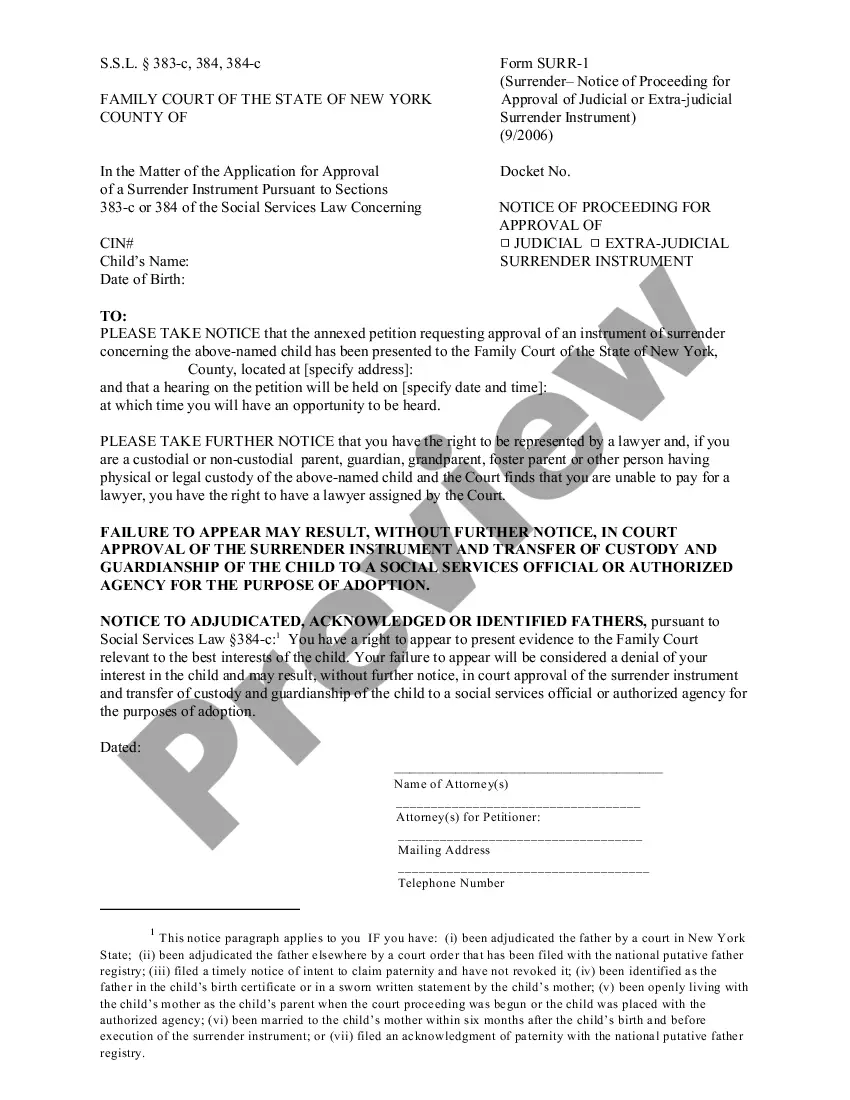

This office lease guaranty states that the guarantor's obligations under this guaranty shall be unaffected by any discharge or release of the tenant, its successors or assigns, or any of their debts, in connection with any bankruptcy, reorganization, or other insolvency proceeding or assignment for the benefit of creditors.

The District of Columbia Guarantor Waiver is a legal document that aims to protect the guarantor's financial responsibility in case the tenant is discharged, released, or declares bankruptcy. This waiver is essential for property owners and landlords who want to safeguard their rights and ensure that the guarantor remains liable for the terms of the lease agreement. Within the District of Columbia Guarantor Waiver, there are different types that cater to specific circumstances. Here are some notable variations: 1. Tenant Discharge Release Waiver: This provision pertains to situations where the tenant is discharged from their obligations due to certain conditions, such as fulfilling their lease term or meeting specific criteria outlined in the lease agreement. With this waiver, the guarantor remains responsible for any outstanding financial obligations, even if the tenant is no longer liable. 2. Tenant Bankruptcy Waiver: In the unfortunate event that the tenant declares bankruptcy, this waiver ensures that the guarantor's obligations remain intact. The bankruptcy filing does not release the guarantor from their responsibilities, allowing the property owner or landlord to seek payment for any outstanding rent, damages, or other lease-related charges. 3. Comprehensive Guarantor Waiver: This type of waiver combines provisions related to tenant discharge release and bankruptcy. It offers comprehensive protection to the property owner or landlord and prevents the guarantor from avoiding their financial responsibilities in either scenario. The District of Columbia Guarantor Waiver serves as a crucial safeguard in lease agreements, ensuring that the guarantor's liability remains unwavering. It is important for property owners and landlords to include this waiver in their contracts to secure their financial interests and reduce potential risks associated with tenant discharge releases or bankruptcies. By implementing the District of Columbia Guarantor Waiver effectively, property owners can gain peace of mind, knowing they have legal recourse and protection against potential financial losses resulting from tenant discharge releases or bankruptcy proceedings.District of Columbia Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy

Description

How to fill out District Of Columbia Guarantor Waiver Which Avoids Release Of Guarantor By Reason Of The Tenant Discharge Release Or Bankruptcy?

Are you currently within a placement the place you need to have documents for sometimes enterprise or personal uses virtually every working day? There are a lot of legitimate record templates available on the Internet, but getting types you can trust is not easy. US Legal Forms gives 1000s of develop templates, much like the District of Columbia Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy, that are written to satisfy federal and state demands.

When you are presently informed about US Legal Forms site and get a merchant account, just log in. Afterward, you can down load the District of Columbia Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy template.

Unless you have an accounts and need to begin using US Legal Forms, adopt these measures:

- Find the develop you will need and ensure it is to the right area/county.

- Take advantage of the Preview switch to analyze the shape.

- Browse the information to ensure that you have selected the proper develop.

- In case the develop is not what you are seeking, make use of the Lookup industry to obtain the develop that meets your needs and demands.

- Once you obtain the right develop, click Purchase now.

- Choose the pricing prepare you would like, submit the desired information and facts to make your account, and pay for an order using your PayPal or bank card.

- Select a convenient document structure and down load your backup.

Locate every one of the record templates you may have purchased in the My Forms food selection. You may get a additional backup of District of Columbia Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy anytime, if necessary. Just click the essential develop to down load or produce the record template.

Use US Legal Forms, one of the most substantial selection of legitimate kinds, in order to save efforts and prevent faults. The service gives skillfully produced legitimate record templates that can be used for a selection of uses. Make a merchant account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Ever since IBC was amended in 2019 to allow recovery from guarantors, promoters who provided personal guarantees objected to it (Section 95 to 100) claiming that the moratorium is imposed even before they are given a chance to present their arguments before the tribunal.

When a company goes under, it's common for someone who has signed a personal guarantee to wonder if there's a way to get out of it. However, unless the lender agrees to waive it (which would be unlikely), or some fundamental flaw exists in the agreement, the personal guarantee will remain binding.

Guaranties are commonly used by creditors to limit their risk by shifting the risk of loss in a transaction to a third party (the guarantor) who will agree to pay the obligations owed by the person or entity primarily liable for the debt (the principal obligor) if the principal obligor defaults on its obligations.

The guarantor waives all rights and defenses that the guarantor may have because the debtor's debt is secured by real property. This means, among other things: (1) The creditor may collect from the guarantor without first foreclosing on any real or personal property collateral pledged by the debtor.

A priority claim is a debt entitled to special treatment and will get paid before nonpriority claims. When filling out the proof of claim form, the creditor indicates whether a priority status exists by checking "yes" in box 12.

The person who gives the guarantee is called the "surety"; the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor". A guarantee may be either oral or written.