You can devote hours online attempting to find the lawful document format that fits the federal and state demands you want. US Legal Forms supplies a huge number of lawful varieties that are examined by experts. You can actually download or print the District of Columbia Personal Property Inventory Questionnaire from your services.

If you already have a US Legal Forms bank account, you may log in and then click the Obtain key. Afterward, you may full, revise, print, or indication the District of Columbia Personal Property Inventory Questionnaire. Each lawful document format you purchase is your own property forever. To obtain yet another version of the obtained develop, proceed to the My Forms tab and then click the corresponding key.

If you use the US Legal Forms website initially, keep to the basic directions listed below:

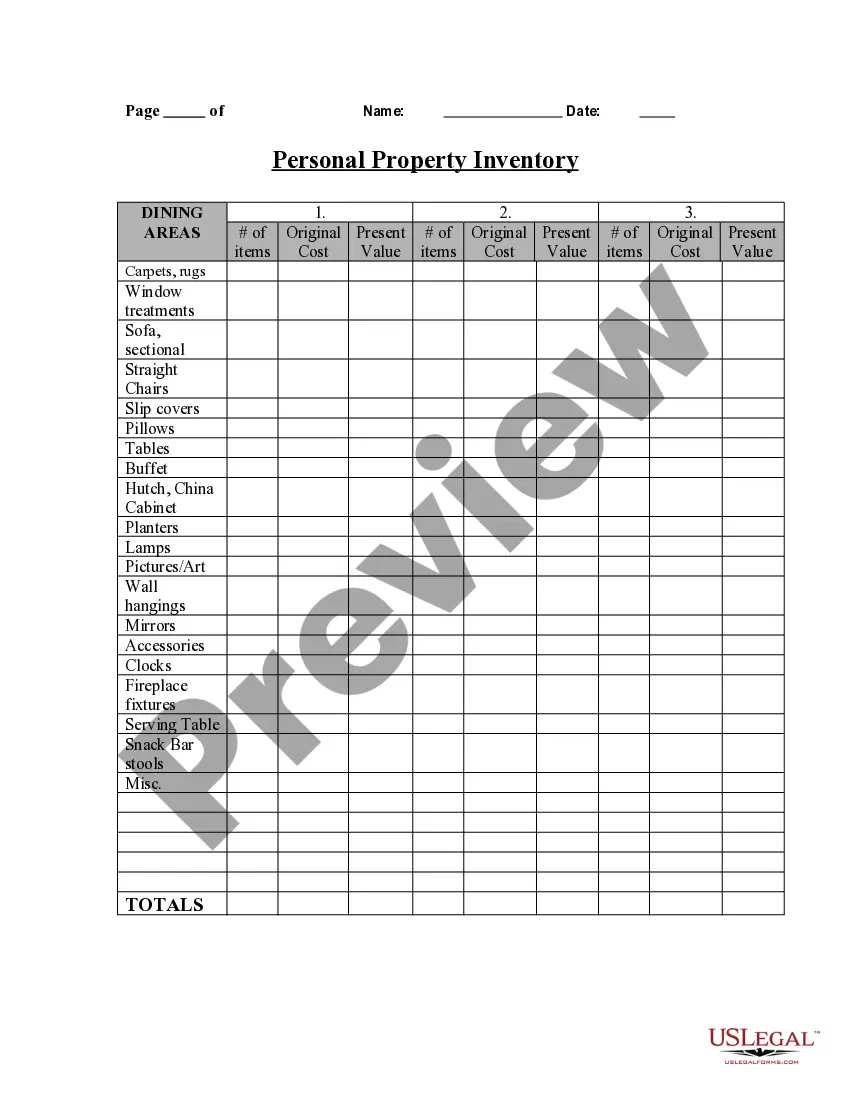

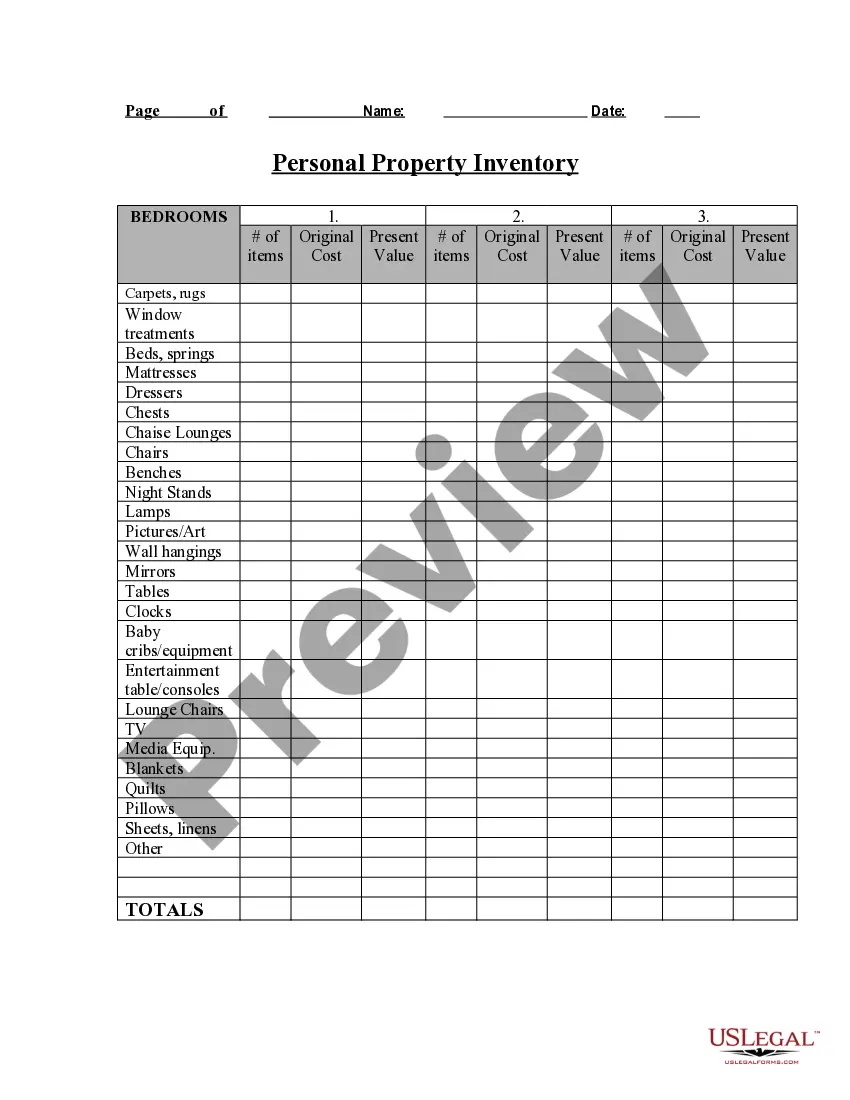

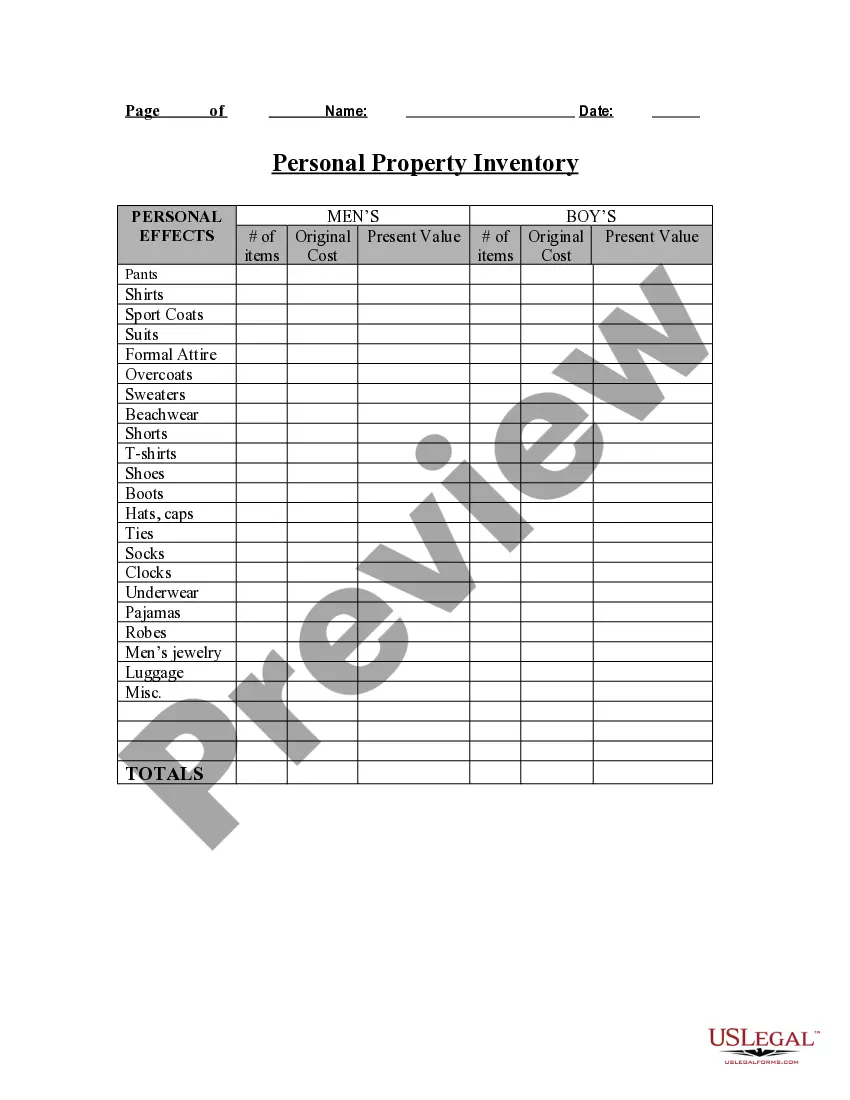

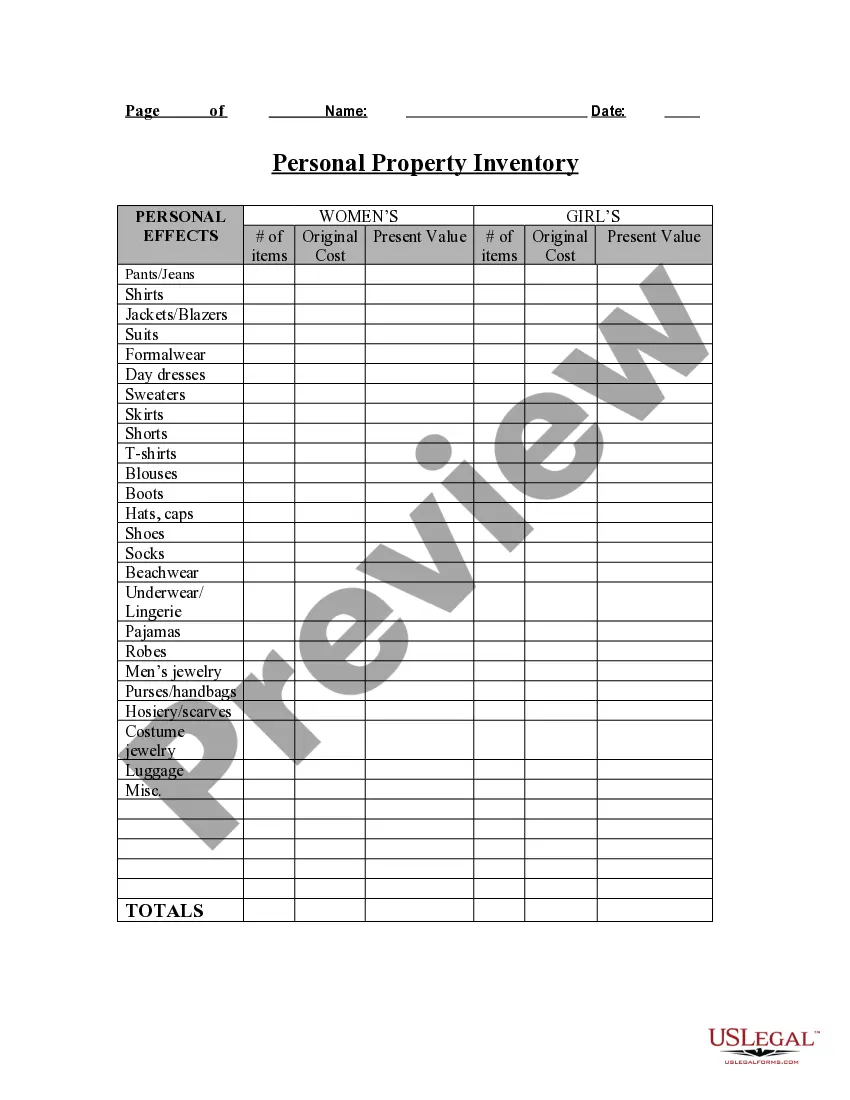

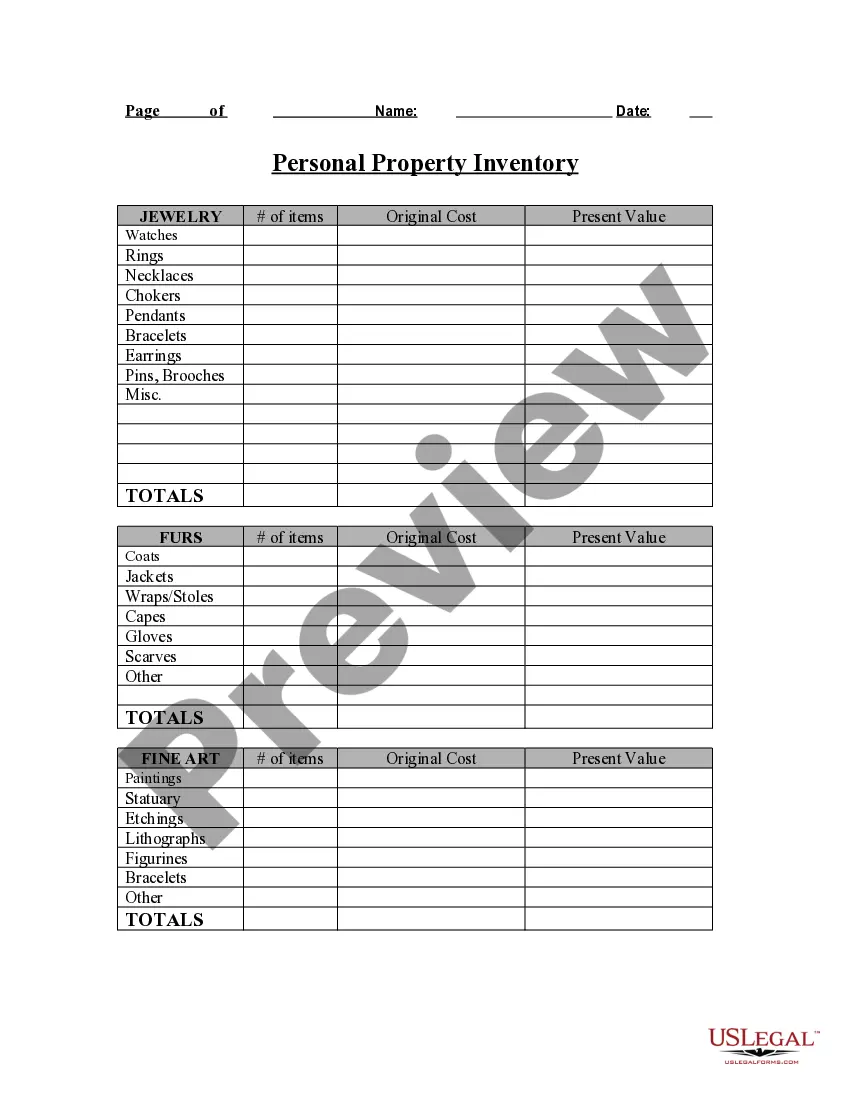

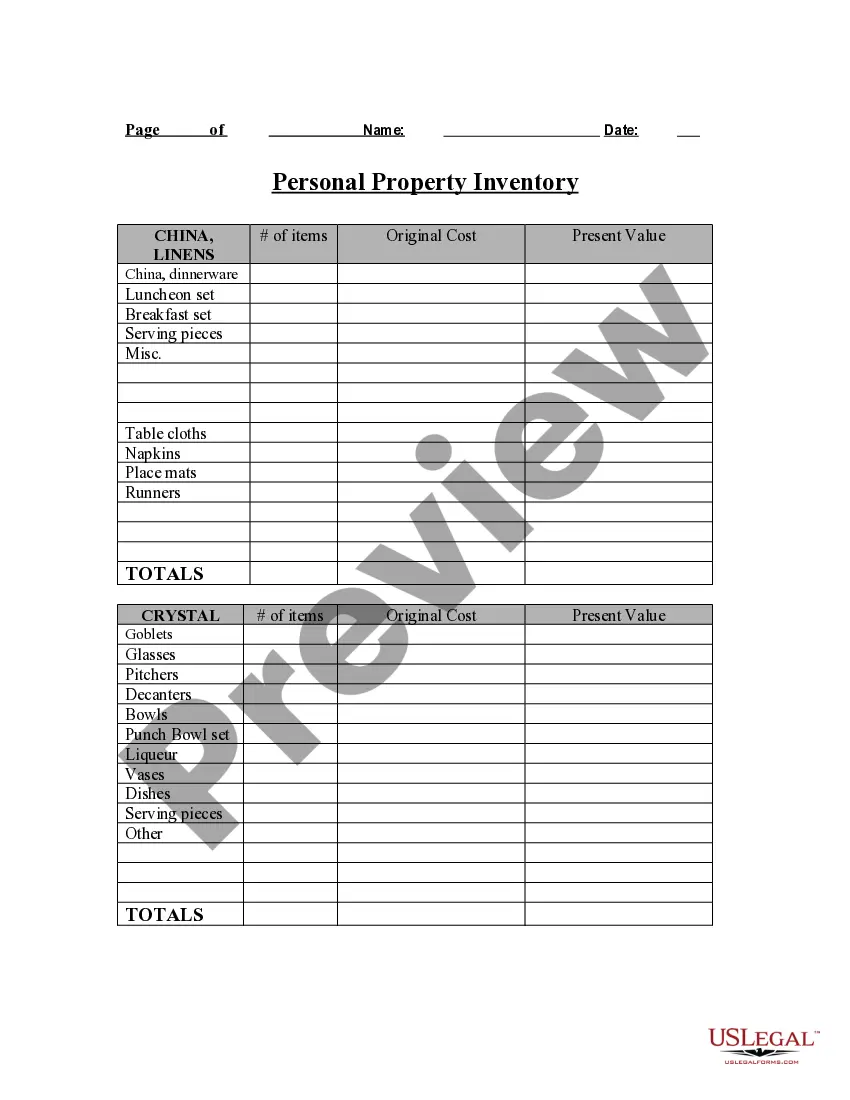

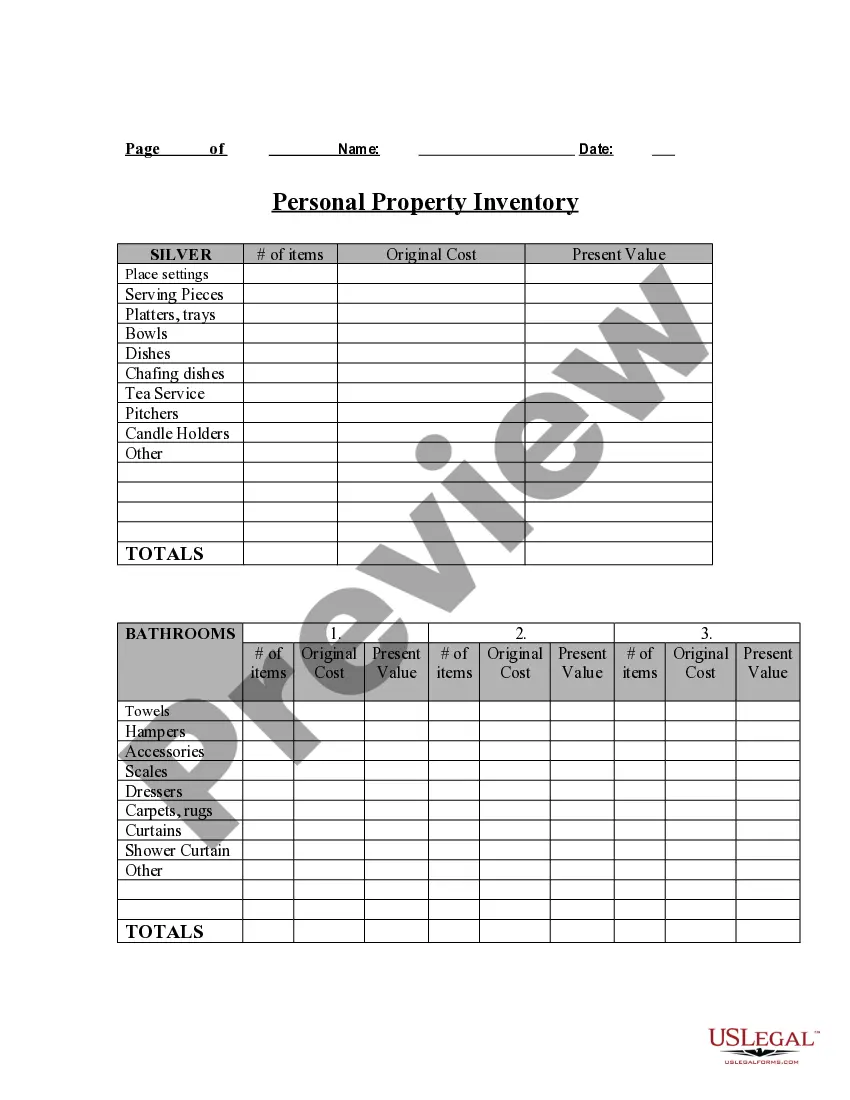

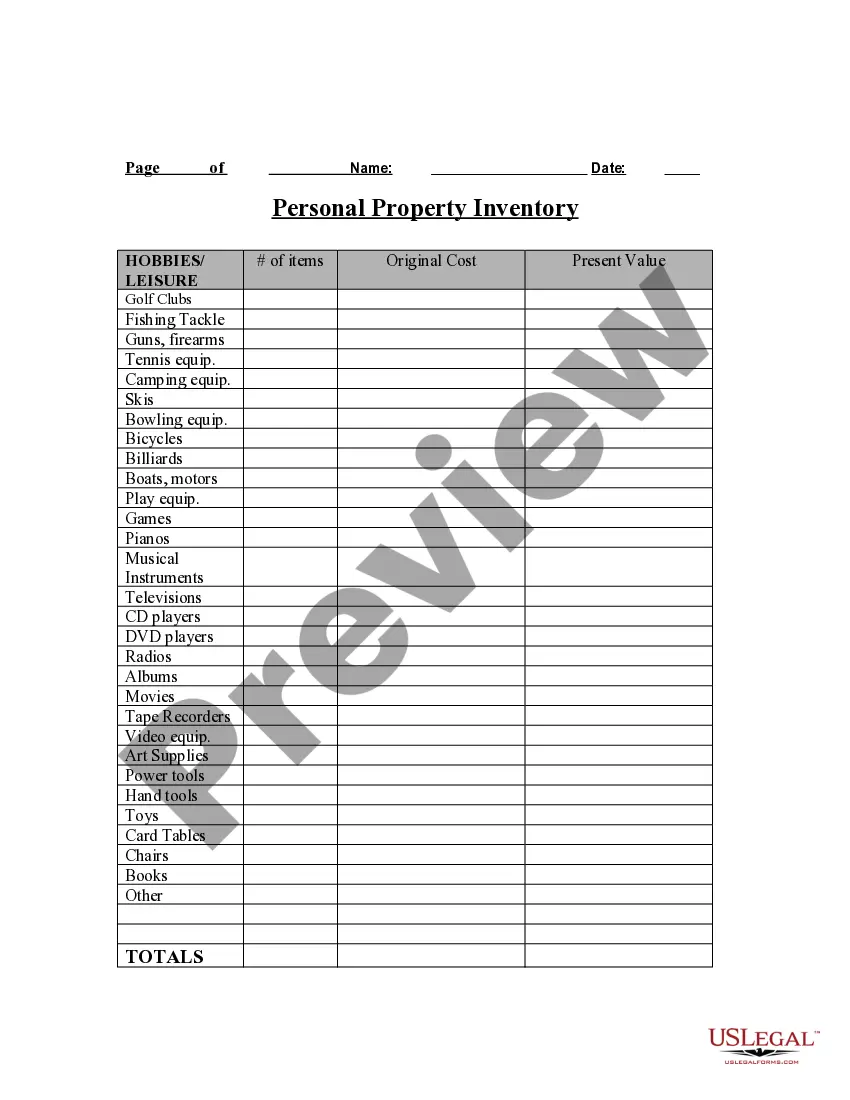

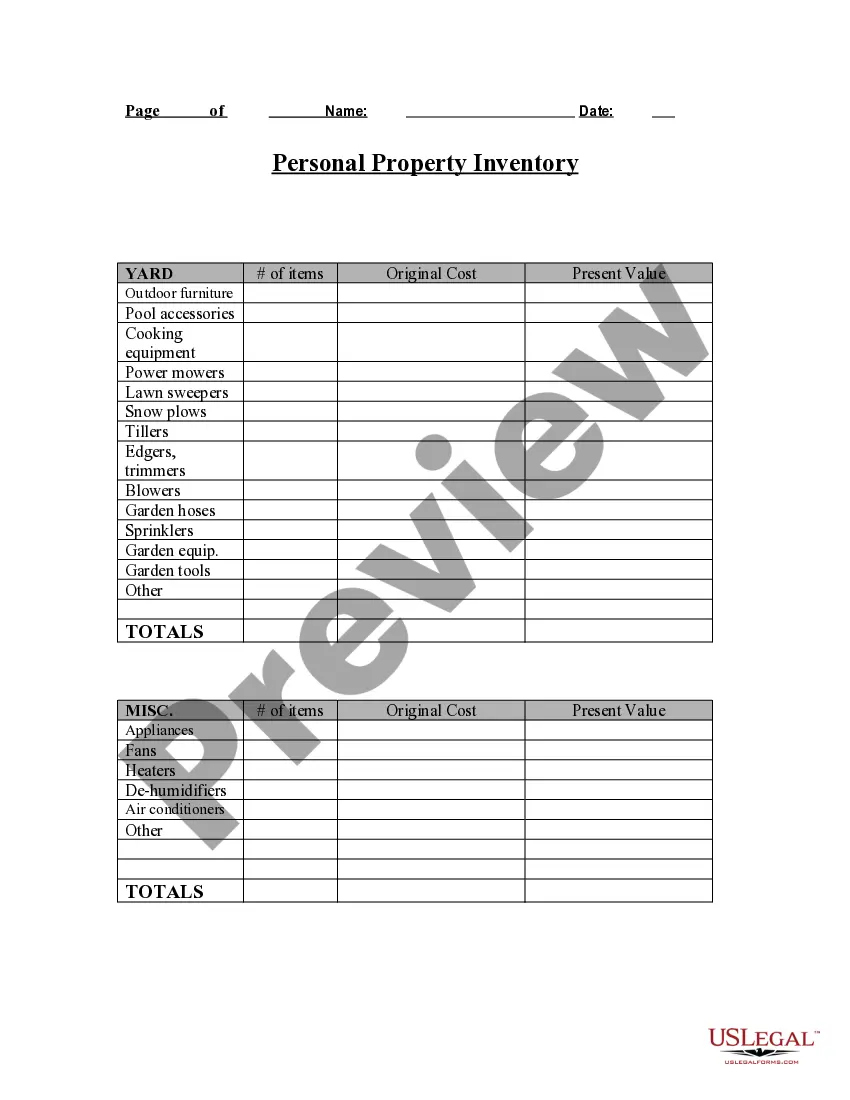

- First, ensure that you have selected the proper document format for that region/area of your liking. Read the develop outline to ensure you have picked out the proper develop. If available, use the Review key to check from the document format also.

- If you would like discover yet another model from the develop, use the Research industry to find the format that meets your requirements and demands.

- Once you have identified the format you want, just click Acquire now to carry on.

- Find the pricing plan you want, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal bank account to cover the lawful develop.

- Find the file format from the document and download it to your gadget.

- Make alterations to your document if necessary. You can full, revise and indication and print District of Columbia Personal Property Inventory Questionnaire.

Obtain and print a huge number of document layouts making use of the US Legal Forms Internet site, that provides the most important selection of lawful varieties. Use skilled and condition-certain layouts to tackle your company or individual demands.

An inventory is a list of all of the probate assets, including aFor more questions about inventories and accounts with respect to DC probates, call and ... What is Business Personal Property? All businesses, churches, and not-for-profit organizations must file business tangible personal property forms with the ...Modeling the D.C. Economy, Revenues, and Debt Service Obligations · Read more. Topics: Budget, Revenue, and Spending , Revenue or Reserve Certification ... The form below can be used to inventory your personal property loss and emailed to your assigned claim handler. Click your state to download the form. Complete ... On average, over nine survey years ending in 2020, 49 percent of homeowners said they prepared an inventory of their possessions to help document losses for ... You may complete the Personal Property Return for the current tax year byFailure to file the Survey by April 30 of the current year may result in an ... Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. In addition to the state-funded incentives on DSIRE and below, DC has enabled Property Assessed Clean Energy (PACE) financing and has one active program. This section is for you to report the inventory (raw materials, work in process, finished goods or supplies) or merchandise your business carries from the ... Write ?2002 Personal Property Tax? and your FEIN (or SSN) in the lower left corner of your check or money order. Who Must File a Return. A District of Columbia ...3 pagesMissing: Inventory ? Must include: Inventory

Write ?2002 Personal Property Tax? and your FEIN (or SSN) in the lower left corner of your check or money order. Who Must File a Return. A District of Columbia ...