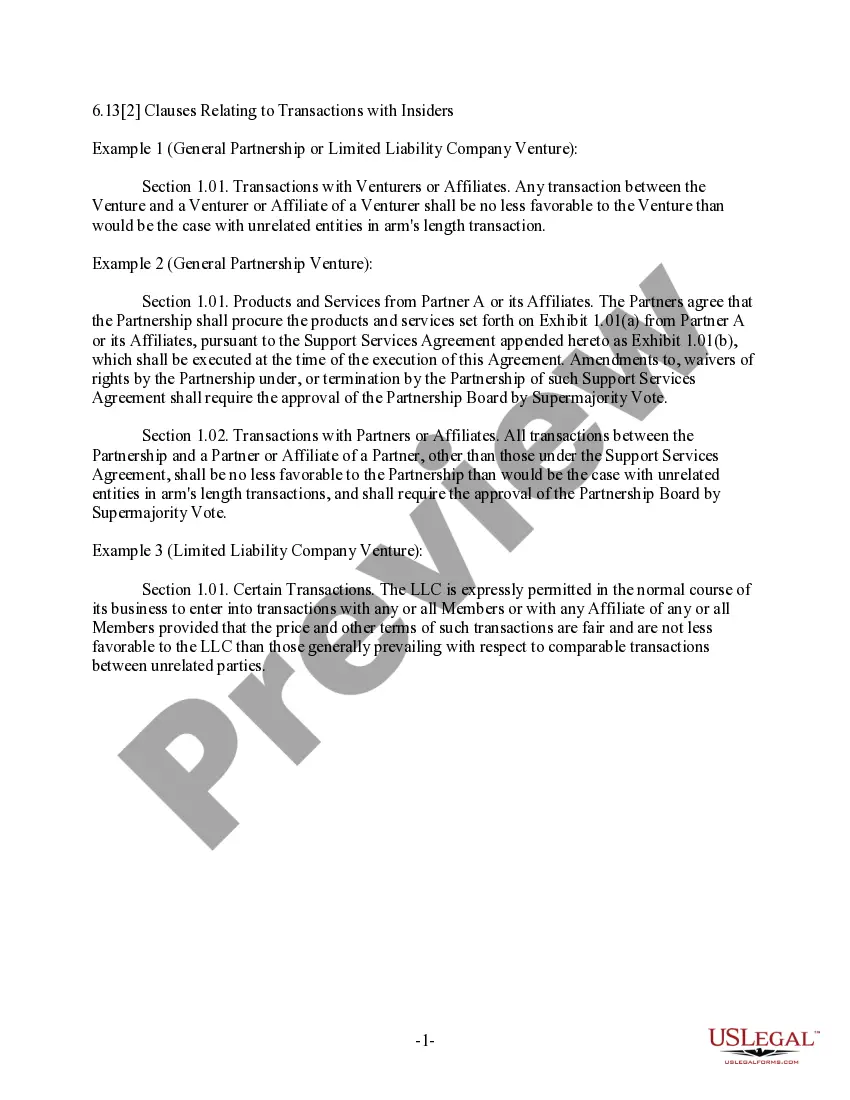

District of Columbia Clauses Relating to Transactions with Insiders

Description

How to fill out Clauses Relating To Transactions With Insiders?

Finding the right authorized document template can be a have a problem. Of course, there are tons of templates available on the Internet, but how would you discover the authorized kind you will need? Make use of the US Legal Forms internet site. The assistance gives thousands of templates, such as the District of Columbia Clauses Relating to Transactions with Insiders, that you can use for enterprise and private demands. All the types are checked out by specialists and meet federal and state requirements.

Should you be already registered, log in to your profile and click on the Acquire button to obtain the District of Columbia Clauses Relating to Transactions with Insiders. Utilize your profile to search through the authorized types you may have bought in the past. Go to the My Forms tab of the profile and get another backup of your document you will need.

Should you be a brand new user of US Legal Forms, listed below are basic guidelines that you can adhere to:

- Very first, be sure you have chosen the correct kind for your town/county. You may look over the shape while using Review button and read the shape explanation to make certain this is basically the right one for you.

- When the kind does not meet your expectations, make use of the Seach discipline to get the appropriate kind.

- Once you are certain the shape is proper, click on the Purchase now button to obtain the kind.

- Choose the costs plan you would like and type in the essential information. Build your profile and buy an order making use of your PayPal profile or credit card.

- Opt for the data file file format and down load the authorized document template to your system.

- Complete, revise and print and signal the acquired District of Columbia Clauses Relating to Transactions with Insiders.

US Legal Forms is definitely the greatest library of authorized types for which you can see numerous document templates. Make use of the company to down load skillfully-created files that adhere to status requirements.

Form popularity

FAQ

Ing to the SEC, a conviction for insider trading can result in: Fines of up to $5 million. Imprisonment of up to 20 years. Being banned from serving as an officer or director of a public company.

No Insider may give trading advice of any kind about the Company to anyone, whether or not such Insider is aware of material nonpublic information about the Company. No Insider may trade in any interest or position relating to the future price of Company Securities, such as a put, call or short sale.

On December 14, 2022, the Securities and Exchange Commission (the ?Commission?) adopted amendments to Rule 10b5-1 under the Securities Exchange Act of 1934 (the ?Exchange Act?), which provides affirmative defenses to trading on the basis of material nonpublic information in insider trading cases.

Market surveillance activities: This is one of the most important ways of identifying insider trading. The SEC uses sophisticated tools to detect illegal insider trading, especially around the time of important events such as earnings reports and key corporate developments.

Insider trading by a designated person or their close associates is forbidden at all times. ing to SEBI laws, a Designated Person who buys or sells any number of the company's stocks may not engage in a contrary transaction within 6 months of the date.

A bank is prohibited from extending credit to insiders unless the extension of credit is made on substantially the same terms (including interest rates and collateral) as, and following underwriting procedures that are not less stringent than, those prevailing at the time for comparable transactions by the bank with ...

SEC Rule 10b-5 prohibits corporate officers and directors or other insider employees from using confidential corporate information to reap a profit (or avoid a loss) by trading in the Company's stock. This rule also prohibits ?tipping? of confidential corporate information to third parties. Who is an insider?

In most cases, when an insider executes a transaction, he or she must file a Form 4. With this form filing, the public is made aware of the insider's various transactions in company securities, including the amount purchased or sold and the price per share.