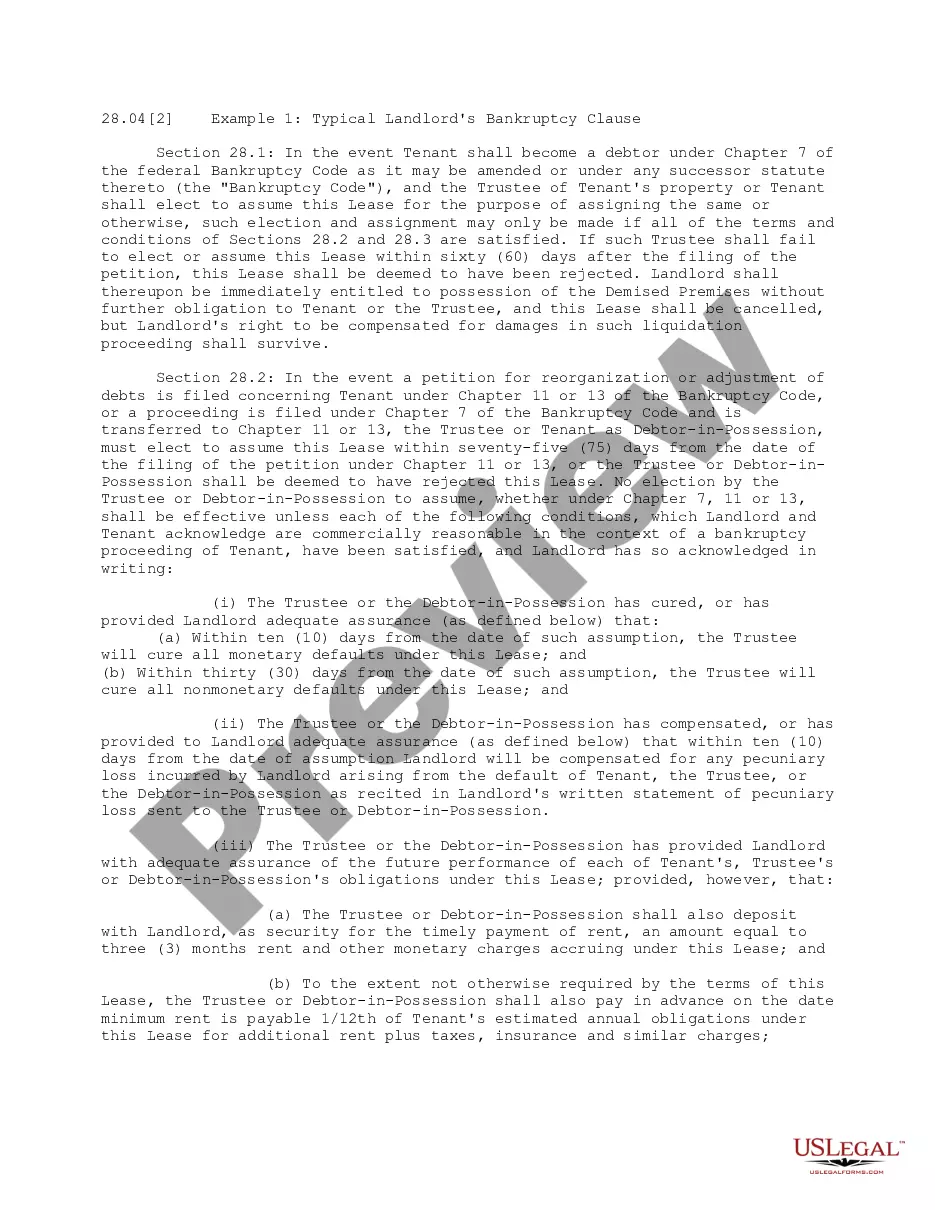

This office lease clause states that in the event the tenant becomes a debtor under Chapter 7 of the federal Bankruptcy Code and the Trustee of the tenant's property or the tenant elects to assume the lease for the purpose of assigning the same or otherwise, such election and assignment may only be made if all of the terms and conditions are satisfied. If such Trustee shall fail to elect or assume the lease within sixty (60) days after the filing of the petition, the lease shall be deemed to have been rejected.

District of Columbia Landlord Bankruptcy Clause

Description

How to fill out Landlord Bankruptcy Clause?

Choosing the best legal document web template can be quite a battle. Obviously, there are tons of templates available on the Internet, but how do you get the legal type you want? Make use of the US Legal Forms internet site. The assistance gives 1000s of templates, such as the District of Columbia Landlord Bankruptcy Clause, which can be used for business and private requirements. All the kinds are examined by experts and fulfill federal and state specifications.

In case you are already signed up, log in in your profile and then click the Obtain button to have the District of Columbia Landlord Bankruptcy Clause. Make use of your profile to check through the legal kinds you possess ordered previously. Visit the My Forms tab of your own profile and obtain one more copy from the document you want.

In case you are a new consumer of US Legal Forms, here are simple instructions so that you can adhere to:

- Very first, ensure you have chosen the appropriate type for the metropolis/county. You can look over the form making use of the Review button and browse the form description to make certain this is the best for you.

- When the type fails to fulfill your needs, take advantage of the Seach field to get the correct type.

- Once you are positive that the form is suitable, select the Acquire now button to have the type.

- Pick the rates plan you want and enter in the necessary info. Build your profile and buy an order with your PayPal profile or credit card.

- Select the file file format and download the legal document web template in your device.

- Comprehensive, change and produce and sign the acquired District of Columbia Landlord Bankruptcy Clause.

US Legal Forms is definitely the most significant catalogue of legal kinds that you can see different document templates. Make use of the service to download appropriately-produced documents that adhere to express specifications.

Form popularity

FAQ

Interference with police. Any willful interference with the Chief of Police, or with any member of the police force, by any of the persons named in § 5-117.01 [repealed], while in official and due discharge of duty, shall be punishable as a misdemeanor. (R.S., D.C., § 407.)

Personal Property D.C. bankruptcy exemptions include: Household furnishings, household goods, clothing, appliances, books, animals, or musical instruments not to exceed $425 per item or $8,625 in total. § 15?501. Up to $1,625 in professional books, or tools of your trade.

Specifically, Section 15-501(a)(14) of the DC Code (the ?Homestead Exemption?) provides that a DC resident's home is ?free and exempt? from ?attachment, levy or seizure and sale on execution or decree of any court in the District of Columbia?? in its entirety.

As a condition to appointment, a personal representative, whether in a supervised or unsupervised administration, shall file (a) a statement of acceptance of the duties of the office, (b) any required bond, and (c) a written consent to personal jurisdiction in any action brought in the District of Columbia against such ...

The Bankruptcy Means Test in District of Columbia helps you estimate whether you qualify for Chapter 7 bankruptcy. The first part of the means test is based on your income relative to those in District of Columbia and household size. The second part deals with your expenses.

(a) A mortgage, deed of trust, assignment for the benefit of creditors, or bill of sale upon exempted articles is not binding or valid unless it is signed by the spouse or domestic partner of a debtor who is living with his or her spouse or domestic partner.

§ 15?501. Exempt property of householder; property in transitu; debt for wages. (15) if the debtor is a notary public, the debtor's official seal, as defined in [§ 1-1231.01(11)], and official documents.