District of Columbia Partial Release of Mortgage / Deed of Trust For Landowner

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust For Landowner?

Finding the right legitimate papers design might be a struggle. Obviously, there are plenty of themes available on the net, but how do you find the legitimate type you will need? Take advantage of the US Legal Forms website. The service provides 1000s of themes, including the District of Columbia Partial Release of Mortgage / Deed of Trust For Landowner, that you can use for company and private demands. Every one of the types are inspected by pros and satisfy state and federal specifications.

When you are presently listed, log in to the account and click on the Download button to obtain the District of Columbia Partial Release of Mortgage / Deed of Trust For Landowner. Make use of your account to check through the legitimate types you might have bought earlier. Go to the My Forms tab of the account and obtain one more copy of your papers you will need.

When you are a whole new customer of US Legal Forms, listed below are basic recommendations so that you can stick to:

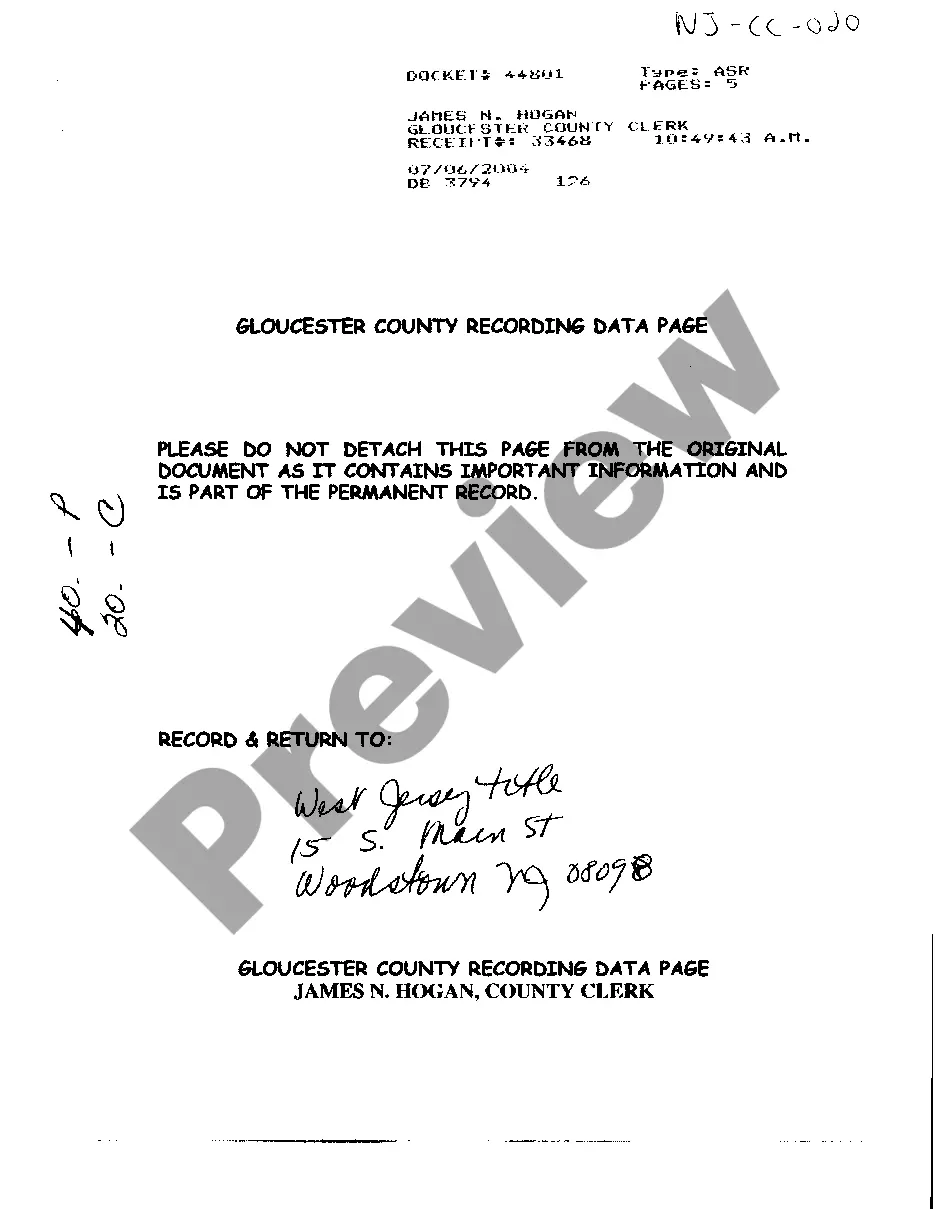

- Initial, make certain you have chosen the appropriate type to your town/region. You may examine the form utilizing the Preview button and browse the form description to guarantee it will be the right one for you.

- In the event the type fails to satisfy your needs, take advantage of the Seach field to find the right type.

- When you are positive that the form is acceptable, click the Buy now button to obtain the type.

- Select the rates program you want and enter in the needed details. Design your account and buy the transaction utilizing your PayPal account or bank card.

- Choose the document formatting and download the legitimate papers design to the device.

- Comprehensive, modify and print out and indicator the attained District of Columbia Partial Release of Mortgage / Deed of Trust For Landowner.

US Legal Forms is the greatest collection of legitimate types that you can see numerous papers themes. Take advantage of the service to download appropriately-created papers that stick to state specifications.

Form popularity

FAQ

A Security Affidavit is required on all Residential Deeds of Trust and Modifications. All Judgments, Orders, etc. must be certified by the DC Superior Court. All notarized documents must include the notary seal (if applicable), signature, name and expiration date.

Through a deed of release of mortgage, also called a release of deed of trust, the lender agrees to remove the deed of trust, which is the document containing all of the mortgage's terms and conditions that is filed at the beginning of the mortgage process.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

A release deed is a legal document that relinquishes all future claims or interests in a property. This document is commonly used when an individual wants to sell their interest in a property or when someone wants to gift their interest in a property to another person.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

You agree to pay a regular amount of money towards your debts and at the end of a fixed time the rest of your debts will be written off. All your belongings and property (your assets) are passed to someone who will look after your financial affairs. They are called your trustee.

The trust deed represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Ing to the Supreme Court of India, a release deed for a joint property rights transfer must comply with specific rules to be considered legal. It must be written on stamp paper, signed and witnessed, and registered with the sub registrar's office, making it a legal, binding instrument that cannot be revoked.