The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

District of Columbia Nonemployee Director Stock Option Plan

Description

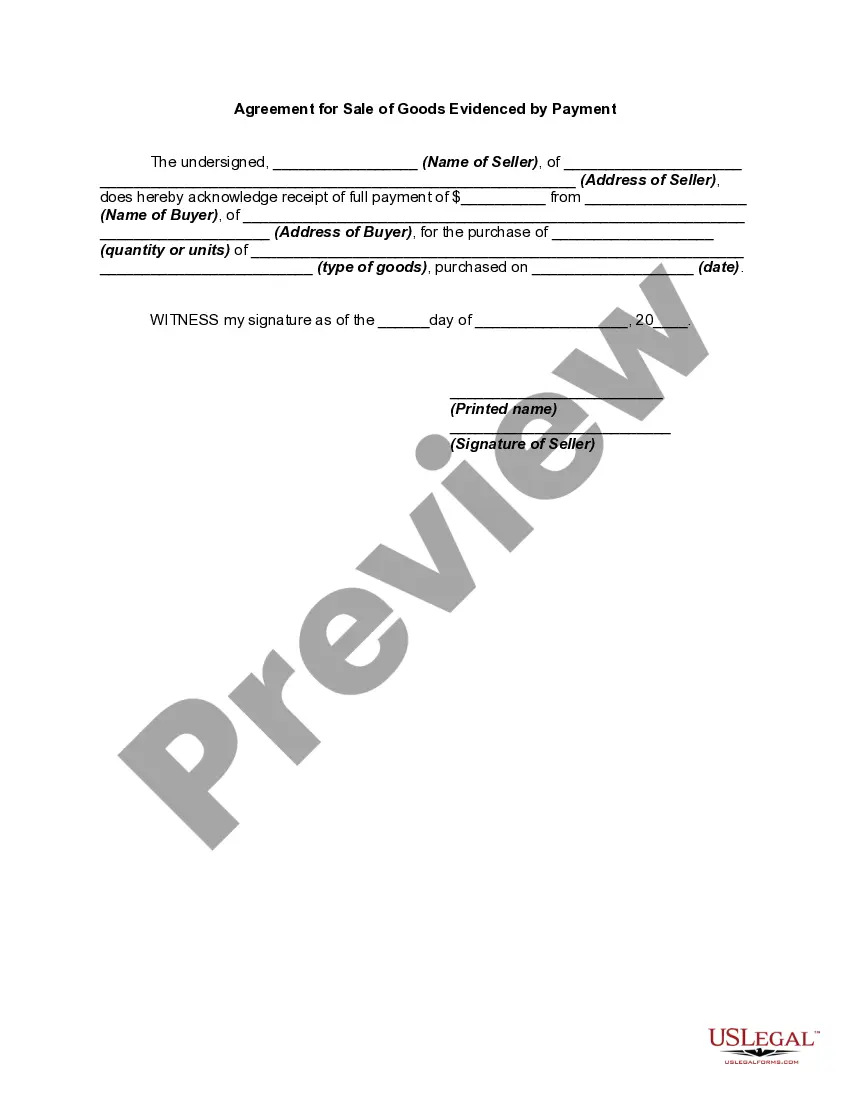

How to fill out Nonemployee Director Stock Option Plan?

US Legal Forms - among the greatest libraries of lawful varieties in the States - offers an array of lawful document layouts you may acquire or print. Utilizing the site, you may get thousands of varieties for business and individual reasons, categorized by classes, states, or keywords and phrases.You can find the newest variations of varieties just like the District of Columbia Nonemployee Director Stock Option Plan within minutes.

If you currently have a monthly subscription, log in and acquire District of Columbia Nonemployee Director Stock Option Plan through the US Legal Forms collection. The Download button will appear on each and every type you look at. You get access to all previously downloaded varieties inside the My Forms tab of your bank account.

If you want to use US Legal Forms the first time, allow me to share basic recommendations to get you started out:

- Be sure you have picked the best type to your area/county. Click on the Preview button to analyze the form`s content material. Browse the type outline to ensure that you have selected the right type.

- When the type does not fit your requirements, use the Search area near the top of the monitor to obtain the one which does.

- If you are pleased with the shape, affirm your decision by visiting the Buy now button. Then, pick the pricing program you want and offer your qualifications to sign up on an bank account.

- Method the deal. Make use of charge card or PayPal bank account to perform the deal.

- Pick the format and acquire the shape in your system.

- Make changes. Complete, revise and print and signal the downloaded District of Columbia Nonemployee Director Stock Option Plan.

Every format you added to your account lacks an expiry day which is yours for a long time. So, if you wish to acquire or print an additional backup, just check out the My Forms section and then click around the type you want.

Gain access to the District of Columbia Nonemployee Director Stock Option Plan with US Legal Forms, by far the most comprehensive collection of lawful document layouts. Use thousands of specialist and status-particular layouts that meet your business or individual demands and requirements.

Form popularity

FAQ

Directors of a corporation - members of the governing board - are defined by statute as non-employees.

For stock options not issued pursuant to section 422 (?nonqualified options?), there are four basic requirements that must be met to be exempt under section 409A, as follows: For nonqualified stock options, the exercise price must be at least equal to the fair market value of the underlying shares as of the grant date.

Non-qualified stock options offer workers, whether independent contractors or regular employees, the right to obtain a certain amount of the company shares for a set price. Employers tend to offer NSOs as an alternative type of compensation, to make sure they remain loyal and work for the company's best interests.

An employee director is a member of the team who is nominated, by the employees, to sit on the company board of directors to act as a focal point for the employees.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

?NON-EMPLOYEE DIRECTOR? means a member of the Board who is not an employee of the Company or any of its Subsidiaries. ?OPTION? means an option to purchase Shares awarded to a Non-Employee Director under the Plan.

This board member isn't a company employee, which means they don't engage in the day-to-day management of the organization. Rather, most non-executive directors act as independent advisors and are involved in policymaking and planning exercises.

In general, directors who have a service agreement, or employment contract, will be classed as employees. But Non-Executive Directors or NEDs ? who often act in more of an advisory or mentorship role ? may not intend to have any employment relationship with the company.