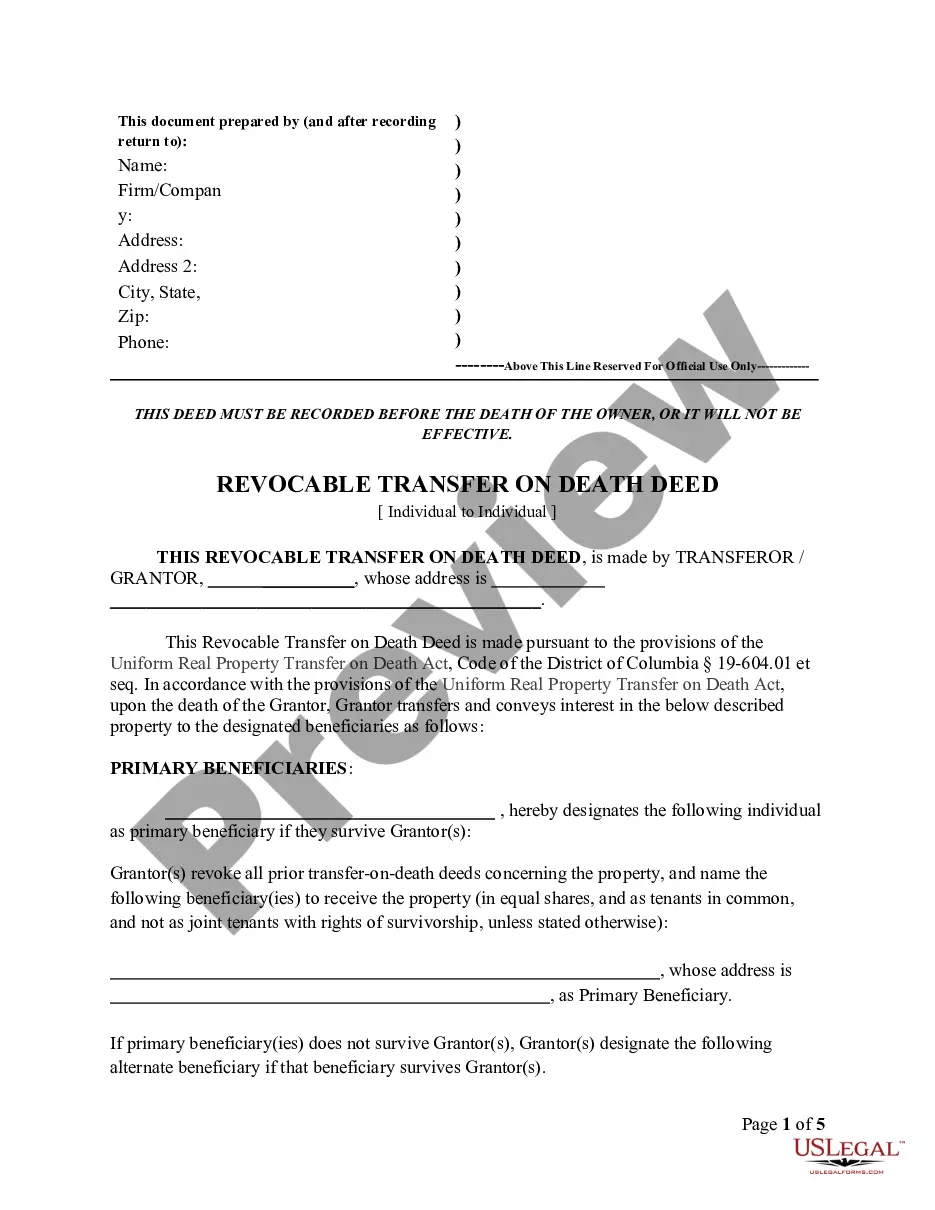

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description Tod Deed Form District Of Columbia

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Use US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and offers reasonably priced and accurate samples for customers and lawyers, and SMBs. The templates are grouped into state-based categories and a number of them might be previewed before being downloaded.

To download samples, users must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual:

- Check out to make sure you have the right form in relation to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. More than three million users have utilized our service successfully. Select your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

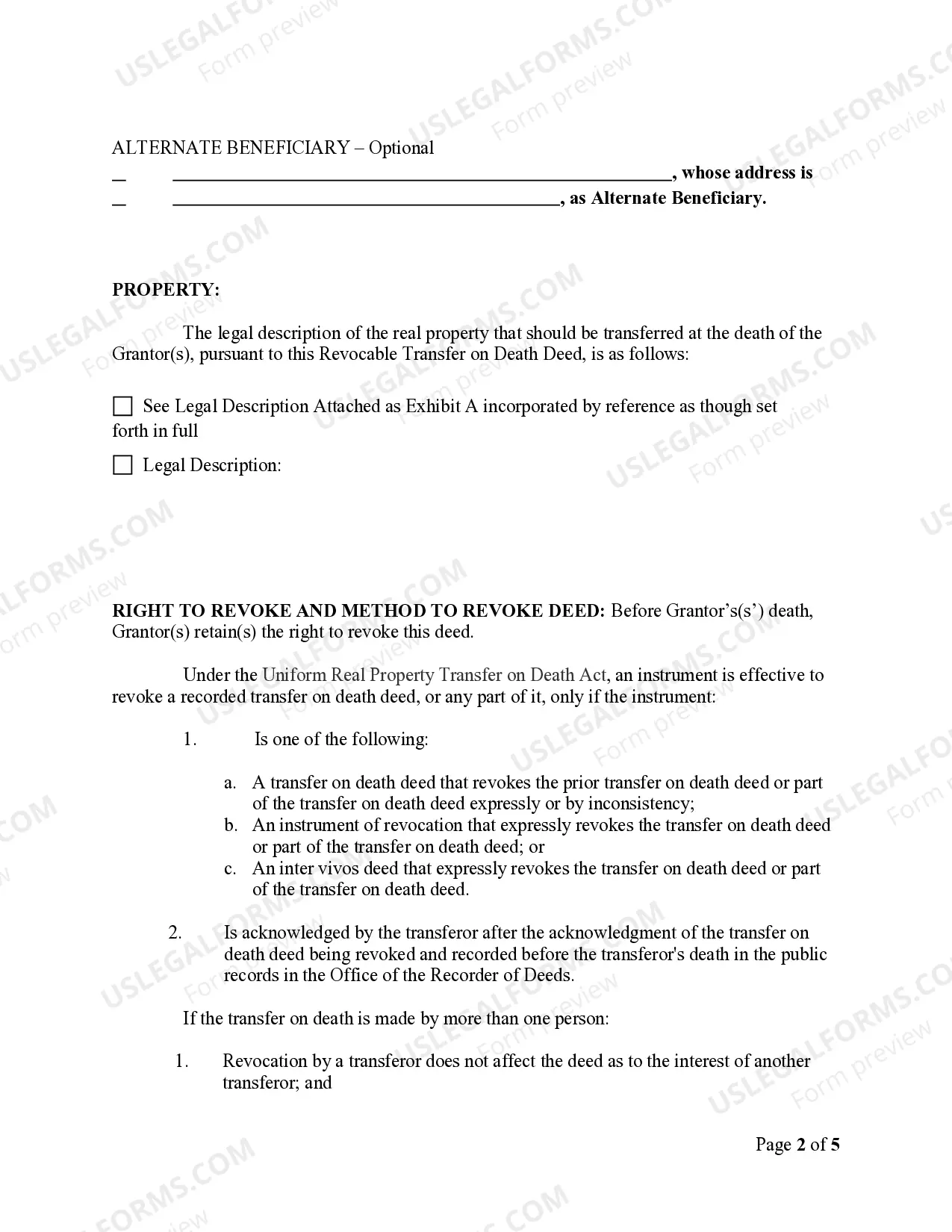

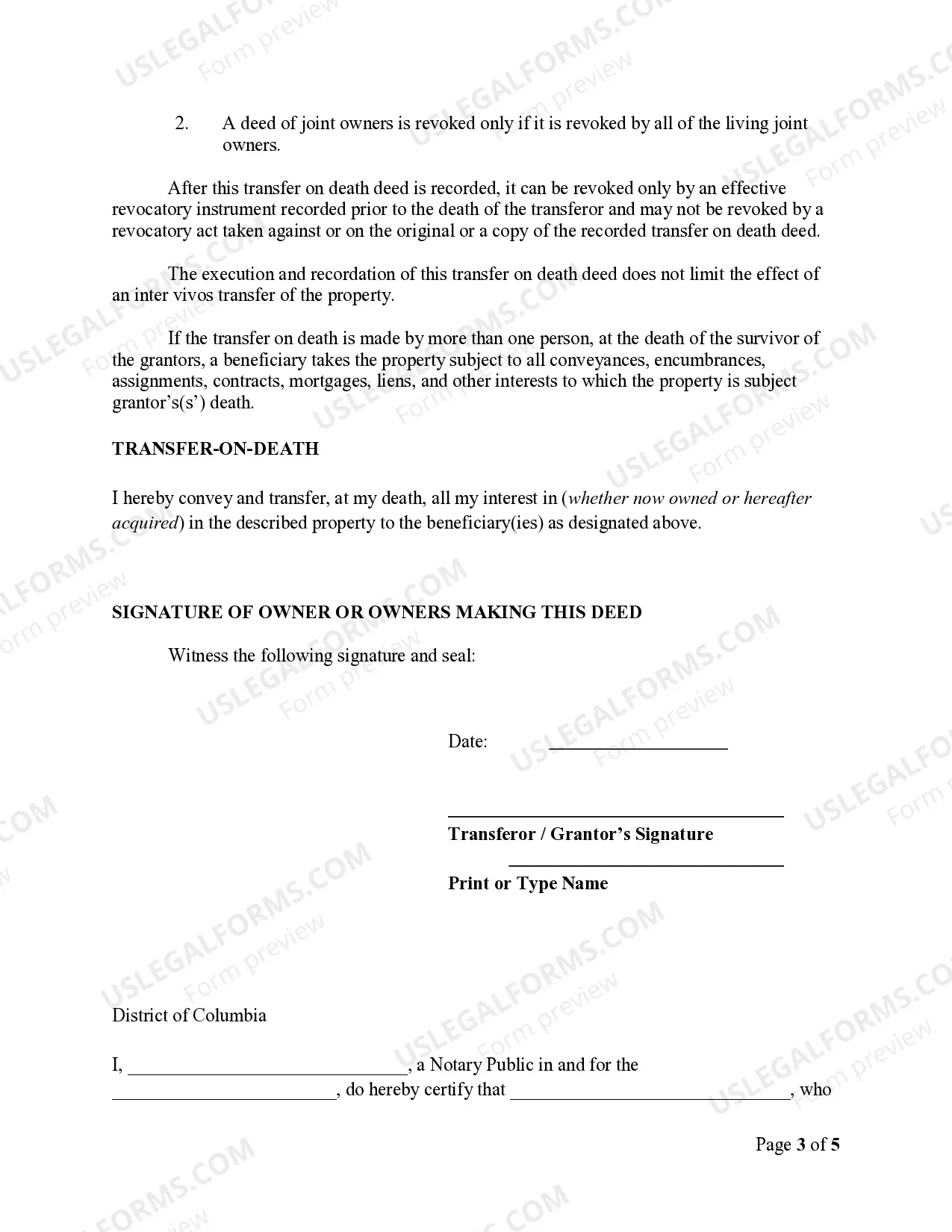

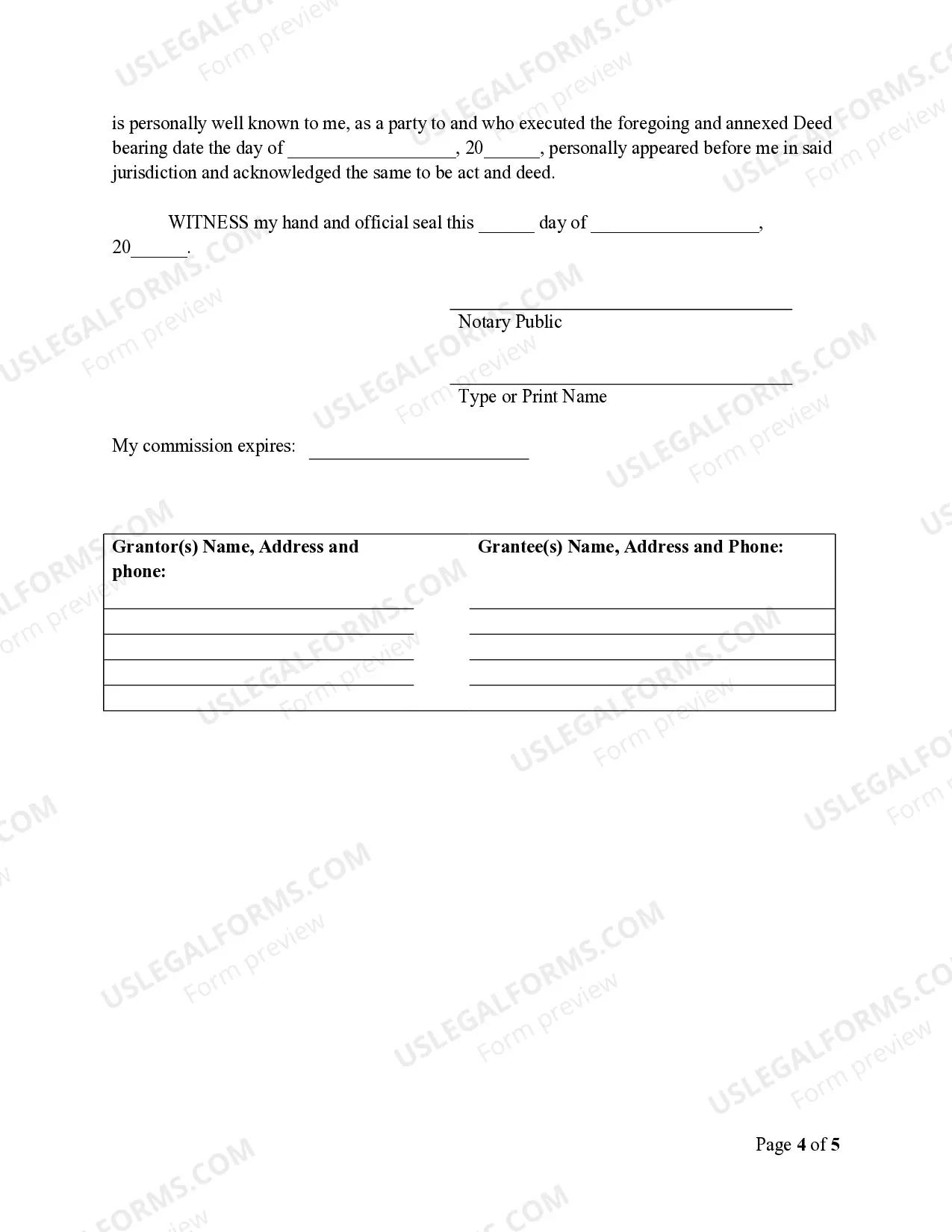

Filling out a transfer on death designation affidavit for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual involves several straightforward steps. Begin by gathering necessary information, such as your property details and beneficiary information. Carefully complete the form, ensuring all sections are filled out accurately. Once you've completed the affidavit, you should file it with the appropriate office, and you might consider using resources from uslegalforms to make the process smoother.

Whether or not you need a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual largely depends on your comfort level with the process. While it's possible to fill out the deed and file it on your own, a lawyer can provide valuable guidance to ensure all details are correctly addressed. Having legal support can also help you navigate any complex situations that might arise. Ultimately, consulting a lawyer can give you peace of mind.

The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual can be a great option depending on your circumstances. If you want a simple way to transfer property directly to a beneficiary without probate, a TOD may work well for you. Consider your specific situation, and if you need assistance, platforms like uslegalforms can guide you through the process and ensure you make informed decisions.

Unfortunately, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual does not provide an exemption from capital gains tax. When your beneficiary sells the property after inheriting it, they may still face capital gains tax based on the property's appreciated value. It's wise to consult a tax professional to understand the implications and plan accordingly for tax obligations.

While the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual offers many advantages, certain drawbacks exist. One key downside is that it does not offer protection from creditors; therefore, any outstanding debts can still impact your beneficiaries. Additionally, if the beneficiary predeceases you, you may need to amend your deed to ensure your assets are transferred as intended.

Yes, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual allows your assets to bypass probate. This means that your beneficiaries can access your property directly after your passing, without enduring the often lengthy probate process. By utilizing a TOD, you can simplify the transfer of your property and ensure a smoother transition for your loved ones.

Many states across the U.S. recognize Transfer on Death Deeds, including the District of Columbia. Each state has different laws and stipulations governing the use of these deeds, so it's essential to research your specific state laws. Using platforms like USLegalForms can help you navigate these rules to ensure the proper execution of your estate planning documents.

A disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual is the potential for family disputes. If the beneficiary feels entitled to a larger share or if conflicts arise over property management, tensions can escalate. Moreover, these deeds do not address concerns related to other aspects of estate planning, such as taxes or long-term care costs.

Indeed, the District of Columbia does allow residents to utilize Transfer on Death Deeds or TOD - Beneficiary Deeds for Individual to Individual. This option is designed to help individuals transfer their property effectively upon death without undergoing the probate process. If you're considering this option, it's wise to ensure that your deed is correctly prepared and filed.

While the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual offers many advantages, it does have some disadvantages. One potential drawback is that it does not provide asset protection if the beneficiary faces legal issues. Additionally, you must be cautious about changes in your intentions or beneficiary status, as this could complicate matters.