District of Columbia Letter regarding Collecting Damages in Automobile Accident

Description

How to fill out Letter Regarding Collecting Damages In Automobile Accident?

You can spend hours on-line searching for the legitimate document design that meets the federal and state needs you need. US Legal Forms supplies a large number of legitimate types which can be reviewed by pros. You can actually down load or printing the District of Columbia Letter regarding Collecting Damages in Automobile Accident from the support.

If you have a US Legal Forms accounts, you may log in and click on the Download button. After that, you may complete, modify, printing, or signal the District of Columbia Letter regarding Collecting Damages in Automobile Accident. Every legitimate document design you buy is your own property permanently. To get yet another version for any acquired kind, visit the My Forms tab and click on the related button.

If you are using the US Legal Forms website the very first time, follow the easy recommendations listed below:

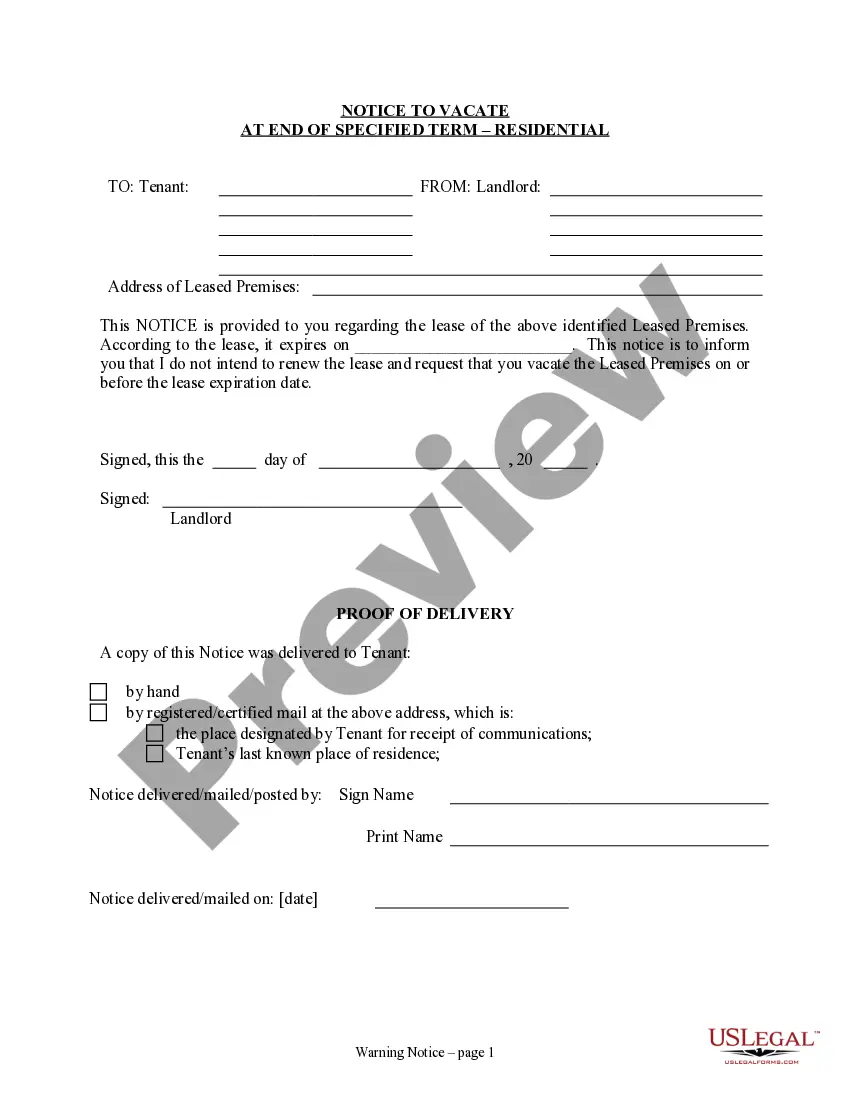

- Very first, ensure that you have selected the right document design for the county/town of your choosing. Look at the kind description to make sure you have chosen the proper kind. If readily available, utilize the Review button to look through the document design at the same time.

- If you want to locate yet another version in the kind, utilize the Search discipline to obtain the design that meets your needs and needs.

- Once you have discovered the design you need, simply click Get now to move forward.

- Select the rates program you need, enter your references, and sign up for your account on US Legal Forms.

- Full the transaction. You can use your bank card or PayPal accounts to purchase the legitimate kind.

- Select the formatting in the document and down load it in your device.

- Make alterations in your document if needed. You can complete, modify and signal and printing District of Columbia Letter regarding Collecting Damages in Automobile Accident.

Download and printing a large number of document layouts while using US Legal Forms Internet site, that provides the biggest collection of legitimate types. Use skilled and status-specific layouts to tackle your small business or specific requirements.

Form popularity

FAQ

Things an Effective Car Accident Demand Letter Should Contain The date and time of the crash. A description of all sustained damages. A statement or fault or discussion about liability. Deadline to respond. The exact compensation amount you want. A breakdown of the expenses incurred due to the accident.

6 Tips for Preparing for a Personal Injury Lawsuit Tip #1: Speak to a Lawyer Immediately. ... Tip #2: Head to Your Doctor for Evaluation and Treatment. ... Tip #3: Collect All Evidence. ... Tip #4: Do Not Talk About Your Injuries or Case on Social Media. ... Tip #5: Know When to Take a Settlement. ... Tip #6: Stay in Touch with Your Attorney.

Your lawyers will assess the value of the claim in terms of compensation based on the medical evidence it obtains and should then be able to inform you of how much you can expect to receive if the claim is successful.

I hereby make demand of $565,759.60 for my injuries, loss, pain and suffering which were in direct correlation with the accident your insured has caused. Please respond back to this demand letter no later than 30 days from the postmarked date. Thank you in advance for your time and consideration of the above claim.

Describe all your injuries, both physical and emotional, and all the treatments you've received. And don't be shy. Emphasize your pain, the length and difficulty of your recovery, and any negative effects your injuries have had on your daily life (such as "pain and suffering," and your "emotional distress").

The pain multiplier approach: This method determines pain and suffering damages by multiplying actual economic damages like medical expenses by a set number (the multiplier). The multiplier is usually between 1.5 and 5, with a higher multiplier for more serious injuries.

It should contain a clear summary of the facts, and an indication of the injuries suffered, and of any financial loss incurred. In particular, it should provide the following information: Details about how the accident occurred. The date and time of the accident or incident.

What to Include in Your Demand Letter for Property Damage Add as many details about how the property got damaged. ... Make sure to include exactly what you are demanding payment for. ... Include how you would like to receive payment.