an additional copy, just proceed to the My Forms segment and then click in the develop you require.

Gain access to the District of Columbia Oil and Gas Division Order with US Legal Forms, one of the most extensive collection of lawful papers layouts. Use a large number of expert and express-specific layouts that fulfill your business or personal needs and demands.

Form popularity

FAQ

On the MyTax.DC.gov homepage, locate the Business section. Click ?Register a New Business ? Form FR-500?. You will be navigated to our FR-500 New Business Registration Form.

Taxicab/Limo Drivers Any non resident taxicab/limo driver who operates a motor vehicle for hire in the District must file a Form D 30. The filing of the D 30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non resident.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income).

Form D-40 is used for the Tax Return and Tax Amendment. You can prepare a current Washington, D.C. Tax Amendment on eFile.com, however you cannot submit it electronically.

DC participates in the Modernized e-File program for Corporation (D-20 family), Unincorporated Business Franchise (D-30 family with an EIN only) tax returns and Partnership Return of Income (D-65). The term "federal/state" means that the DC return is transmitted with the federal return to the IRS.

DC Corporate Franchise Tax Overview A minimum tax of $250 applies for businesses with DC gross receipts of $1 million or less, and $1,000 for receipts exceeding the $1 million mark.

Personal Property Tax Form FP-31 may be filed online by signing up for a MyTax.DC.gov account. Form FP-31 Instructions are available and include information on exemptions, due dates, payment options, and penalties and interest. This helpful User Guide will walk you through the process of filling out Form FP-31.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income).